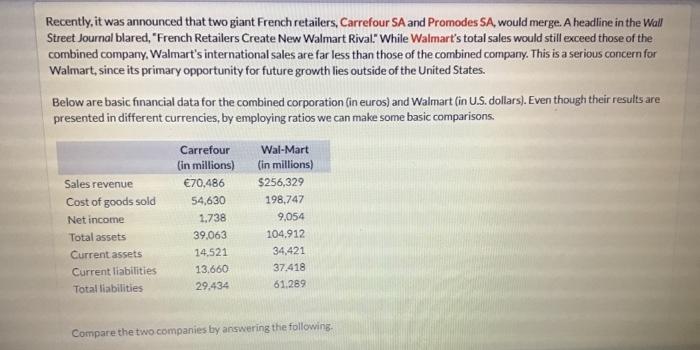

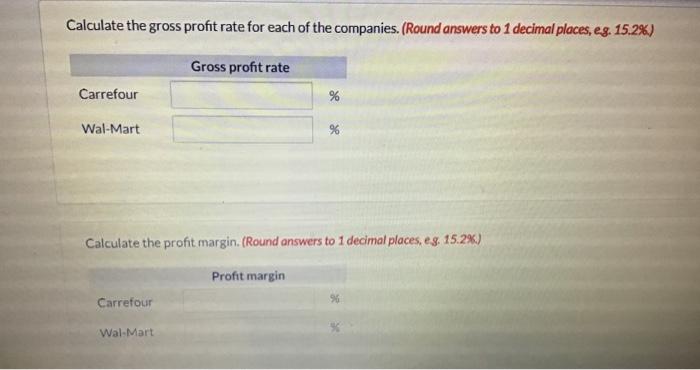

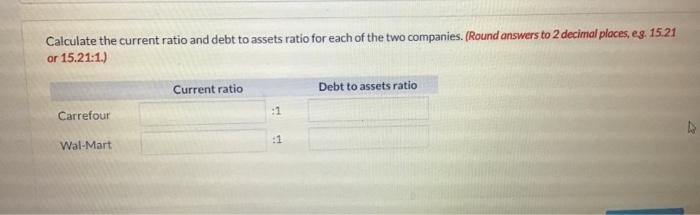

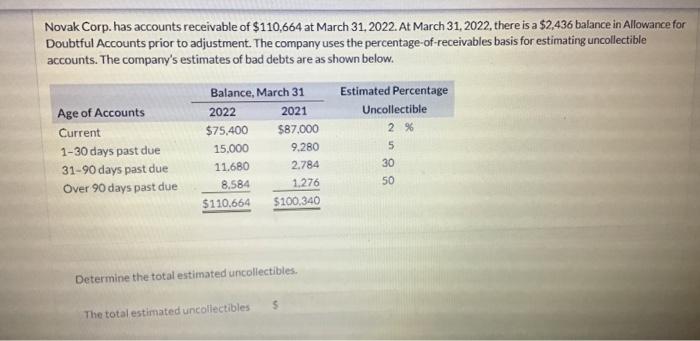

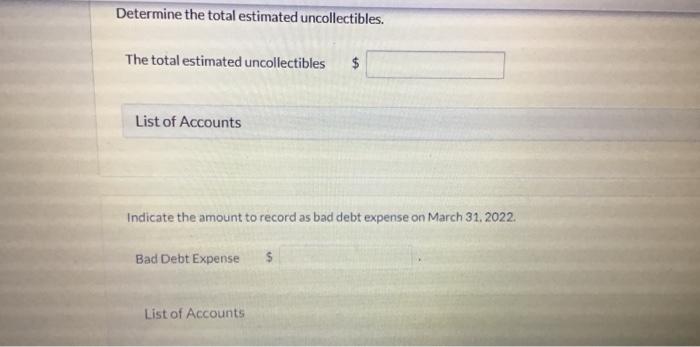

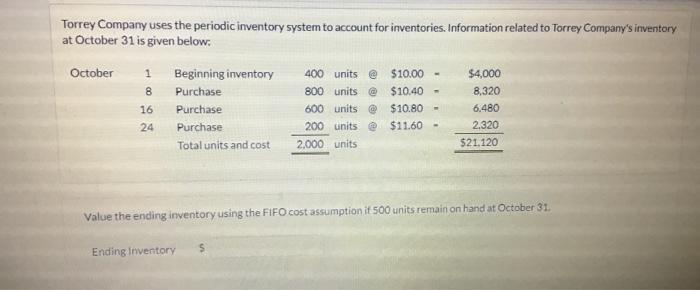

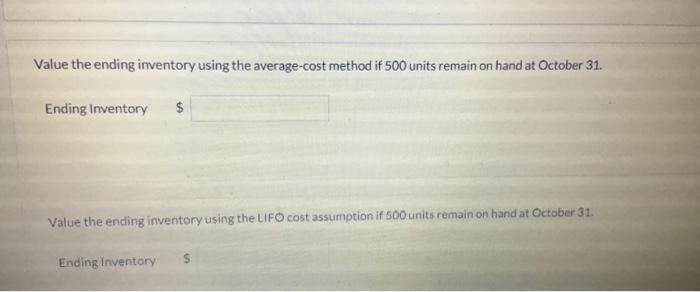

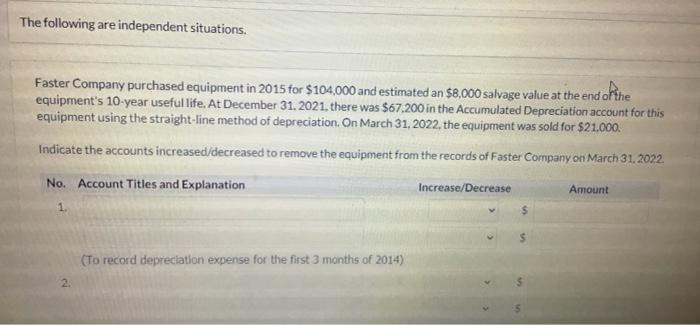

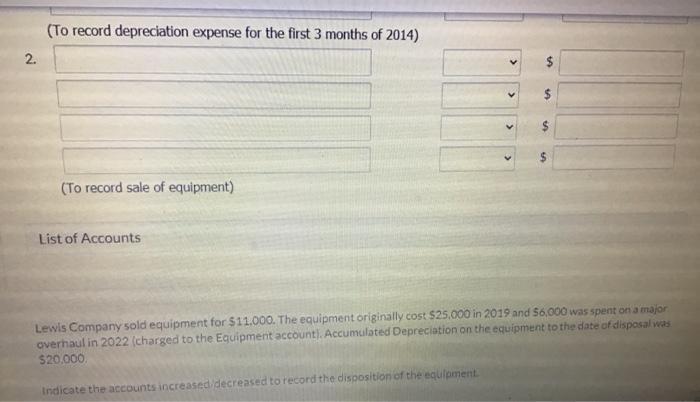

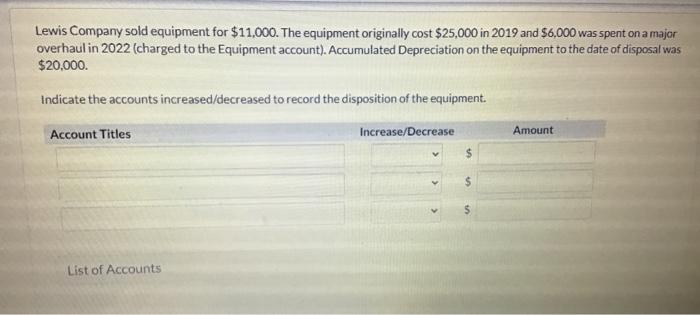

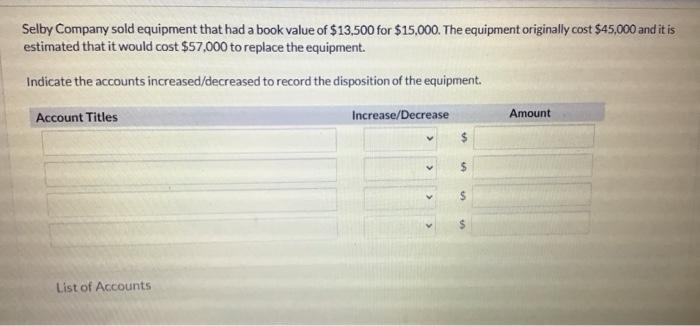

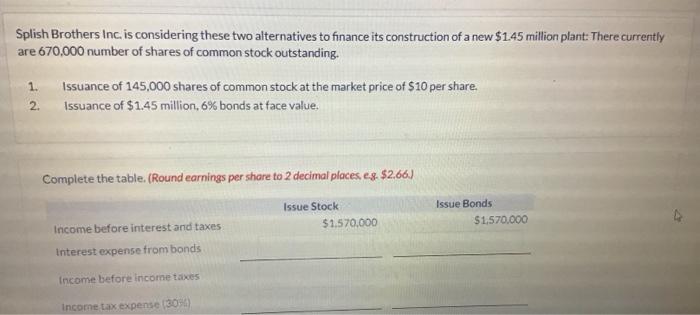

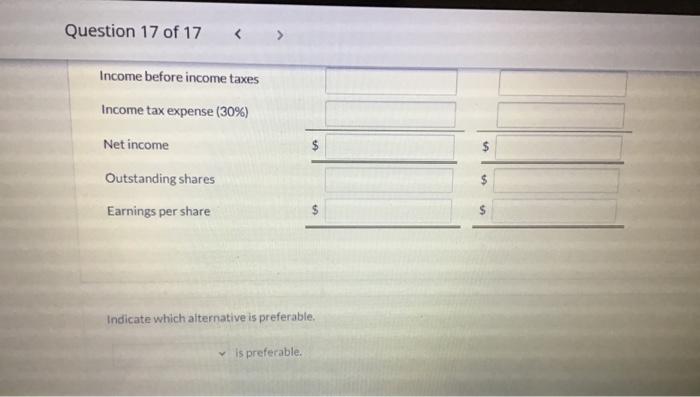

Recently, it was announced that two giant French retailers, Carrefour SA and Promodes SA, would merge. A headline in the Wall Street Journal blared, "French Retailers Create New Walmart Rival" While Walmart's total sales would still exceed those of the combined company. Walmart's international sales are far less than those of the combined company. This is a serious concern for Walmart, since its primary opportunity for future growth lies outside of the United States. Below are basic financial data for the combined corporation (in euros) and Walmart (in U.S. dollars). Even though their results are presented in different currencies, by employing ratios we can make some basic comparisons. Sales revenue Cost of goods sold Net income Total assets Current assets Current liabilities Total liabilities Carrefour (in millions) 70.486 54,630 1.738 39.063 14,521 13.660 29.434 Wal-Mart (in millions) $256,329 198,747 9,054 104.912 34,421 37.418 61.289 Compare the two companies by answering the following. Calculate the gross profit rate for each of the companies. (Round answers to 1 decimal places, eg. 15.2%) Gross profit rate Carrefour % Wal-Mart % Calculate the profit margin. (Round answers to 1 decimal places, eg. 15.2%) Profit margin Carrefour Wal-Mart Calculate the current ratio and debt to assets ratio for each of the two companies. (Round answers to 2 decimal places, eg: 15.21 or 15.21:1.) Current ratio Debt to assets ratio Carrefour Wal-Mart Novak Corp. has accounts receivable