Read the Wells Fargo OFS Case and develop objectives and measures for:

a) increasing revenues per customer and b) reducing costs per customer using the example format provided in Exhibit 8 of the case. Please develop 4 to 5 objectives/measures

THANK YOU!!!

THANK YOU!!!

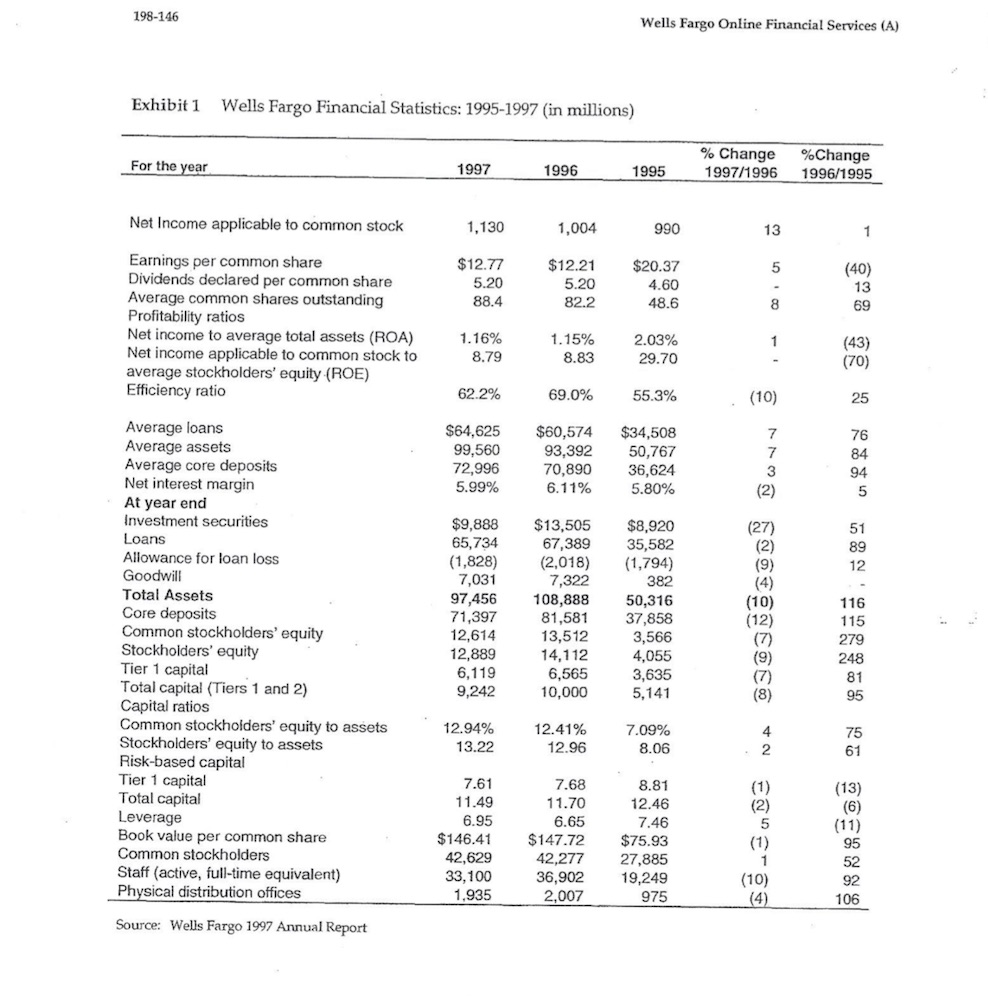

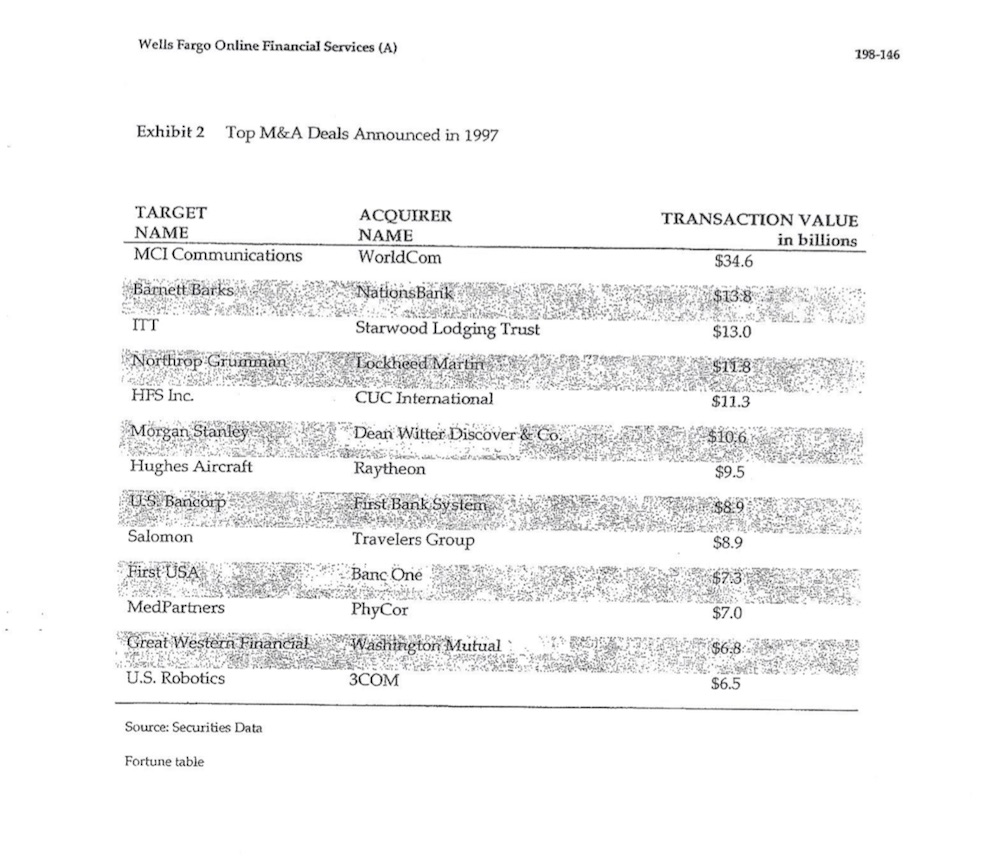

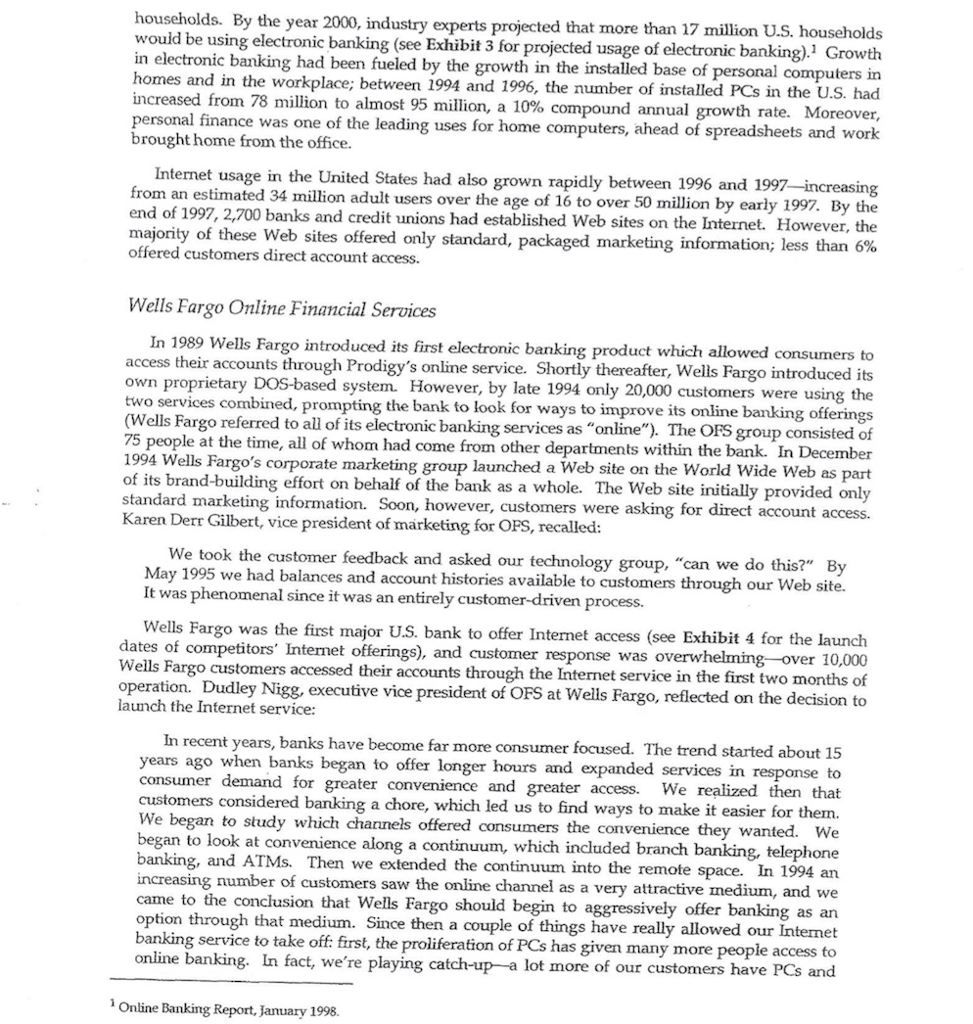

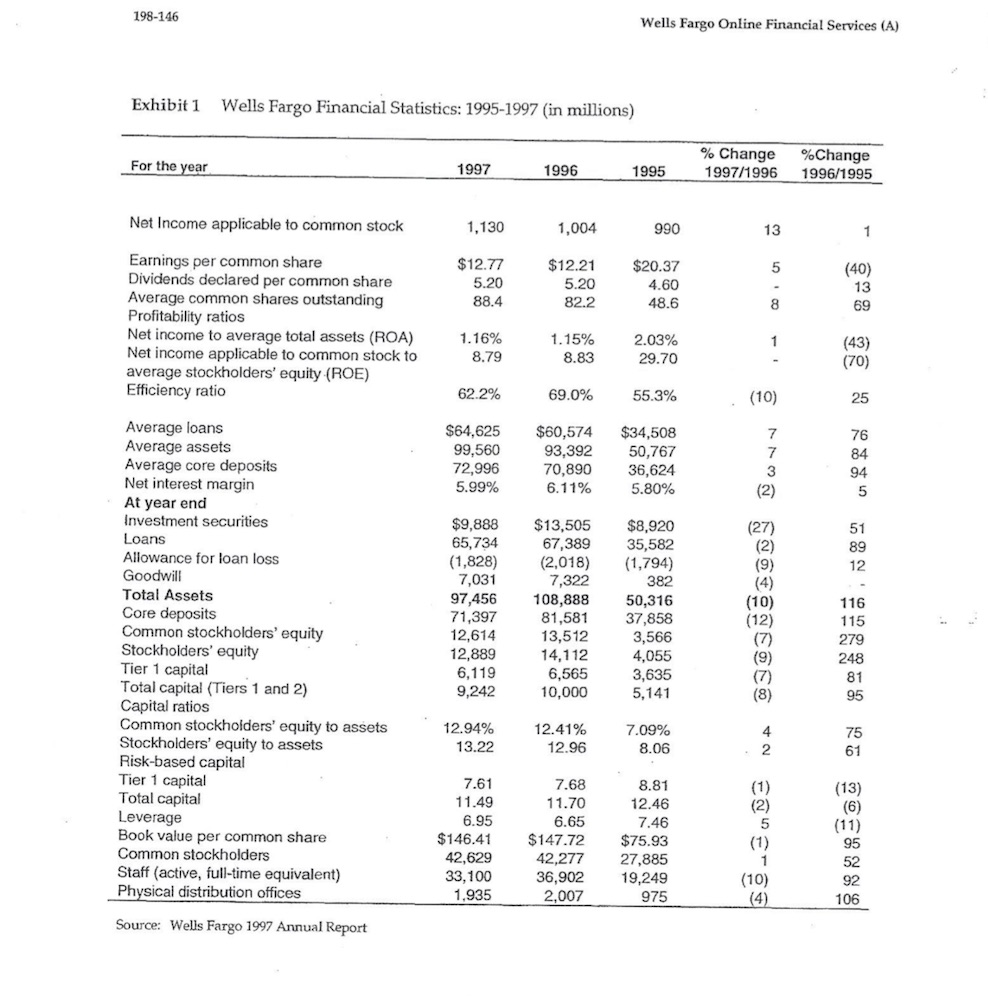

HARVARD|BUSINESS|SCHOOL 9-198-146 REV: AUGUST 21. 2001 ROBERT KAPLAN Wells Fargo Online Financial Services (A) Mary D'Agostino, vice president and manager of finance, strategy, and planning for Wells Fargo's Online Financial Services group (OFS), headed back to her office, following a half-day workshop in December 1997 in which the team working on the balanced scorecard (BSC) initiative had debated, and ultimately agreed on, performance measures for the seven objectives underlying one of OFS's three strategic themes: to add and retain high-value and high-potential-value customers. She was struck by how differently the team was already thinking about the online banking business, and they hadn't even completed the scorecard. Whereas previously OFS had focused predominantly on financial measures to track performance-which was quite typical in the Wells agoculture the team