Read the Case BMW and find the solution to the following questions.

What are the current challenges for BMW?

What are the characteristics of its supplier market?

What are the important factors for a best buy?

What are the biggest problem for the purchasing organisation at the moment?

What are the important factors for comparison on different quotations?

What are the important factors for a negotiation?

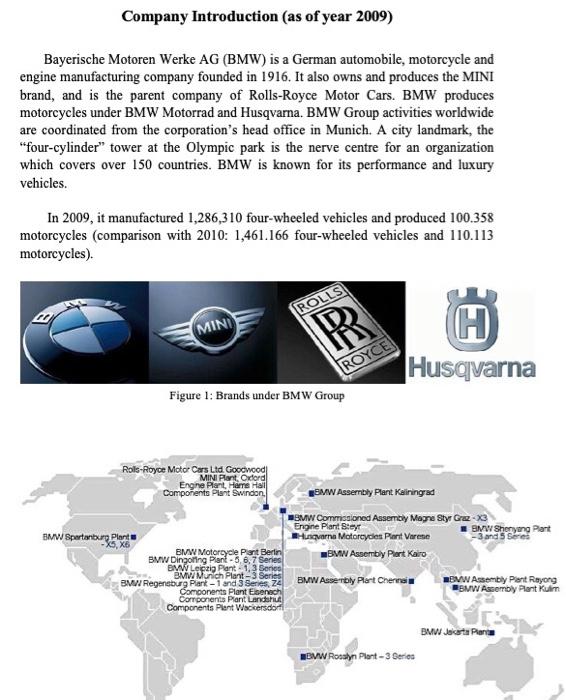

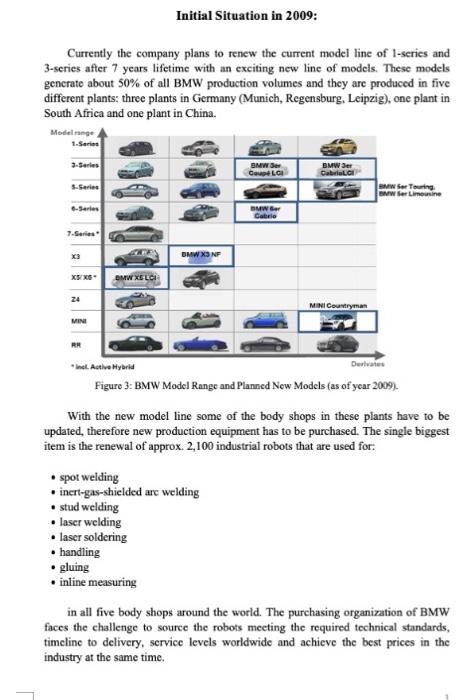

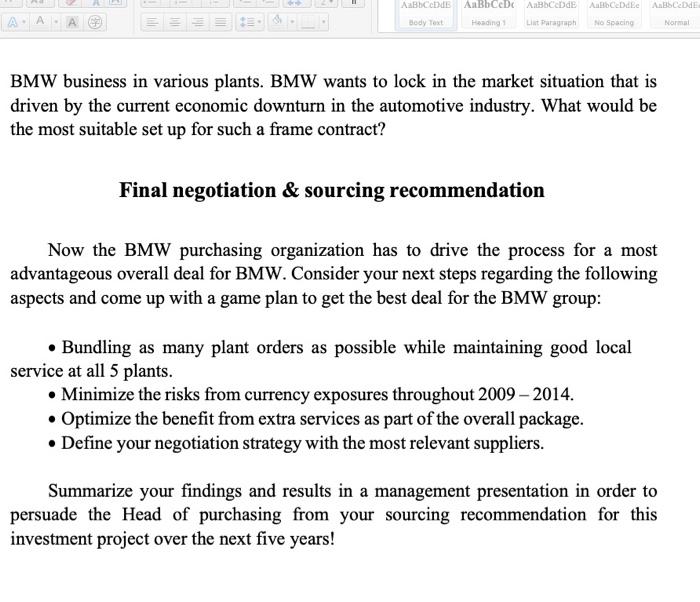

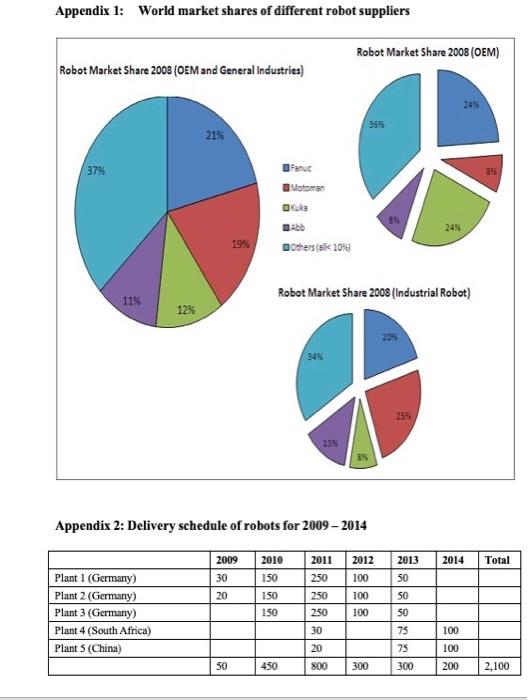

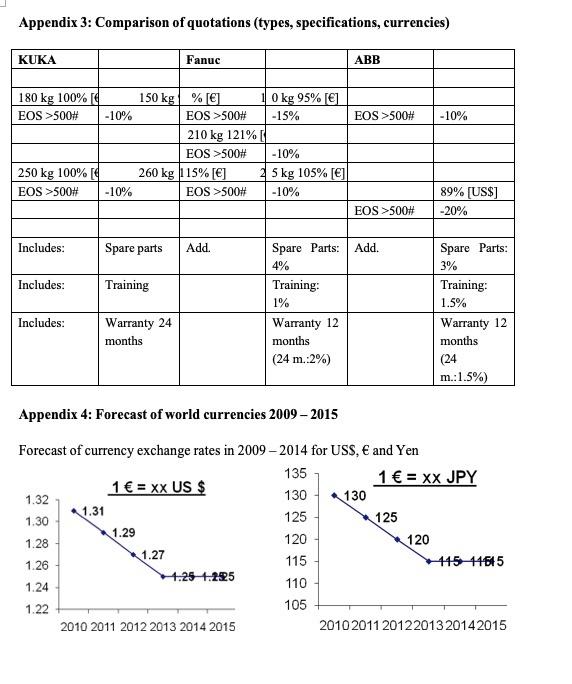

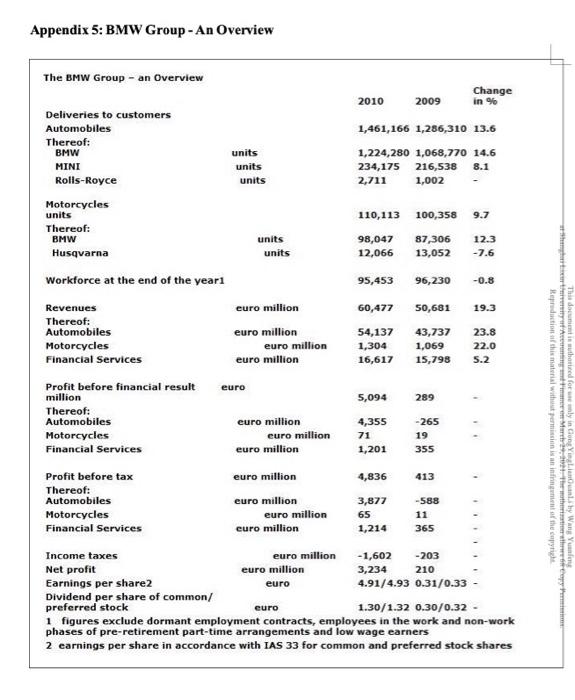

Indirect Purchasing at BMW: Competitive Tender for all Industrial Robots worldwide 46% was the figure Mr. Griem was searching for in the latest market analysis report received from the corporate sales department at the BMW headquarters in Munich, Germany. The percentage number which represented the vehicle sales growth in China in 2009 was indeed mind-boggling. While the Big Three in the US were struggling to survive the day, the auto sector in China was sizzling hot - seemingly untouched by the global recession. BMW, which operates through its joint venture with Chinese auto manufacturer Brilliance in the northern city of Shenyang, had recently experienced the growth pain like most other OEMs in the country. In order to meet future demand, the JV constellation in Shenyang had decided in 2009 to double production capacity at the existing plant - meaning increasing the annual production output from 35,000 cars per year to almost 100,000 units. Furthermore, in order to increase the level of localization, it had also recently been decided to abandon the former complete-knockdown (CKD) production mode in favor of a complete local transplant, meaning better opportunities to tap into the local supplier base as well as lower costs for parts imports. Despite the global recession, the corporate strategic planning team had come to the conclusion that markets outside of China would eventually thaw, triggering a world-wide need for upgrading and expansion of production equipment. In the position of VP for purchasing of Production Equipment and Construction, Mr. Griem had been assigned to the task of ensuring world-class standards at all of BMW's production plants. Considering the unstable global consumer markets, volatile currencies, and tightened budgets, Mr. Griem already knew that this project would be a bit of a hack. Company Introduction (as of year 2009) Bayerische Motoren Werke AG (BMW) is a German automobile, motorcycle and engine manufacturing company founded in 1916. It also owns and produces the MINI brand, and is the parent company of Rolls-Royce Motor Cars. BMW produces motorcycles under BMW Motorrad and Husqvarna. BMW Group activities worldwide are coordinated from the corporation's head office in Munich. A city landmark, the "four-cylinder" tower at the Olympic park is the nerve centre for an organization which covers over 150 countries. BMW is known for its performance and luxury vehicles. In 2009, it manufactured 1,286,310 four-wheeled vehicles and produced 100.358 motorcycles (comparison with 2010: 1,461.166 four-wheeled vehicles and 110.113 motorcycles). Currently the company plans to renew the current model line of 1-series and 3-series after 7 years lifetime with an exciting new line of models. These models generate about 50% of all BMW production volumes and they are produced in five different plants: three plants in Germany (Munich, Regensburg, Leipzig), one plant in South Africa and one plant in China. Figure 3: BMW Model Range and Planned New Models (as of year 2009). With the new model line some of the body shops in these plants have to be updated, therefore new production equipment has to be purchased. The single biggest item is the renewal of approx. 