Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. Assume all taxpayers did NOT

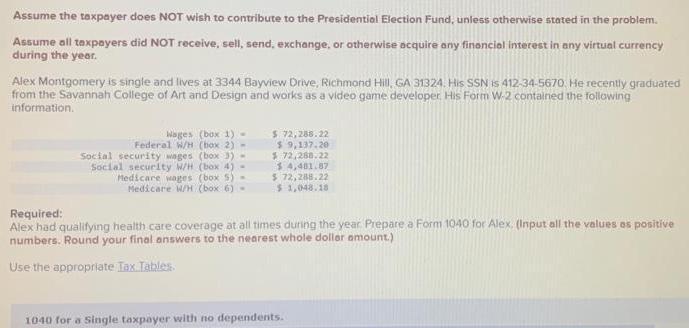

Assume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. Assume all taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. Alex Montgomery is single and lives at 3344 Bayview Drive, Richmond Hill, GA 31324. His SSN is 412-34-5670. He recently graduated from the Savannah College of Art and Design and works as a video game developer His Form W-2 contained the following information. Federal W/H Social security wages Social security W/H Medicare wages (box S) - Wages (box 1) - (box 2) - (box 3) - (box 4) - Medicare W/H (box 6) - $ 72,288.22 $9,137.20 $ 72,288.22 $4,481.87 $ 72,288.22 $1,048.18 Required: Alex had qualifying health care coverage at all times during the year. Prepare a Form 1040 for Alex. (Input all the values as positive numbers. Round your final answers to the nearest whole dollar amount.) Use the appropriate Tax Tables. 1040 for a single taxpayer with no dependents.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Note Specific ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started