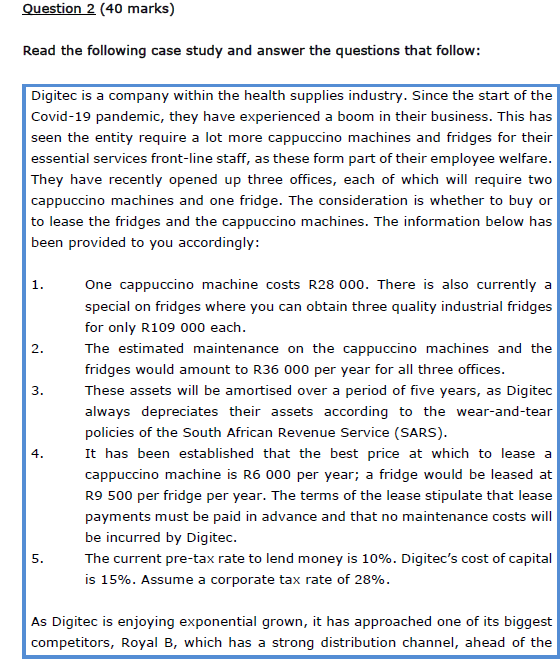

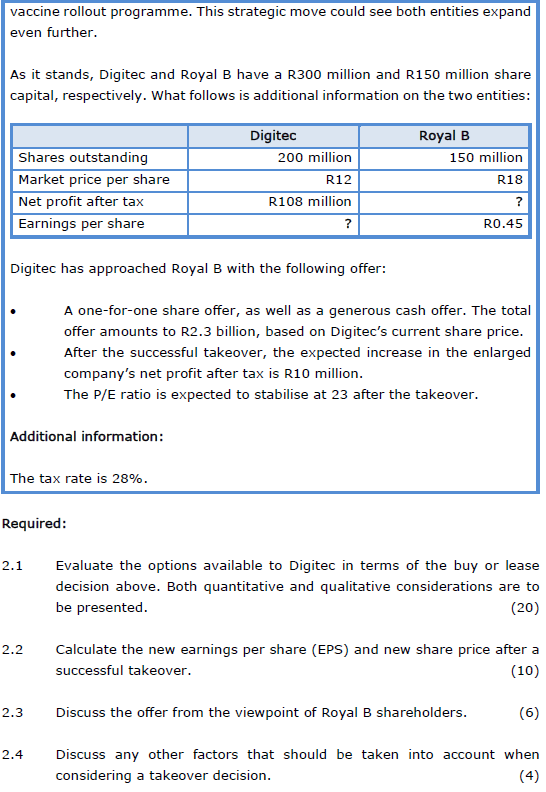

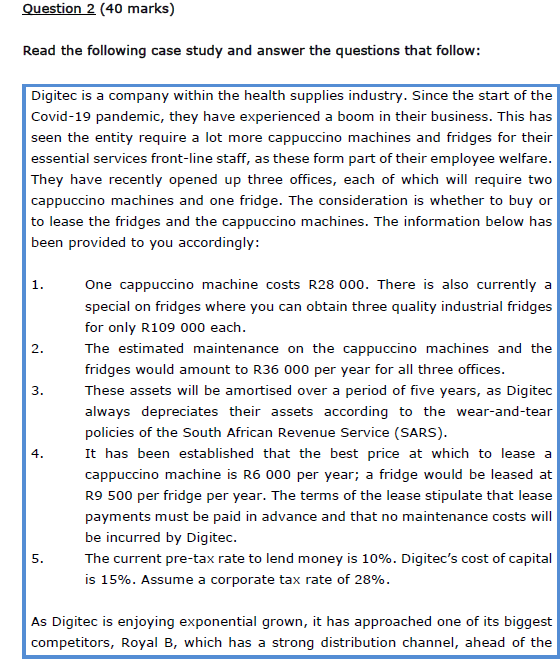

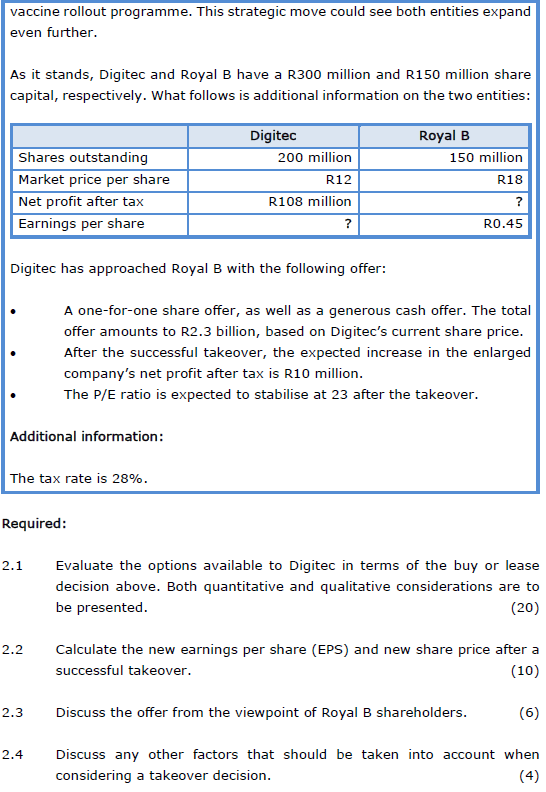

Read the following case study and answer the questions that follow: Digitec is a company within the health supplies industry. Since the start of the Covid-19 pandemic, they have experienced a boom in their business. This has seen the entity require a lot more cappuccino machines and fridges for their essential services front-line staff, as these form part of their employee welfare. They have recently opened up three offices, each of which will require two cappuccino machines and one fridge. The consideration is whether to buy or to lease the fridges and the cappuccino machines. The information below has been provided to you accordingly: 1. One cappuccino machine costs R28 000. There is also currently a special on fridges where you can obtain three quality industrial fridges for only R109 000 each. 2. The estimated maintenance on the cappuccino machines and the fridges would amount to R36 000 per year for all three offices. 3. These assets will be amortised over a period of five years, as Digitec always depreciates their assets according to the wear-and-tear policies of the South African Revenue Service (SARS). 4. It has been established that the best price at which to lease a cappuccino machine is R6 000 per year; a fridge would be leased at R9 500 per fridge per year. The terms of the lease stipulate that lease payments must be paid in advance and that no maintenance costs will be incurred by Digitec. 5. The current pre-tax rate to lend money is \10. Digitec's cost of capital is \15. Assume a corporate tax rate of \28. As Digitec is enjoying exponential grown, it has approached one of its biggest competitors, Royal B, which has a strong distribution channel, ahead of the vaccine rollout programme. This strategic move could see both entities expand even further. As it stands, Digitec and Royal B have a R300 million and R150 million share capital, respectively. What follows is additional information on the two entities: Digitec has approached Royal B with the following offer: - A one-for-one share offer, as well as a generous cash offer. The total offer amounts to R2.3 billion, based on Digitec's current share price. - After the successful takeover, the expected increase in the enlarged company's net profit after tax is R10 million. - The P/E ratio is expected to stabilise at 23 after the takeover. Additional information: The tax rate is \28. Required: 2.1 Evaluate the options available to Digitec in terms of the buy or lease decision above. Both quantitative and qualitative considerations are to be presented. 2.2 Calculate the new earnings per share (EPS) and new share price after a successful takeover. 2.3 Discuss the offer from the viewpoint of Royal B shareholders. 2.4 Discuss any other factors that should be taken into account when considering a takeover decision