Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Really need help on this asset management question Question 6 You are provided with the following information on a UK equity market neutral fund which

Really need help on this asset management question

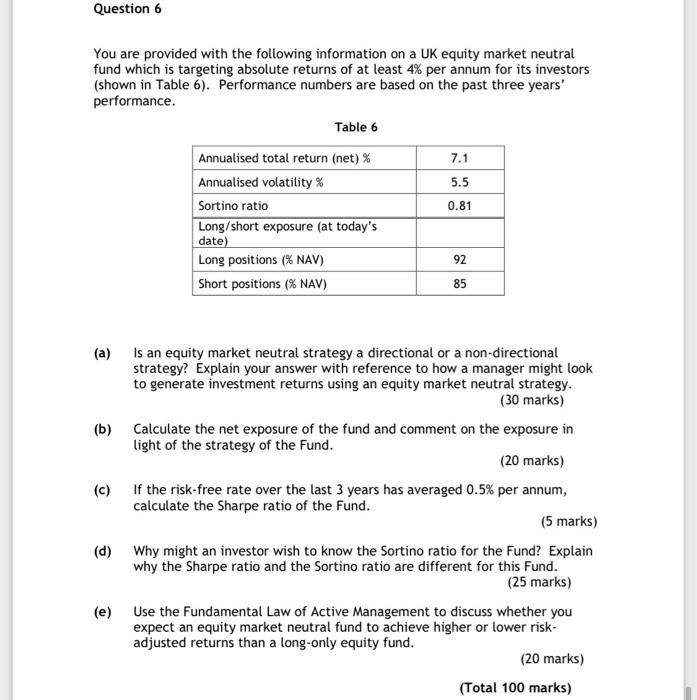

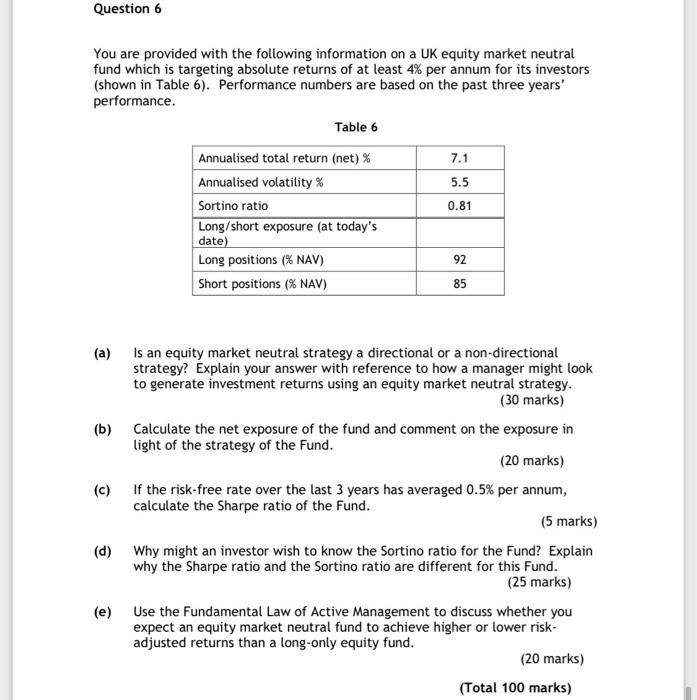

Question 6 You are provided with the following information on a UK equity market neutral fund which is targeting absolute returns of at least 4% per annum for its investors (shown in Table 6). Performance numbers are based on the past three years' performance. Table 6 7.1 5.5 0.81 Annualised total return (net) % Annualised volatility % Sortino ratio Long/short exposure (at today's date) Long positions (% NAV) Short positions (% NAV) 92 85 (b) (a) is an equity market neutral strategy a directional or a non-directional strategy? Explain your answer with reference to how a manager might look to generate investment returns using an equity market neutral strategy. (30 marks) Calculate the net exposure of the fund and comment on the exposure in light of the strategy of the Fund. (20 marks) (c) If the risk-free rate over the last 3 years has averaged 0.5% per annum, calculate the Sharpe ratio of the Fund. (5 marks) (d) Why might an investor wish to know the Sortino ratio for the Fund? Explain why the Sharpe ratio and the Sortino ratio are different for this Fund. (25 marks) (e) Use the Fundamental Law of Active Management to discuss whether you expect an equity market neutral fund to achieve higher or lower risk- adjusted returns than a long-only equity fund. (20 marks) (Total 100 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started