of $110,664 at March 31, 2022. At March 31, 2022, there is a $2,436 balance in Allowance for Doubtful Accounts prior to adjustment. The company uses the percentage-of-receivables basis for estimating uncollectible accounts. The company's estimates of bad debts are as shown below. Balance, March 31 Estimated Percentage Age of Accounts 2022 2021 Uncollectible Current $75,400 $87.000 2 % 1-30 days past due 15.000 9,280 5 31-90 days past due 11,680 2.784 30 Over 90 days past due 8.584 1.276 50 $110,664 $100,340 Determine the total estimated uncollectibles The total estimated uncollectibles Determine the total estimated uncollectibles. The total estimated uncollectibles $ List of Accounts Indicate the amount to record as bad debt expense on March 31, 2022. Bad Debt Expense List of Accounts Torrey Company uses the periodic inventory system to account for inventories. Information related to Torrey Company's inventory at October 31 is given below: October 1 Beginning inventory 400 units e $10.00 - $4,000 8 Purchase 800 units @ $10.40 - 8,320 16 Purchase 600 units $10.80 - 6.480 24 Purchase 200 units @ $11.60 - 2.320 Total units and cost 2,000 units $21.120 Value the ending inventory using the FIFO cost assumption it 500 units remain on hand at October 31. Ending Inventory Value the ending inventory using the average cost method if 500 units remain on hand at October 31. Ending Inventory $ Value the ending inventory using the LIFO cost assumption if 500 units remain on hand at October 31. Ending Inventory The following are independent situations. Faster Company purchased equipment in 2015 for $104,000 and estimated an $8,000 salvage value at the end of the equipment's 10-year useful life. At December 31, 2021, there was $67,200 in the Accumulated Depreciation account for this equipment using the straight-line method of depreciation. On March 31, 2022, the equipment was sold for $21.000. Indicate the accounts increased/decreased to remove the equipment from the records of Faster Company on March 31, 2022 No. Account