Answered step by step

Verified Expert Solution

Question

1 Approved Answer

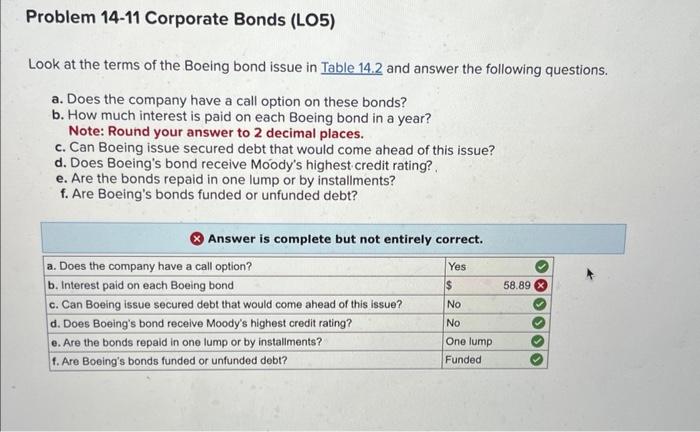

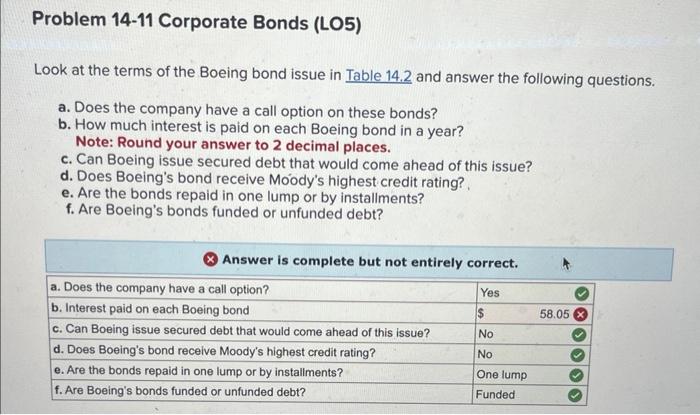

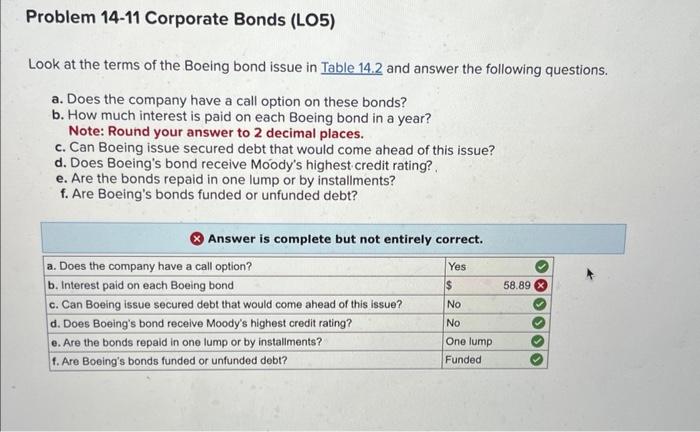

really need answer to part b, 58.05 and 58.89 and wrong answers please dont provide those thank you! Look at the terms of the Boeing

really need answer to part b, 58.05 and 58.89 and wrong answers please dont provide those thank you!

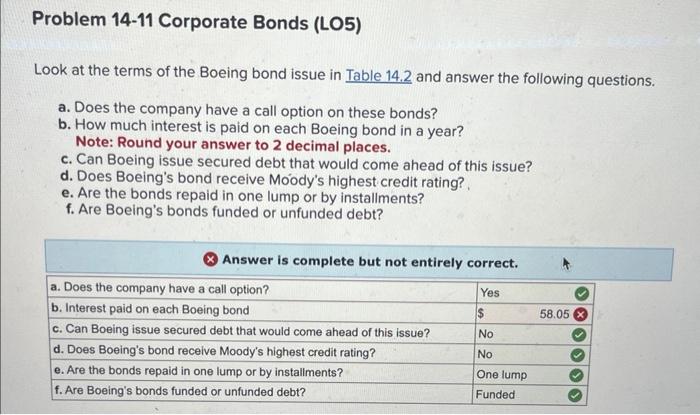

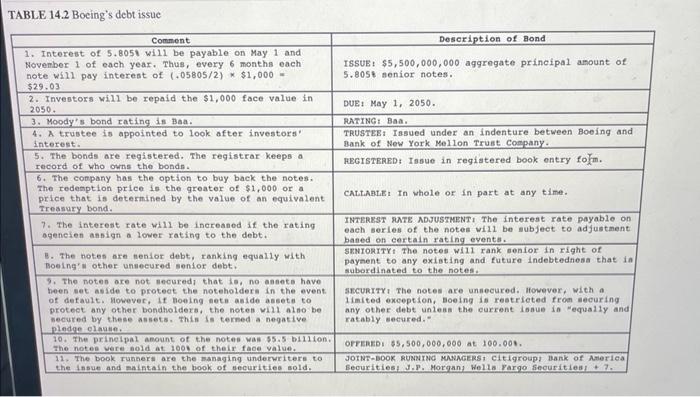

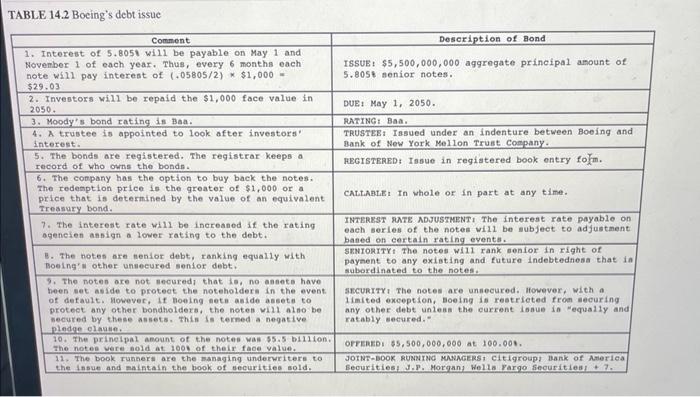

Look at the terms of the Boeing bond issue in Table 14.2 and answer the following questions. a. Does the company have a call option on these bonds? b. How much interest is paid on each Boeing bond in a year? Note: Round your answer to 2 decimal places. c. Can Boeing issue secured debt that would come ahead of this issue? d. Does Boeing's bond receive Moody's highest credit rating? e. Are the bonds repaid in one lump or by installments? f. Are Boeing's bonds funded or unfunded debt? TABLE 14.2 Bocing's debt issue Problem 14-11 Corporate Bonds (LO5) Look at the terms of the Boeing bond issue in Table 14.2 and answer the following questions. a. Does the company have a call option on these bonds? b. How much interest is paid on each Boeing bond in a year? Note: Round your answer to 2 decimal places. c. Can Boeing issue secured debt that would come ahead of this issue? d. Does Boeing's bond receive Moody's highest credit rating? e. Are the bonds repaid in one lump or by installments? f. Are Boeing's bonds funded or unfunded debt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started