Question

Read the overview below and complete the activities that follow. The 1933 and 1934 acts are different in the way they protect investors and the

Read the overview below and complete the activities that follow.

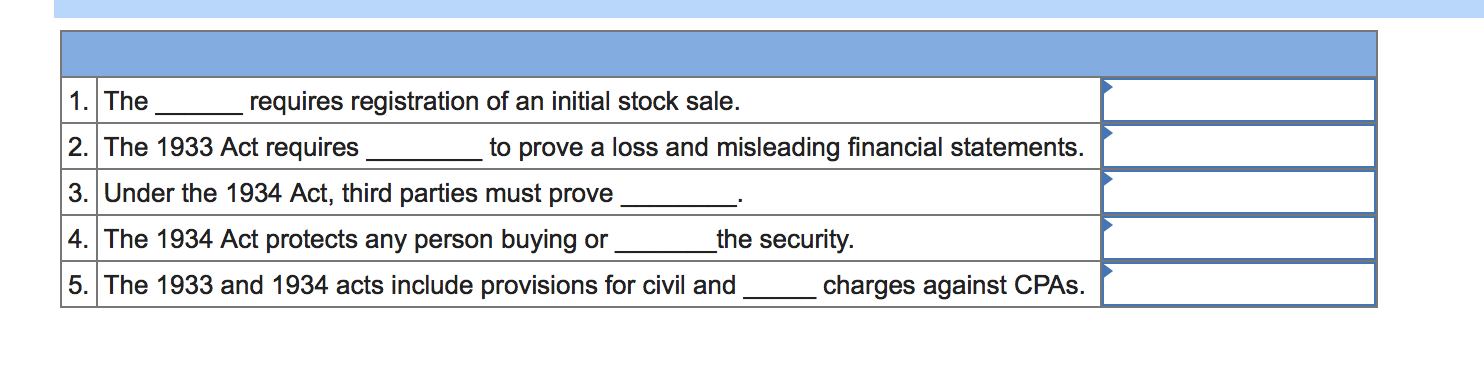

The 1933 and 1934 acts are different in the way they protect investors and the burden of proof required. The 1933 Act pertains to those acquiring an initial distribution of a security; the 1934 Act is for anyone buying or selling the security.

CONCEPT REVIEW:

Auditors have different liability/responsibility under the different acts. For example, under the 1933 Act, the third party does not need to prove reliance on the financial statements; under the 1934 Act, the third party must prove reliance. There is also a difference relating to which third parties the auditor is liable to.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started