2,100 industrial robots that are used for: - spot welding - inerf-gas-shielded are welding - stud welding - laser welding - laser soldering - handling - gluing - inline measuring in all five body shops around the world. The purchasing organization of BMW faces the challenge to source the robots meeting the required technical standards, timeline to delivery, service levels worldwide and achieve the best prices in the industry at the same time. Supplier market/situation of competition: Statistics of the International Federation of Robotics Quarterly shows that the robots sales increased by 53% in the first quarter of 2011 year on year. Especially sales of robots for handling operations and welding increased above average in North America, Europe and Asia. The market of industry robots is mainly driven by the automotive industry. Since the first implementation of robot cell back the early 80 s, robot automation has become state of the art in the auto industry with current auto body shops being automated at >95% of all operations. The continued strong demand for industrial robots within automotive body shops in all regions looks assured for at least the next decade. The major vehicle makers, including PSA Group in France and Ford's Premier Automotive Group are looking set to use more industrial robots to cater for its production lines. Meanwhile, German automakers, like Audi and BMW, will continue to enhance the status of their brands and boost the introduction of advanced technology in auto body design and manufacture. The evolution of advanced technology will inevitably enhance the increasing demand for robotics - a move that is likely to be followed by other car makers as they seek to maintain their competitive position within the automotive industry. It is also expected that further refinements in health and safety legislation within the industry will lead to greater use of automated robot cells. The robot remains the most dexterous type of automation that can deal with the wide requirements of the industry. Robots were initially introduced to as replacement of shop floor operatives that were hot, heavy, and hazardous such as die casting, forging, and spot welding. In addition, the quality, the speed and continuity in which the task is performed is unmatched by any human competition. Time and again, cells have grown up alongside the main body framing lines that form the backbone of automotive body shell construction, commonly called body-in-white. Robots have taken on the burden of welding heavy, lumbering spot welding, arc welding and riveting guns. Handling such burdensome tools required brawn and skill both to minimize weld-to-weld times and floor-to-floor times. Meanwhile, just as robots have replaced skilled and unskilled labor, improvements have been made in both hardware and software making it possible to extend the areas of robot application. Owing to the latest technological advancements the value proposition for robotics has largely enhanced, allowing customers both small and large, improvements in quality and productivity that allow them to remain competitive in the fast paced global economy. Three main players have driven the automotive