was now looking at performance from a multidimensional perspective. She was convinced that the new system would help OFS track the progress and impact of its recently defined strategy and communicate its performance both within OFS and to the rest of the bank. D'Agostino reflected on the new scorecard approach: This set of metrics gets at the core of the business case for OPS. We've never tracked and summarized the underlying drivers of our business on a systematic basis. The scorecard will take the mystery out of what is happening with our customers and our internal operations and it will be extremely useful to see the information on a monthly basis. We just don't get the same perspective from looking at our revenue and expense figures alone. D'Agostino looked forward to next week's meeting in which the objectives and measures for the other two strategic themes would be discussed. Wells Fargo Bank Wells Fargo Bank (Wells Fargo), headquartered in San Francisco, California, was the second largest bank in California and one of the largest banks in the United States with almost $100 billion in assets in 1997 (see Exhibit 1 for Wells Fargo financial information). Wells Fargo served 10 million households in 10 western states: Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, and Washington. As of December 1997, the bank operated over 1,900 staffed retail outlets and 4,400 automated teller machines, including 1,295 ATMs it assumed through its $11.6 billion acquisition of First Interstate Bancorp in April 1996. HARVARD|BUSINESS|SCHOOL 9-198-146 REV: AUGUST 21. 2001 ROBERT KAPLAN Wells Fargo Online Financial Services (A) Mary D'Agostino, vice president and manager of finance, strategy, and planning for Wells Fargo's Online Financial Services group (OFS), headed back to her office, following a half-day workshop in December 1997 in which the team working on the balanced scorecard (BSC) initiative had debated, and ultimately agreed on, performance measures for the seven objectives underlying one of OFS's three strategic themes: to add and retain high-value and high-potential-value customers. She was struck by how differently the team was already thinking about the online banking business, and they hadn't even completed the scorecard. Whereas previously OFS had focused predominantly on financial measures to track performance-which was quite typical in the Wells agoculture the team was now looking at performance from a multidimensional perspective. She was convinced that the new system would help OFS track the progress and impact of its recently defined strategy and communicate its performance both within OFS and to the rest of the bank. D'Agostino reflected on the new scorecard approach: This set of metrics gets at the core of the business case for OPS. We've never tracked and summarized the underlying drivers of our business on a systematic basis. The scorecard will take the mystery out of what is happening with our customers and our internal operations and it will be extremely useful to see the information on a monthly basis. We just don't get the same perspective from looking at our revenue and expense figures alone. D'Agostino looked forward to next week's meeting in which the objectives and measures for the other two strategic themes would be discussed. Wells Fargo Bank Wells Fargo Bank (Wells Fargo), headquartered in San Francisco, California, was the second largest bank in California and one of the largest banks in the United States with almost $100 billion in assets in 1997 (see Exhibit 1 for Wells Fargo financial information). Wells Fargo served 10 million households in 10 western states: Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, and Washington. As of December 1997, the bank operated over 1,900 staffed retail outlets and 4,400 automated teller machines, including 1,295 ATMs it assumed through its $11.6 billion acquisition of First Interstate Bancorp in April 1996

THANK YOU!!!

THANK YOU!!!