Answered step by step

Verified Expert Solution

Question

1 Approved Answer

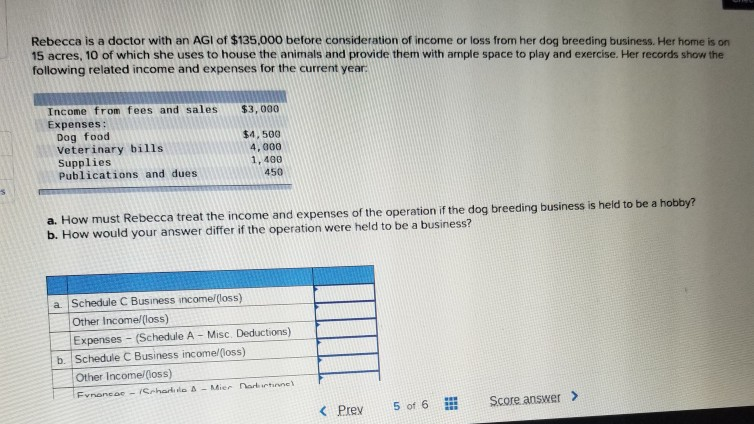

Rebecca is a doctor with an AGI of $135,000 before consideration of income or loss from her dog breeding business. Her home is on 15

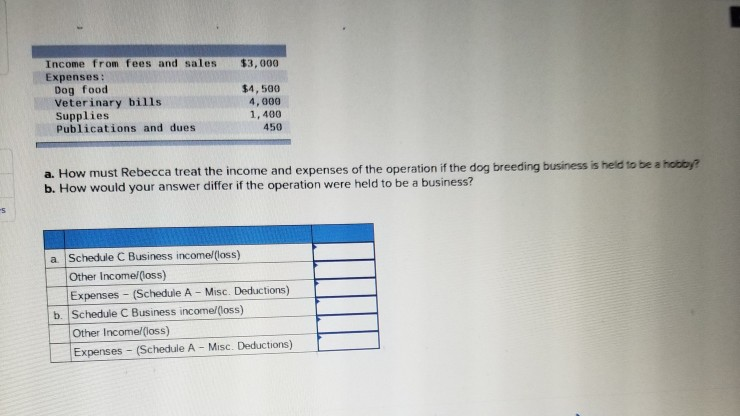

Rebecca is a doctor with an AGI of $135,000 before consideration of income or loss from her dog breeding business. Her home is on 15 acres, 10 of which she uses to house the animals and provide them with ample space to play and exercise. Her records show the following related income and expenses for the current year Income from fees and sales Expenses: $3, 000 Dog food Veterinary bills Supplies Publications and dues $4,500 4, 000 1,400 450 ebecca treat the income and expenses of the operation if the dog breeding business is held to be a hobby? a. How must R b. How would your answer differ if the operation were held to be a business? a Schedule C Business incomelloss) Other Income/(loss) Expenses (Schedule A Misc. Deductions) b. Schedule C Business income/(loss) Other Income/(loss) 5 of 6 Scoreanswer >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started