industry with their innovations and new products: KUKA (Germany), ABB (Sweden) and Fanuc (Japan), but there are also a few other players still actively involved in the market (Appendix 1). BMW has established a strong relationship with KUKA in the neighboring city of Augsburg, Germany, and KUKA has supplied robots to all BMW plants worldwide for the past years. On one hand long lasting relationships have been established to develop new technologics and products, provide the best service and train the maintenance personnel at BMW, for KUKA traditionally offers a lot of extra benefits to BMW free of charge, e.g. training, warranty of 24 months, spare parts, and ete. On the other hand: Does BMW really get the best prices in the industry with this given setup? BMW business in various plants. BMW wants to lock in the market situation that is driven by the current economic downturn in the automotive industry. What would be the most suitable set up for such a frame contract? Final negotiation \& sourcing recommendation Now the BMW purchasing organization has to drive the process for a most advantageous overall deal for BMW. Consider your next steps regarding the following aspects and come up with a game plan to get the best deal for the BMW group: - Bundling as many plant orders as possible while maintaining good local service at all 5 plants. - Minimize the risks from currency exposures throughout 2009-2014. - Optimize the benefit from extra services as part of the overall package. - Define your negotiation strategy with the most relevant suppliers. Summarize your findings and results in a management presentation in order to persuade the Head of purchasing from your sourcing recommendation for this investment project over the next five years! Appendix 1: World market shares of different robot suppliers Appendix 2: Delivery schedule of robots for 2009-2014 Appendix 3: Comparison of quotations (types, specifications, currencies) Appendix 4: Forecast of world currencies 2009-2015 Forecast of currency exchange rates in 20092014 for USS, and Yen Appendix 5: BMW Group - An Overview Indirect Purchasing at BMW: Competitive Tender for all Industrial Robots worldwide 46% was the figure Mr. Griem was searching for in the latest market analysis report received from the corporate sales department at the BMW headquarters in Munich, Germany. The percentage number which represented the vehicle sales growth in China in 2009 was indeed mind-boggling. While the Big Three in the US were struggling to survive the day, the auto sector in China was sizzling hot - seemingly untouched by the global recession. BMW, which operates through its joint venture with Chinese auto manufacturer Brilliance in the northern city of Shenyang, had recently experienced the growth pain like most other OEMs in the country. In order to meet future demand, the JV constellation in Shenyang had decided in 2009 to double production capacity at the existing plant - meaning increasing the annual production output from 35,000 cars per year to almost 100,000 units. Furthermore, in order to increase the level of localization, it had also recently been decided to abandon the former complete-knockdown (CKD) production mode in favor of a complete local transplant, meaning better opportunities to tap into the local supplier base as well as lower costs for parts imports. Despite the global recession, the corporate strategic planning team had come to the conclusion that markets outside of China would eventually thaw, triggering a world-wide need