really need help with explanation

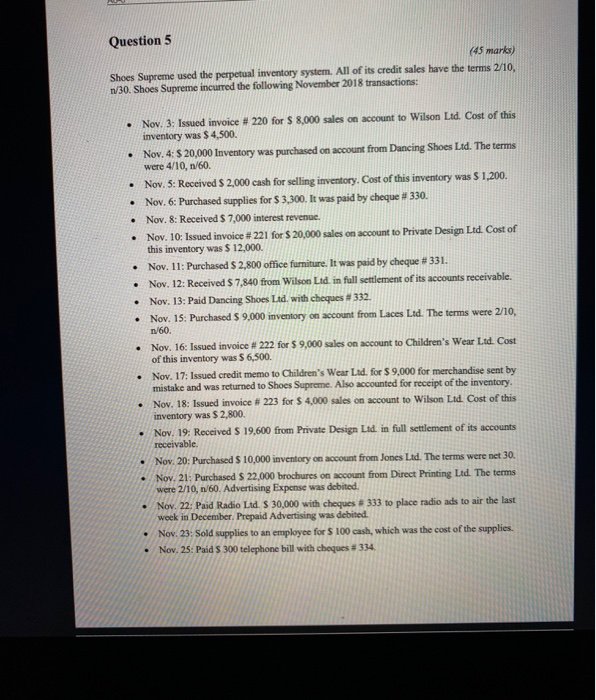

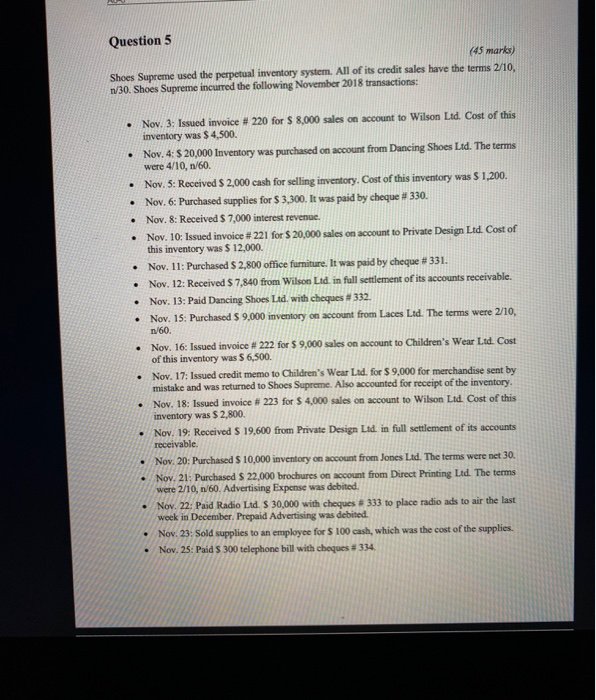

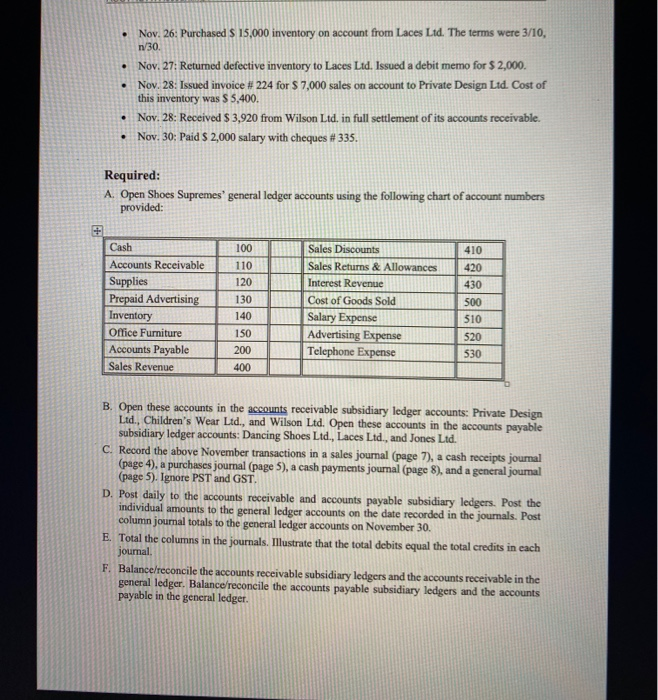

Question 5 (45 marks) Shoes Supreme used the perpetual inventory system. All of its credit sales have the terms 2/10, n/30. Shoes Supreme incurred the following November 2018 transactions: Nov. 3: Issued invoice # 220 for $ 8,000 sales on account to Wilson Ltd. Cost of this inventory was $4,500. Nov. 4: $ 20,000 Inventory was purchased on account from Dancing Shoes Ltd. The terms were 4/10, n/60. Nov. 5: Received $ 2,000 cash for selling inventory. Cost of this inventory was $ 1,200. Nov. 6: Purchased supplies for $ 3,300. It was paid by cheque # 330. Nov. 8: Received $ 7,000 interest revenue. Nov. 10: Issued invoice # 221 for $ 20,000 sales on account to Private Design Ltd. Cost of this inventory was $ 12,000. Nov. 11: Purchased $ 2,800 office furniture. It was paid by cheque #331. Nov. 12: Received $ 7,840 from Wilson Ltd. in full settlement of its accounts receivable. Nov. 13: Paid Dancing Shoes Ltd. with cheques # 332. Nov. 15: Purchased $ 9,000 inventory on account from Laces Ltd. The terms were 2/10, 1/60. Nov. 16: Issued invoice # 222 for $ 9,000 sales on account to Children's Wear Ltd. Cost of this inventory was $ 6,500. Noy, 17 Issued credit memo to Children's Wear Lid. for $9,000 for merchandise sent by mistake and was returned to Shoes Supreme. Also accounted for receipt of the inventory. Nov. 18: Issued invoice # 223 for $4,000 sales on account to Wilson Lid Cost of this inventory was $ 2,800. Nov. 19: Received 5 19,600 from Private Design Ltd. in full settlement of its accounts receivable. Nov. 20: Purchased $10,000 inventory on account from Jones Ltd. The terms were net 30. Nov. 21 Purchased $ 22,000 brochures on account from Direct Printing Ltd. The terms were 2/10, n/60. Advertising Expense was debited. Nov. 22: Paid Radio Lid. $ 30,000 with cheques # 333 to place radio ads to air the last weck in December. Prepaid Advertising was