really need expert help

Thanks a lot for helping

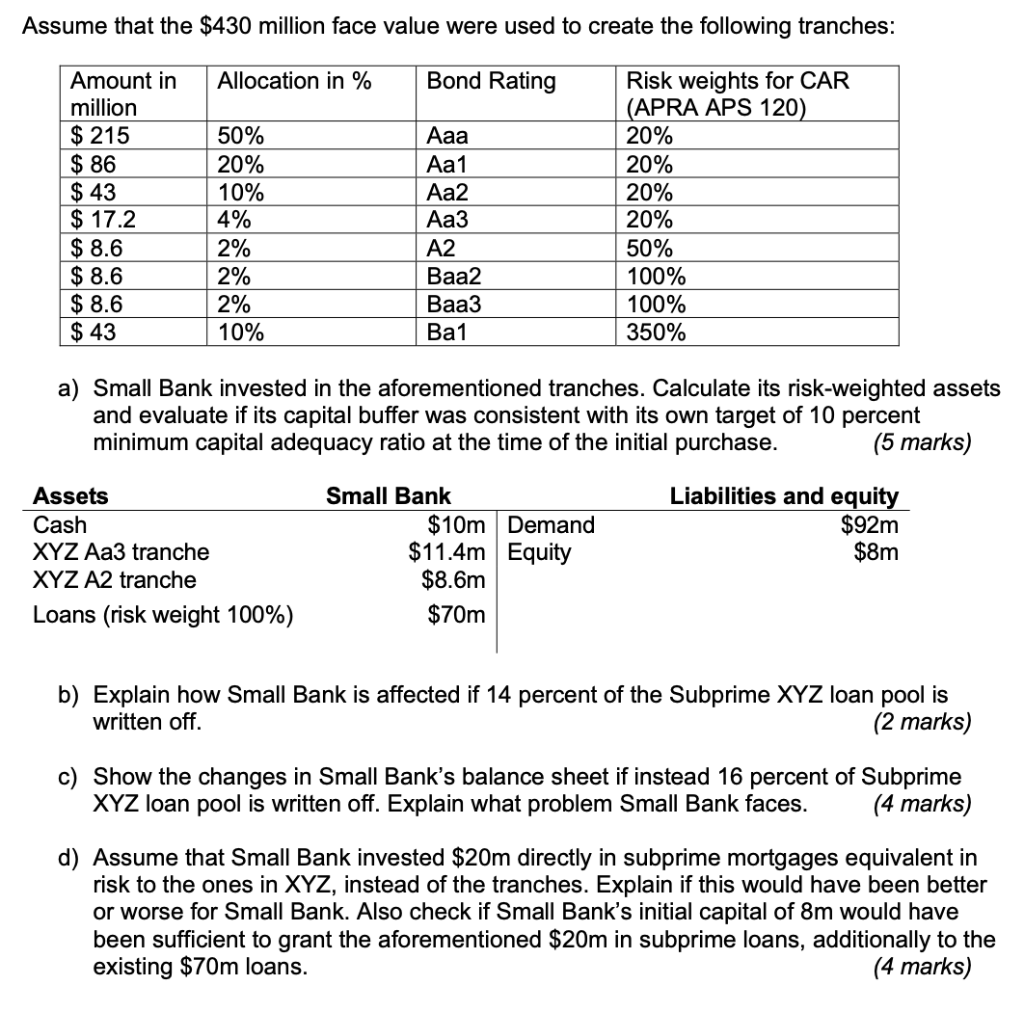

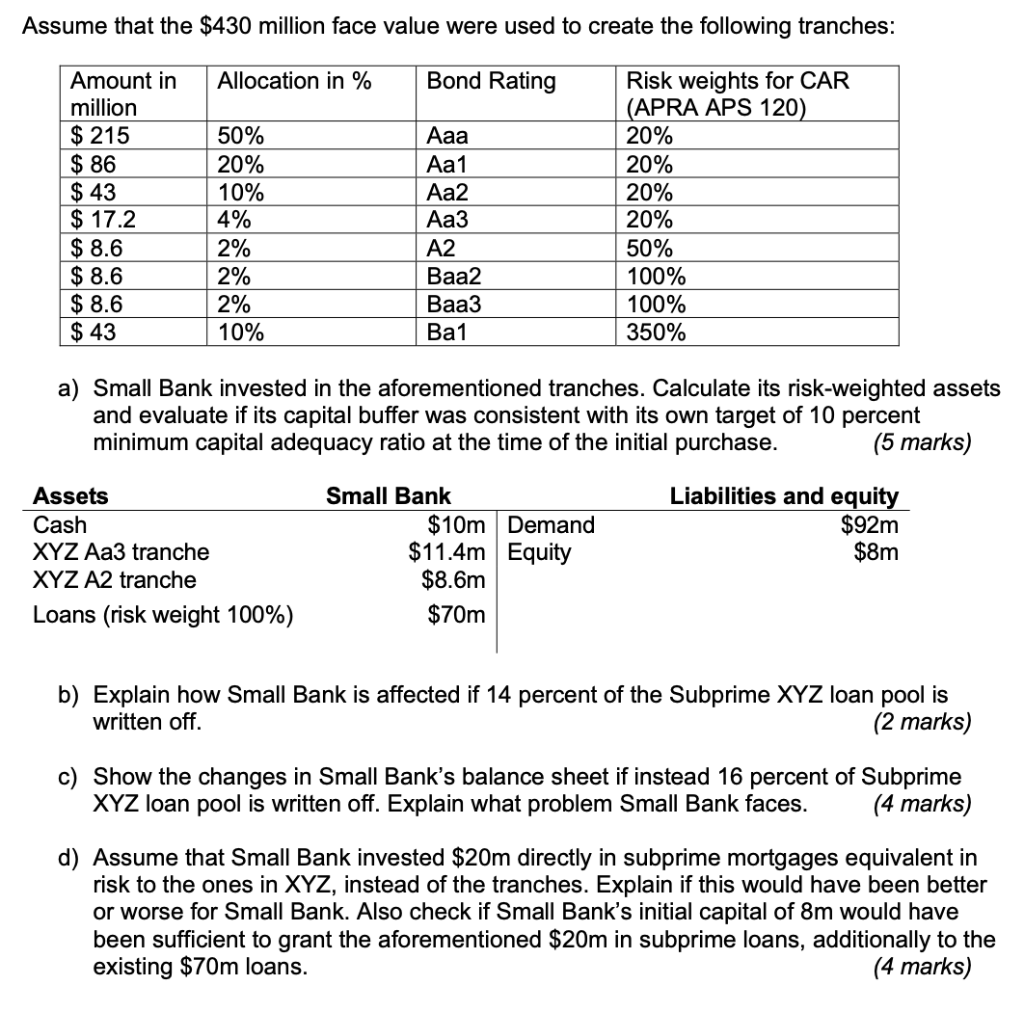

Assume that the $430 million face value were used to create the following tranches: Allocation in % Bond Rating Amount in million $ 215 $ 86 $ 43 $ 17.2 $ 8.6 $ 8.6 50% 20% 10% 4% 2% 2% 2% 10% Aaa Aa1 Aa2 Aa3 A2 Baa2 Baa3 Ba1 Risk weights for CAR (APRA APS 120) 20% 20% 20% 20% 50% 100% 100% 350% $ 8.6 $ 43 a) Small Bank invested in the aforementioned tranches. Calculate its risk-weighted assets and evaluate if its capital buffer was consistent with its own target of 10 percent minimum capital adequacy ratio at the time of the initial purchase. (5 marks) Assets Cash XYZ Aa3 tranche XYZ A2 tranche Loans (risk weight 100%) Small Bank $10m Demand $11.4m Equity $8.6m $70m Liabilities and equity $92m $8m b) Explain how Small Bank is affected if 14 percent of the Subprime XYZ loan pool is written off. (2 marks) c) Show the changes in Small Bank's balance sheet if instead 16 percent of Subprime XYZ loan pool is written off. Explain what problem Small Bank faces. (4 marks) d) Assume that Small Bank invested $20m directly in subprime mortgages equivalent in risk to the ones in XYZ, instead of the tranches. Explain if this would have been better or worse for Small Bank. Also check if Small Bank's initial capital of 8m would have been sufficient to grant the aforementioned $20m in