Answered step by step

Verified Expert Solution

Question

1 Approved Answer

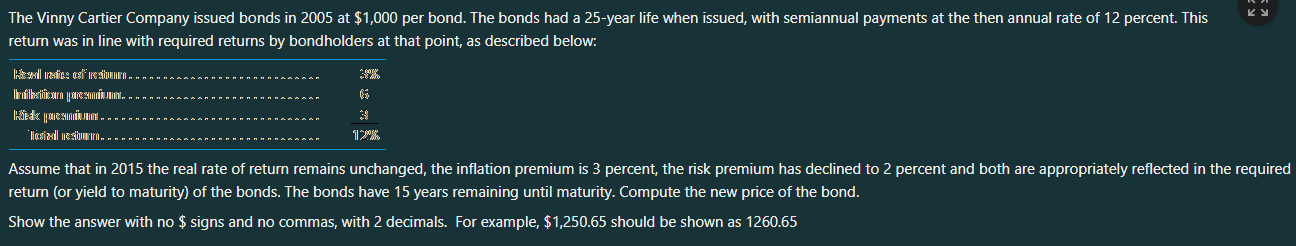

Real rate of return 3 % Inflation premium 6 Risk premium 3 Total return 12 % Please compute the NEW PRICE OF THE BOND. I

| Real rate of return | 3 | % |

| Inflation premium | 6 | |

| Risk premium | 3 | |

| Total return | 12 | % |

Please compute the NEW PRICE OF THE BOND. I WILL UPVOTE ONCE COMPLETED PROPERLY

The Vinny Cartier Company issued bonds in 2005 at $1,000 per bond. The bonds had a 25 -year life when issued, with semiannual payments at the then annual rate of 12 percent. This return was in line with required returns by bondholders at that point, as described below: Assume that in 2015 the real rate of return remains unchanged, the inflation premium is 3 percent, the risk premium has declined to 2 percent and both are appropriately reflected in the required return (or yield to maturity) of the bonds. The bonds have 15 years remaining until maturity. Compute the new price of the bond. Show the answer with no $ signs and no commas, with 2 decimals. For example, $1,250.65 should be shown as 1260.65Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started