Answered step by step

Verified Expert Solution

Question

1 Approved Answer

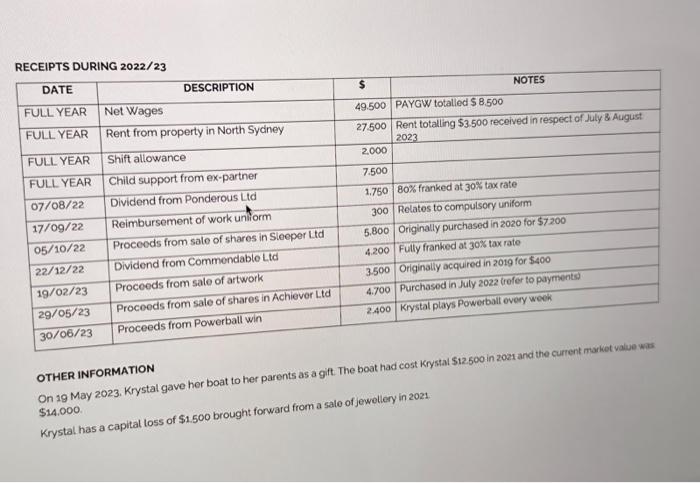

RECEIPTS DURING 2022/23 DESCRIPTION Rent from property in North Sydney DATE FULL YEAR Net Wages FULL YEAR FULL YEAR FULL YEAR 07/08/22 17/09/22 Shift

RECEIPTS DURING 2022/23 DESCRIPTION Rent from property in North Sydney DATE FULL YEAR Net Wages FULL YEAR FULL YEAR FULL YEAR 07/08/22 17/09/22 Shift allowance Child support from ex-partner Dividend from Ponderous Ltd Reimbursement of work uniform Proceeds from sale of shares in Sleeper Ltd Dividend from Commendable Ltd 05/10/22 22/12/22 19/02/23 Proceeds from sale of artwork 29/05/23 30/06/23 Proceeds from sale of shares in Achiever Ltd Proceeds from Powerball win $ 49.500 PAYGW totalled $8.500 NOTES 27.500 Rent totalling $3.500 received in respect of July & August 2,000 7.500 2023 1.750 80% franked at 30% tax rate 300 Relates to compulsory uniform 5.800 Originally purchased in 2020 for $7.200 4.200 Fully franked at 30% tax rate 3.500 Originally acquired in 2019 for $400 4.700 Purchased in July 2022 (refer to payments) 2.400 Krystal plays Powerball every week OTHER INFORMATION On 19 May 2023. Krystal gave her boat to her parents as a gift. The boat had cost Krystal $12.500 in 2021 and the current market value was $14.000. Krystal has a capital loss of $1.500 brought forward from a sale of jewellery in 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Krystals Income Summary for 202223 Income Salary and Wages Net Wages49500 PAYGW already withheld Ren...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started