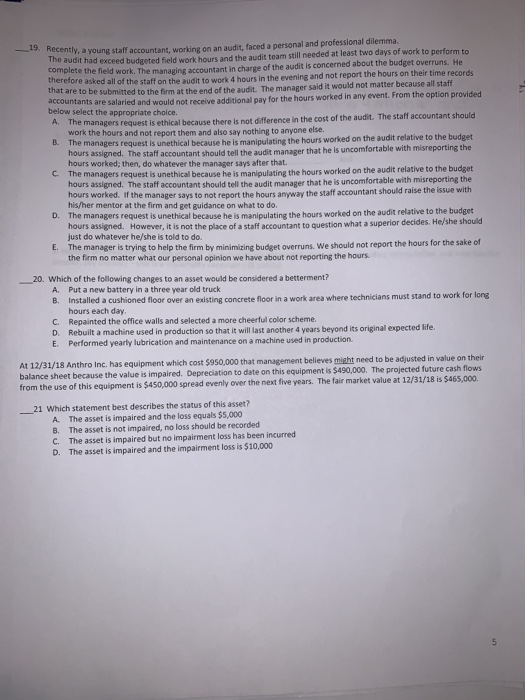

Recently, a young staff accountant, working on an audit, faced a personal and professional dilemma. the audit had exceed budgeted field work hours and the audit team still needed at least two days of work to perform to complete the field work. The managing accountant in charge of the audit is concerned about the budget overruns. He therefore asked all of the staff on the audit to work 4 hours in the evening and not report the hours on their time records that are to be submitted to the form at the end of the audit. The manager said it would not matter because all staff accountants are salaried and would not receive additional pay for the hours worked in any event. From the option provided below select the appropriate choice. The managers request is ethical because there is not difference in the cost of the audit. The staff accountant should work the hours and not report them and also say nothing to anyone else. . The managers request is unethical because he is manipulating the hours worked on the audit relative to the budget hours assigned. The staff accountant should tell the audit manager that he is uncomfortable with misreporting the hours worked; then, do whatever the manager says after that. The managers request is unethical because he is manipulating the hours worked on the audit relative to the budget hours assigned. The staff accountant should tell the audit manager that he is uncomfortable with misreporting the hours worked. If the manager says to not report the hours anyway the staff accountant should raise the issue with his/her mentor at the firm and get guidance on what to do. D. The managers request is unethical because he is manipulating the hours worked on the audit relative to the budget hours assigned. However, it is not the place of a staff accountant to question what a superior decides. He/she should just do whatever he/she is told to do. E. The manager is trying to help the firm by minimizing budget overruns. We should not report the hours for the sake of the firm no matter what our personal opinion we have about not reporting the hours. 20. Which of the following changes to an asset would be considered a betterment? A. Put a new battery in a three year old truck B. Installed a cushioned floor over an existing concrete floor in a work area where technicians must stand to work for long hours each day. C. Repainted the office walls and selected a more cheerful color scheme. D. Rebuilt a machine used in production so that it will last another 4 years beyond its original expected life. E Performed yearly lubrication and maintenance on a machine used in production. AL 12/31/18 Anthro Inc. has equipment which cost $950,000 that management believes might need to be adjusted in value on their balance sheet because the value is impaired. Depreciation to date on this equipment is $490,000. The projected future cash flows from the use of this equipment is $450,000 spread evenly over the next five years. The fair market value at 12/31/18 is $465,000 _21 Which statement best describes the status of this asset? A The asset is impaired and the loss equals $5,000 B. The asset is not impaired, no loss should be recorded C. The asset is impaired but no impairment loss has been incurred D. The asset is impaired and the impairment loss is $10,000