for upgrading and expansion of production equipment. In the position of VP for purchasing of Production Equipment and Construction, Mr. Griem had been assigned to the task of ensuring world-class standards at all of BMW's production plants. Considering the unstable global consumer markets, volatile currencies, and tightened budgets, Mr. Griem already knew that this project would be a bit of a hack. Company Introduction (as of year 2009) Bayerische Motoren Werke AG (BMW) is a German automobile, motorcycle and engine manufacturing company founded in 1916. It also owns and produces the MINI brand, and is the parent company of Rolls-Royce Motor Cars. BMW produces motorcycles under BMW Motorrad and Husqvarna. BMW Group activities worldwide are coordinated from the corporation's head office in Munich. A city landmark, the "four-cylinder" tower at the Olympic park is the nerve centre for an organization which covers over 150 countries. BMW is known for its performance and luxury vehicles. In 2009, it manufactured 1,286,310 four-wheeled vehicles and produced 100.358 motorcycles (comparison with 2010: 1,461.166 four-wheeled vehicles and 110.113 motorcycles). Currently the company plans to renew the current model line of 1-series and 3-series after 7 years lifetime with an exciting new line of models. These models generate about 50% of all BMW production volumes and they are produced in five different plants: three plants in Germany (Munich, Regensburg, Leipzig), one plant in South Africa and one plant in China. Figure 3: BMW Model Range and Planned New Models (as of year 2009). With the new model line some of the body shops in these plants have to be updated, therefore new production equipment has to be purchased. The single biggest item is the renewal of approx. 2,100 industrial robots that are used for: - spot welding - inerf-gas-shielded are welding - stud welding - laser welding - laser soldering - handling - gluing - inline measuring in all five body shops around the world. The purchasing organization of BMW faces the challenge to source the robots meeting the required technical standards, timeline to delivery, service levels worldwide and achieve the best prices in the industry at the same time. Supplier market/situation of competition: Statistics of the International Federation of Robotics Quarterly shows that the robots sales increased by 53% in the first quarter of 2011 year on year. Especially sales of robots for handling operations and welding increased above average in North America, Europe and Asia. The market of industry robots is mainly driven by the automotive industry. Since the first implementation of robot cell back the early 80 s, robot automation has become state of the art in the auto industry with current auto body shops being automated at >95% of all operations. The continued strong demand for industrial robots within automotive body shops in all regions looks assured for at least the next decade. The major vehicle makers, including PSA Group in France and Ford's Premier Automotive Group are looking set to use more industrial robots to cater for its production lines. Meanwhile, German automakers, like Audi and BMW, will continue to enhance the status of their brands and boost the introduction of advanced technology in auto body design and manufacture. The evolution of advanced technology will inevitably enhance the increasing demand for robotics - a move that is likely to be followed by other car makers as they seek to maintain their competitive position within the