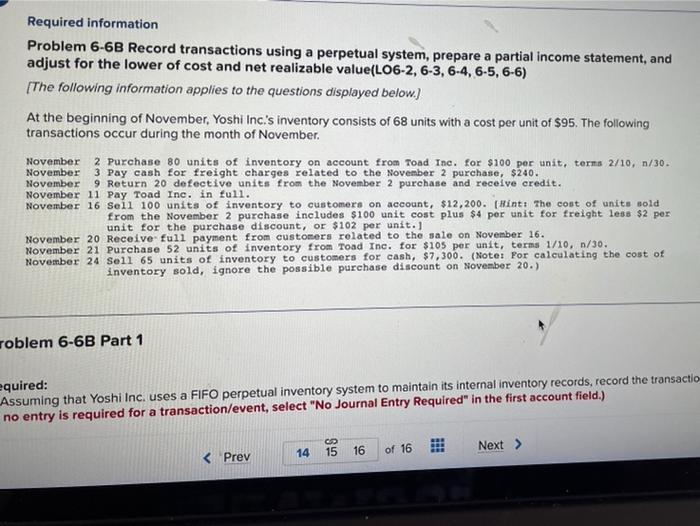

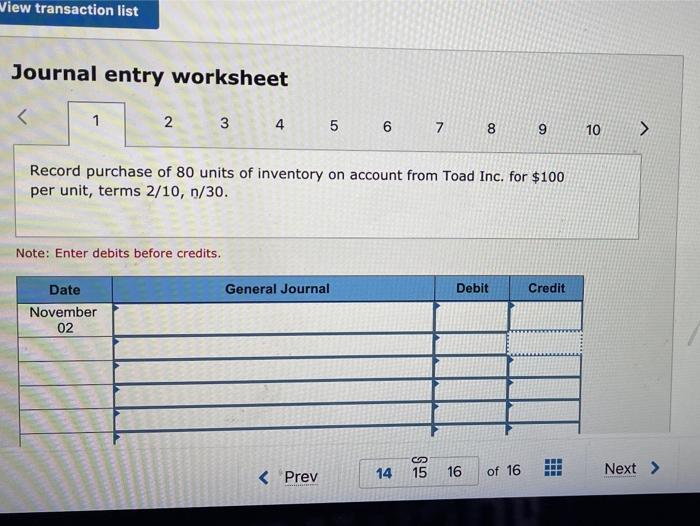

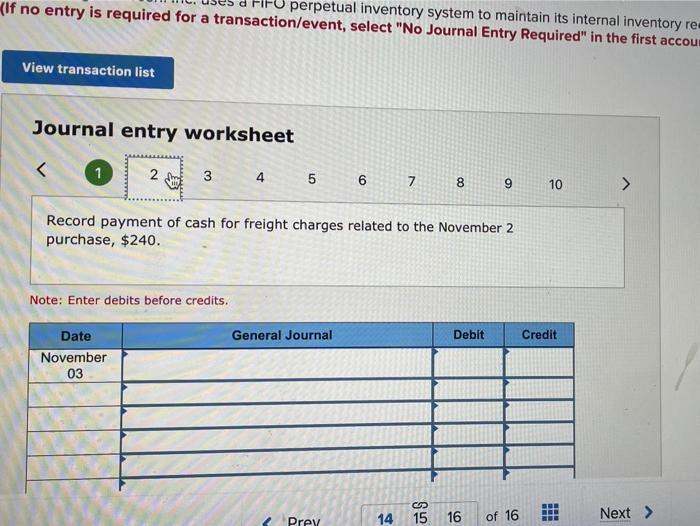

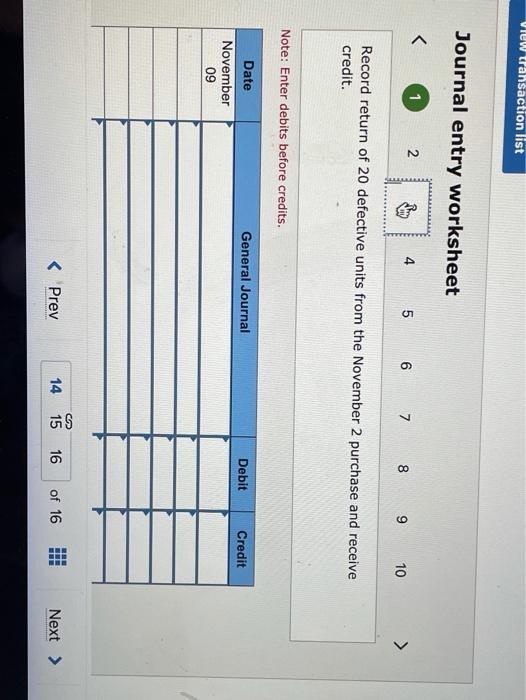

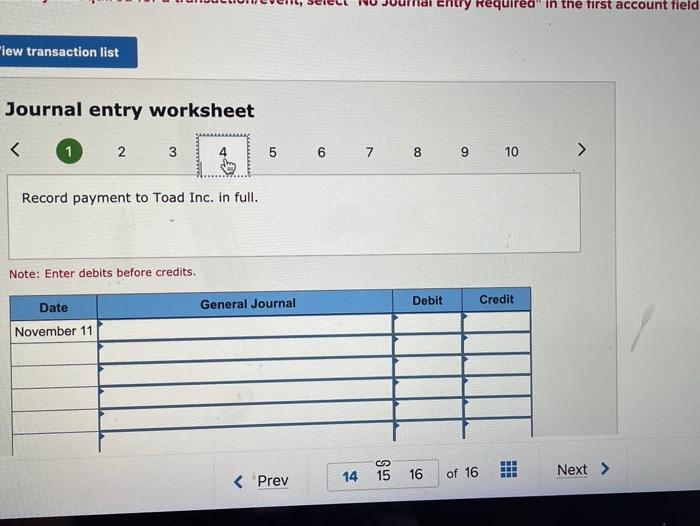

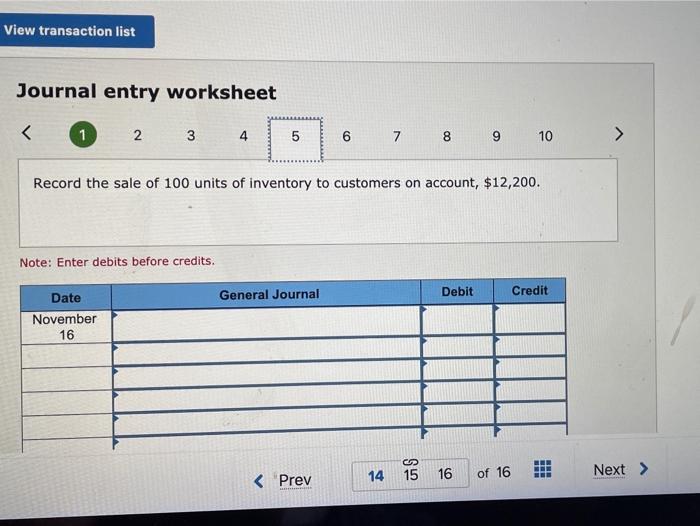

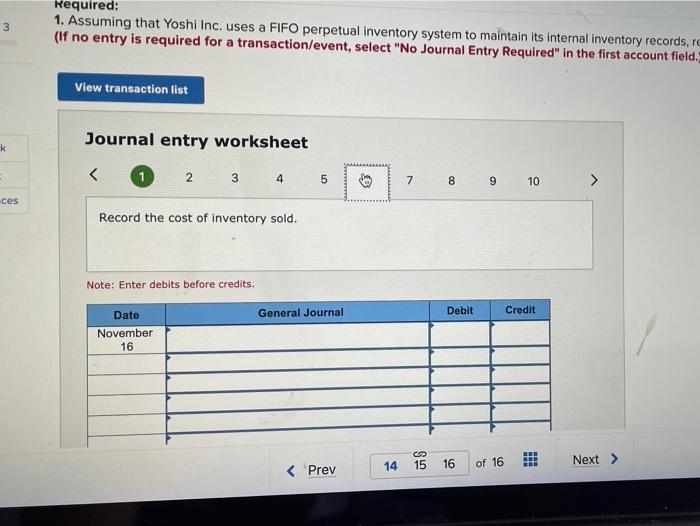

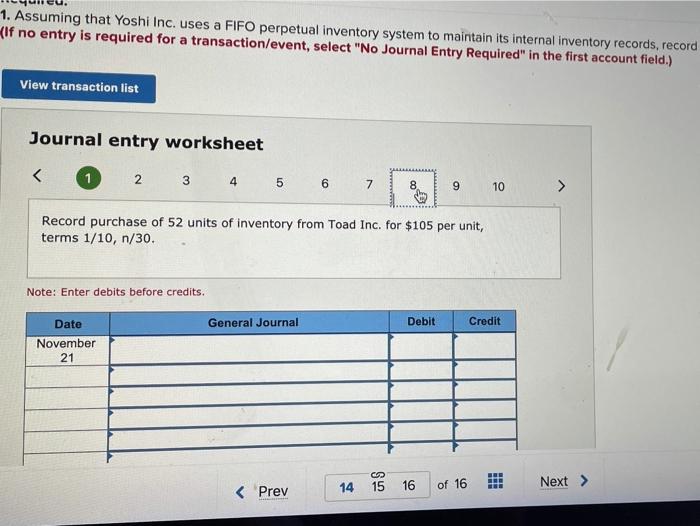

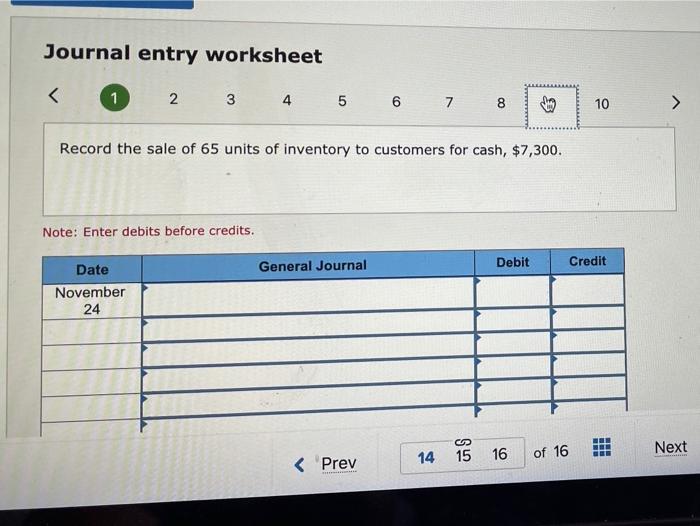

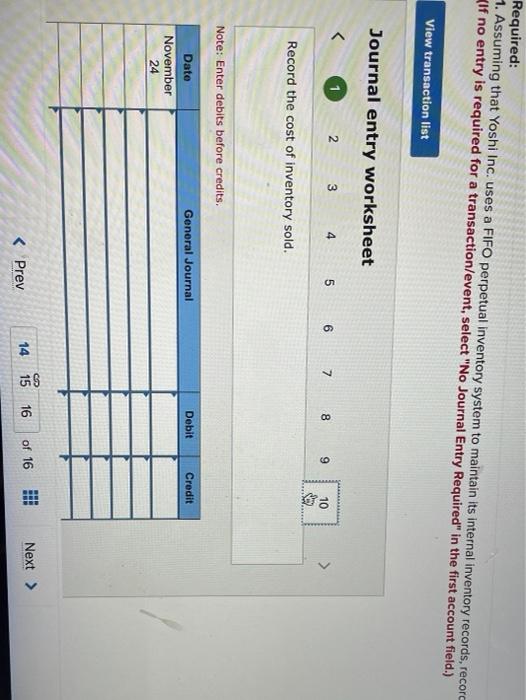

Required information Problem 6-6B Record transactions using a perpetual system, prepare a partial income statement, and adjust for the lower of cost and net realizable value(LO6-2, 6-3, 6-4, 6-5, 6-6) [The following information applies to the questions displayed below.) At the beginning of November, Yoshi Inc.'s inventory consists of 68 units with a cost per unit of $95. The following transactions occur during the month of November November 2 Purchase 80 units of inventory on account from Toad Inc. for $100 per unit, terms 2/10, n/30. November 3 Pay cash for freight charges related to the November 2 purchase, $240. November 9 Return 20 defective units from the