Question

Real Estate Case Study You are evaluating the purchasing a Low-Income Housing Tax Credit (LIHTC) property, Poinciana Crossing LTD, in Fort Lauderdale. The complex is

Real Estate Case Study You are evaluating the purchasing a Low-Income Housing Tax Credit (LIHTC) property, Poinciana Crossing LTD, in Fort Lauderdale. The complex is 164 unit made up of 50 one bedrooms, 50 two bedrooms, 50 three bedrooms, and 14 four bedrooms. The property qualifies for tax credits and the rents are capped based on medium incomes in the County. You expect to close on December 20, 2021. The year end is December 31st.

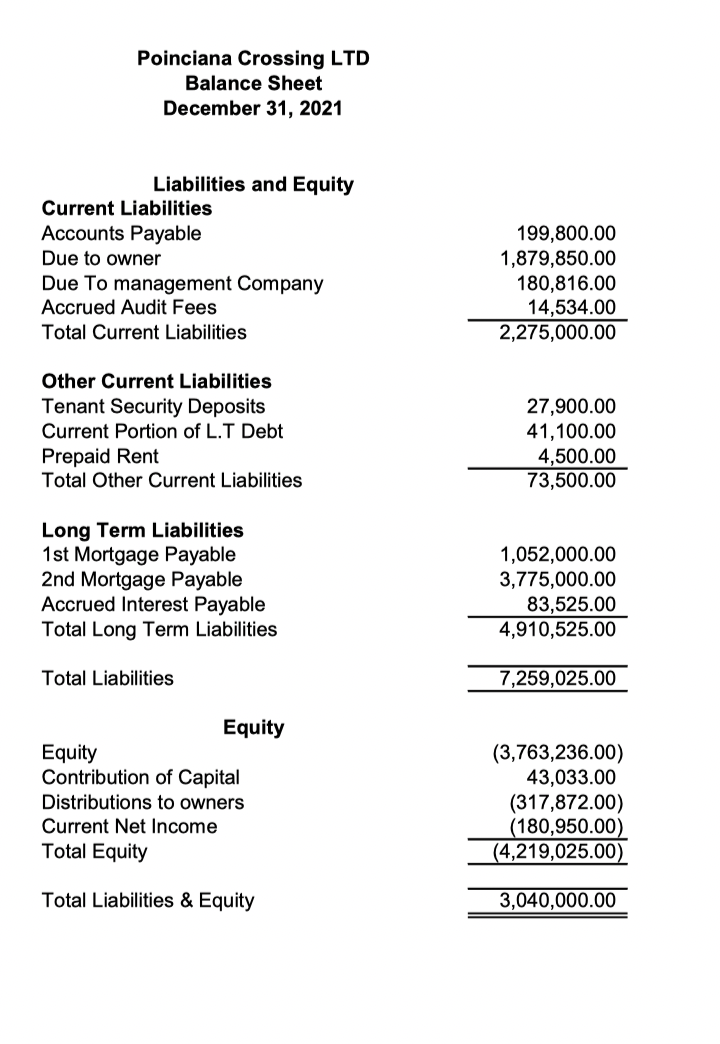

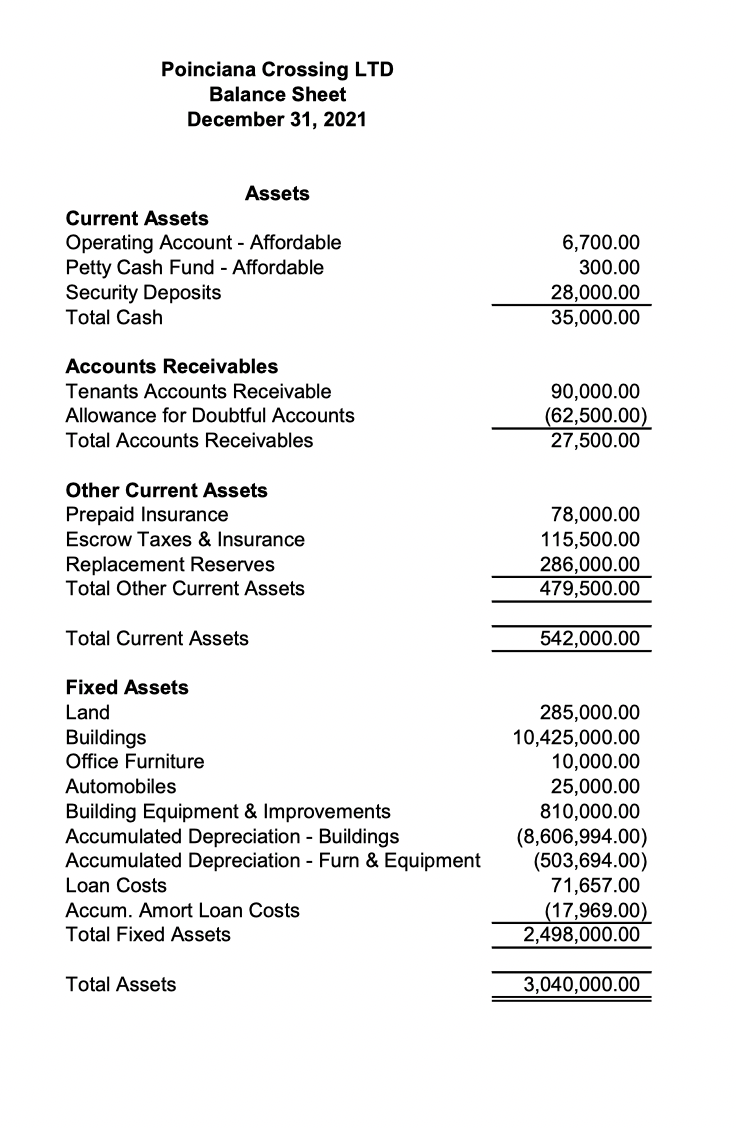

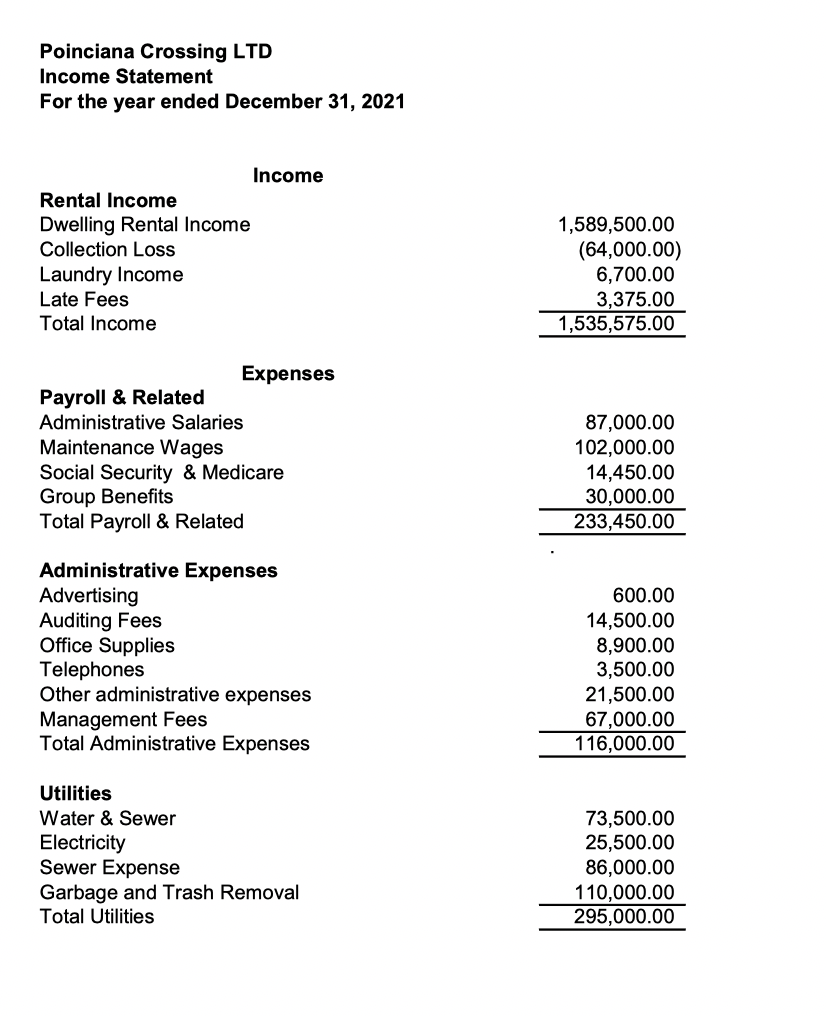

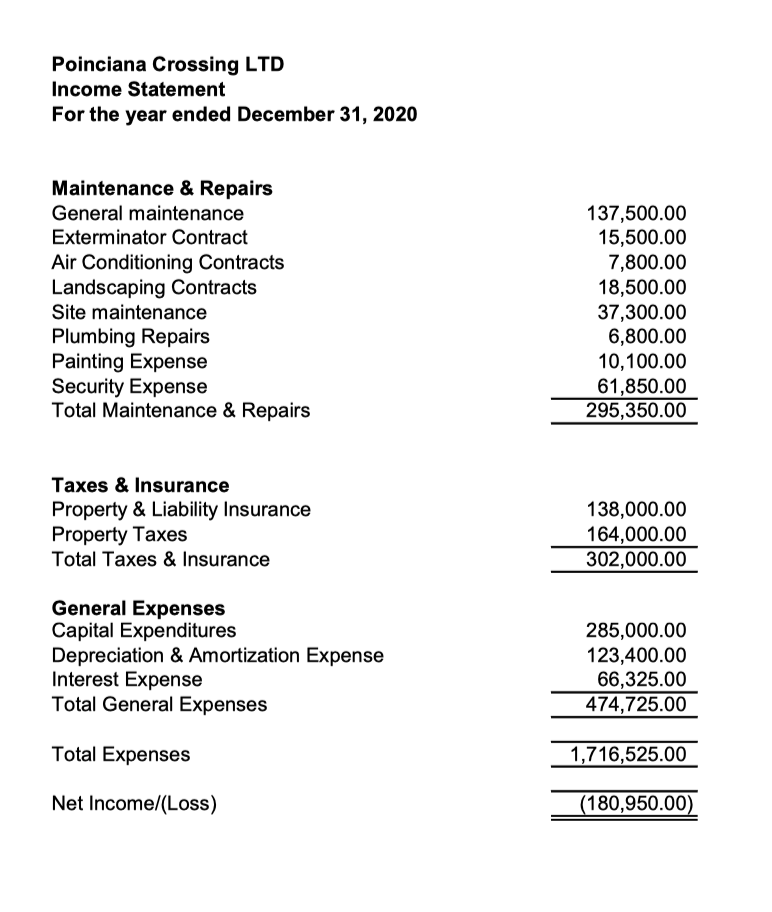