automotive industry. It is also expected that further refinements in health and safety legislation within the industry will lead to greater use of automated robot cells. The robot remains the most dexterous type of automation that can deal with the wide requirements of the industry. Robots were initially introduced to as replacement of shop floor operatives that were hot, heavy, and hazardous such as die casting, forging, and spot welding. In addition, the quality, the speed and continuity in which the task is performed is unmatched by any human competition. Time and again, cells have grown up alongside the main body framing lines that form the backbone of automotive body shell construction, commonly called body-in-white. Robots have taken on the burden of welding heavy, lumbering spot welding, arc welding and riveting guns. Handling such burdensome tools required brawn and skill both to minimize weld-to-weld times and floor-to-floor times. Meanwhile, just as robots have replaced skilled and unskilled labor, improvements have been made in both hardware and software making it possible to extend the areas of robot application. Owing to the latest technological advancements the value proposition for robotics has largely enhanced, allowing customers both small and large, improvements in quality and productivity that allow them to remain competitive in the fast paced global economy. Three main players have driven the automotive industry with their innovations and new products: KUKA (Germany), ABB (Sweden) and Fanuc (Japan), but there are also a few other players still actively involved in the market (Appendix 1). BMW has established a strong relationship with KUKA in the neighboring city of Augsburg, Germany, and KUKA has supplied robots to all BMW plants worldwide for the past years. On one hand long lasting relationships have been established to develop new technologics and products, provide the best service and train the maintenance personnel at BMW, for KUKA traditionally offers a lot of extra benefits to BMW free of charge, e.g. training, warranty of 24 months, spare parts, and ete. On the other hand: Does BMW really get the best prices in the industry with this given setup? BMW business in various plants. BMW wants to lock in the market situation that is driven by the current economic downturn in the automotive industry. What would be the most suitable set up for such a frame contract? Final negotiation \& sourcing recommendation Now the BMW purchasing organization has to drive the process for a most advantageous overall deal for BMW. Consider your next steps regarding the following aspects and come up with a game plan to get the best deal for the BMW group: - Bundling as many plant orders as possible while maintaining good local service at all 5 plants. - Minimize the risks from currency exposures throughout 2009-2014. - Optimize the benefit from extra services as part of the overall package. - Define your negotiation strategy with the most relevant suppliers. Summarize your findings and results in a management presentation in order to persuade the Head of purchasing from your sourcing recommendation for this investment project over the next five years! Appendix 1: World market shares of different robot suppliers Appendix 2: Delivery schedule of robots for 2009-2014 Appendix 3: Comparison of quotations (types, specifications, currencies) Appendix 4: Forecast of world currencies 2009-2015 Forecast of currency exchange rates in 20092014 for USS, and Yen Appendix 5: BMW Group - An Overview