subprime loans, additionally to the existing $70m loans. (4 marks) Assume that the $430 million face value were used to create the following tranches: Allocation in % Bond Rating Amount in million $ 215 $ 86 $ 43 $ 17.2 $ 8.6 $ 8.6 50% 20% 10% 4% 2% 2% 2% 10% Aaa Aa1 Aa2 Aa3 A2 Baa2 Baa3 Ba1 Risk weights for CAR (APRA APS 120) 20% 20% 20% 20% 50% 100% 100% 350% $ 8.6 $ 43 a) Small Bank invested in the aforementioned tranches. Calculate its risk-weighted assets and evaluate if its capital buffer was consistent with its own target of 10 percent minimum capital adequacy ratio at the time of the initial purchase. (5 marks) Assets Cash XYZ Aa3 tranche XYZ A2 tranche Loans (risk weight 100%) Small Bank $10m Demand $11.4m Equity $8.6m $70m Liabilities and equity $92m $8m b) Explain how Small Bank is affected if 14 percent of the Subprime XYZ loan pool is written off. (2 marks) c) Show the changes in Small Bank's balance sheet if instead 16 percent of Subprime XYZ loan pool is written off. Explain what problem Small Bank faces. (4 marks) d) Assume that Small Bank invested $20m directly in subprime mortgages equivalent in risk to the ones in XYZ, instead of the tranches. Explain if this would have been better or worse for Small Bank. Also check if Small Bank's initial capital of 8m would have been sufficient to grant the aforementioned $20m in subprime loans, additionally to the existing $70m loans. (4 marks)