Poinciana Crossing has provided the property income statement and balance sheet for the year ended December 31, 2021. The financial statements fairly reflect the operating condition of the property.

The books are maintained on an accrual basis. To prepare for the sale of the property, Poinciana Crossing made substantial capital repairs. You will not have these expenses in the future.

Rents are: Unit Rent per month 1 bedroom 725 2 bedrooms 825 3 bedrooms 900 4 bedrooms 1050 Purchase price was negotiated at $6,200.000. The purchaser negotiated a new mortgage with the local bank at 80% LTV at 3.50% interest, fixed for 25 years. The bank agreed to the mortgage if the property maintains a minimum DSCR of 1.15. Vacancy is estimated at 3% and collection losses at 1%. Only Gross Potential Rent is expected to grow at 1.5% and expenses at 2 % each year. Based on the property appraisal land value is estimated at $500,000. Taxes are estimated to be $175,0000 and insurance is $125,000. Fixed and variable expenses are expected to be the same. The purchaser requires a capitalization rate of 6.25%.

PLEASE ANSWER THE BELOW PROBLEMS 1-8 using all information provided.

Using the accompanying financial statements calculate; 1. Net operating income for 2022 to 2025. 2. Debit Service (P&I) 3. Annual cash flow 4. DSCR for each year 5. Value of the property based on the 2022 operations. 6. Depreciation in each year 7. Projected Taxable income. 8. Discuss the relationship between depreciation and cash flow.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started