debited. Nov. 23: Sold supplies to an employee for $ 100 cash, which was the cost of the supplies. Nov. 25: Paid S 300 telephone bill with cheques # 334 Nov. 26: Purchased S 15,000 inventory on account from Laces Ltd. The terms were 3/10, n/30. Nov. 27: Returned defective inventory to Laces Ltd. Issued a debit memo for $ 2,000. Nov. 28: Issued invoice # 224 for $ 7,000 sales on account to Private Design Ltd. Cost of this inventory was S 5,400. Nov. 28: Received $ 3,920 from Wilson Ltd. in full settlement of its accounts receivable. Nov. 30: Paid $ 2,000 salary with cheques # 335. Required: A. Open Shoes Supremes general ledger accounts using the following chart of account numbers provided: 410 420 430 Cash Accounts Receivable Supplies Prepaid Advertising Inventory Office Furniture Accounts Payable Sales Revenue 500 100 110 120 130 140 150 200 400 Sales Discounts Sales Returns & Allowances Interest Revenue Cost of Goods Sold Salary Expense Advertising Expense Telephone Expense 530 B. Open these accounts in the accounts receivable subsidiary ledger accounts: Private Design Ltd, Children's Wear Ltd., and Wilson Ltd. Open these accounts in the accounts payable subsidiary ledger accounts: Dancing Shoes Ltd., Laces Ltd., and Jones Ltd. Record the above November transactions in a sales journal (page 7), a cash receipts journal (page 4), a purchases journal (page 5), a cash payments journal (page 8), and a general joumal (page 5). Ignore PST and GST. Post daily to the accounts receivable and accounts payable subsidiary ledgers. Post the individual amounts to the general ledger accounts on the date recorded in the journals. Post column journal totals to the general ledger accounts on November 30. Total the columns in the journals. Illustrate that the total debits equal the total credits in each journal F. Balance/reconcile the accounts receivable subsidiary ledgers and the accounts receivable in the general ledger. Balance reconcile the accounts payable subsidiary ledgers and the accounts payable in the general ledger