November 2 purchase and receive credit. November 11 Pay Toad Inc. in full. November 16 Seil 100 units of inventory to customers on account, $12,200. (Hint: The cost of unite sold from the November 2 purchase includes $100 unit cost plus $4 per unit for freight less $2 per unit for the purchase discount, or $102 per unit. ) November 20 Receive full payment from customers related to the sale on November 16. November 21 Purchase 52 units of inventory from Toad Inc. for $105 per unit, terms 1/10, n/30. November 24 Sell 65 units of inventory to customers for cash, $7,300. (Note: For calculating the cost of inventory sold, ignore the possible purchase discount on November 20.) roblem 6-6B Part 1 equired: Assuming that Yoshi Inc. uses a FIFO perpetual inventory system to maintain its internal inventory records, record the transactio no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) 15 14 16 of 16 Next > perpetual inventory system to maintain its internal inventory re (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first accou View transaction list Journal entry worksheet Record payment of cash for freight charges related to the November 2 purchase, $240. Note: Enter debits before credits. General Journal Debit Credit Date November 03 Prev 14 15 16 of 16 Next > View transaction list Journal entry worksheet try Required" in the first account field iew transaction list Journal entry worksheet Record payment to Toad Inc. in full. Note: Enter debits before credits. Debit Credit General Journal Date November 11 14 15 16 of 16 View transaction list Journal entry worksheet 3 Required: 1. Assuming that Yoshi Inc. us uses a FIFO perpetual inventory system to maintain its internal inventory records, re (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. View transaction list k Journal entry worksheet Journal entry worksheet Record the sale of 65 units of inventory to customers for cash, $7,300. Note: Enter debits before credits. General Journal Debit Credit Date November 24 14 16 11 15 of 16 Next 6 Record the cost of inventory sold. Note: Enter debits before credits. General Journal Debit Credit Date November 24 CD 15 14 16 of 16 I Next >