Titles and Explanation Increase/Decrease Amount 1 (To record depreciation expense for the first 3 months of 2014) (To record depreciation expense for the first 3 months of 2014) 2. (To record sale of equipment) List of Accounts Lewis Company sold equipment for $11.000. The equipment originally cost $25.000 in 2019 and 56,000 was spent on a major overhaul in 2022 (charged to the Equipment account). Accumulated Depreciation on the equipment to the date of disposal was $20,000 Indicate the accounts increased decreased to record the disposition of the equipment Lewis Company sold equipment for $11,000. The equipment originally cost $25,000 in 2019 and $6,000 was spent on a major overhaul in 2022 (charged to the Equipment account). Accumulated Depreciation on the equipment to the date of disposal was $20,000 Indicate the accounts increased/decreased to record the disposition of the equipment. Account Titles Increase/Decrease Amount List of Accounts Selby Company sold equipment that had a book value of $13,500 for $15,000. The equipment originally cost $45,000 and it is estimated that it would cost $57,000 to replace the equipment. Indicate the accounts increased/decreased to record the disposition of the equipment. Account Titles Increase/Decrease Amount $ $ List of Accounts Splish Brothers Inc. is considering these two alternatives to finance its construction of a new $1.45 million plant: There currently are 670,000 number of shares of common stock outstanding. 1. Issuance of 145,000 shares of common stock at the market price of $10 per share. 2. Issuance of $1.45 million, 6% bonds at face value. Complete the table. (Round earnings per share to 2 decimal places eg. $2.66) Issue Stock $1.570,000 Issue Bonds $1,570.000 Income before interest and taxes Interest expense from bonds Income before income taxes Income tax expense 30%) Question 17 of 17 Income before income taxes Income tax expense (30%) Net income $ $ Outstanding shares Earnings per share Indicate which alternative is preferable, is preferable