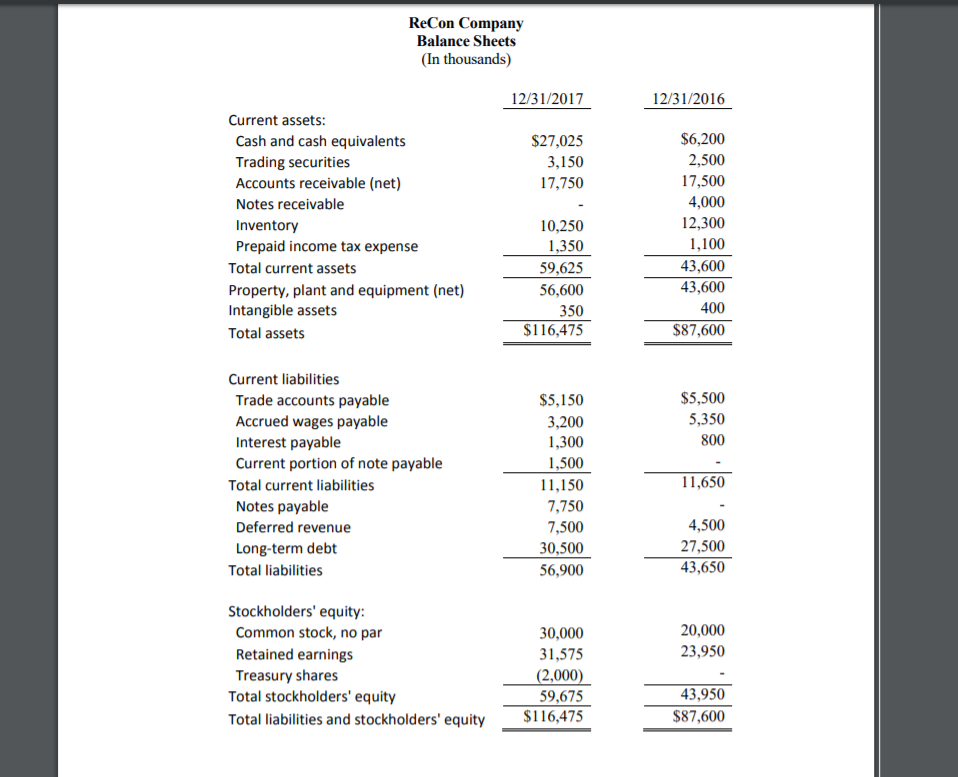

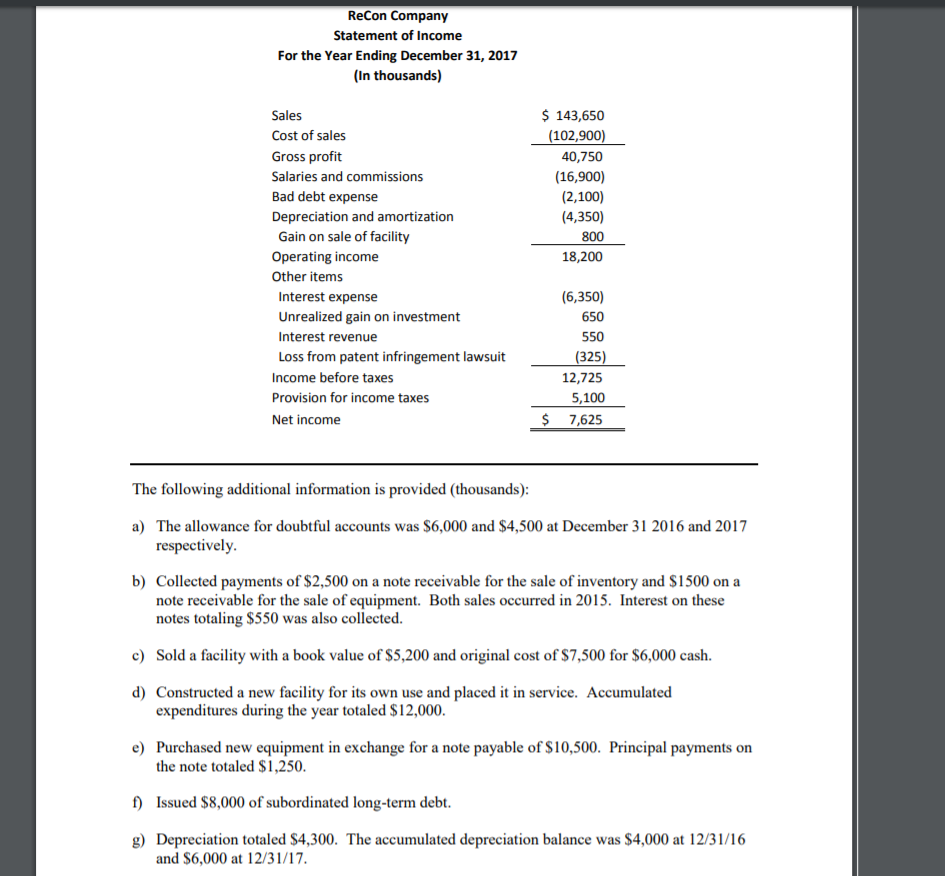

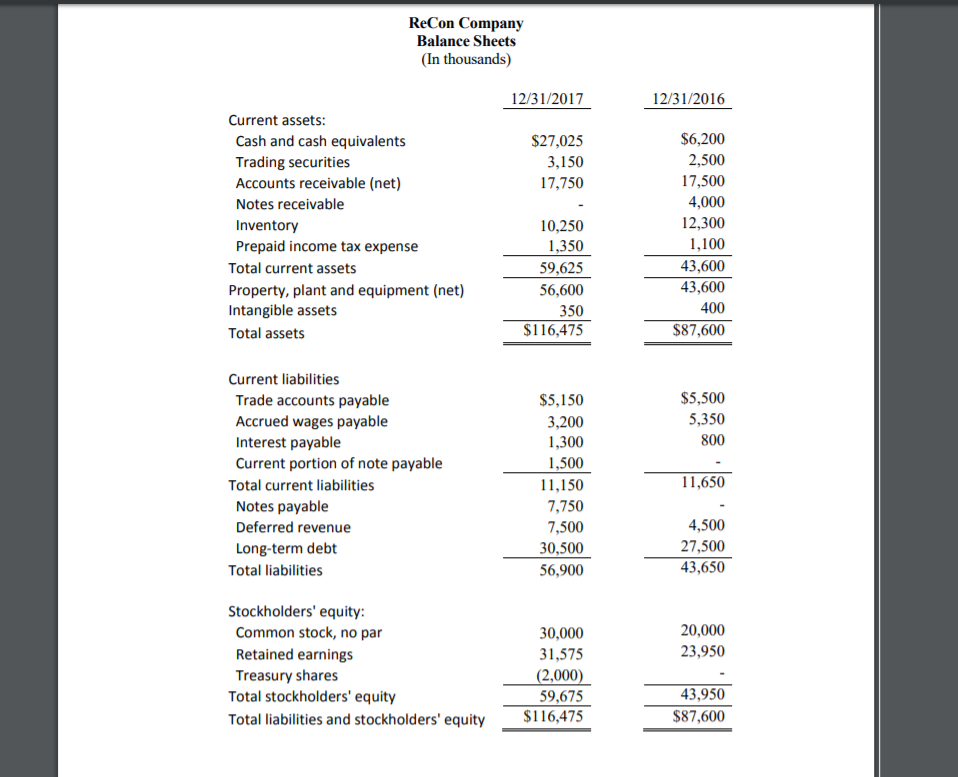

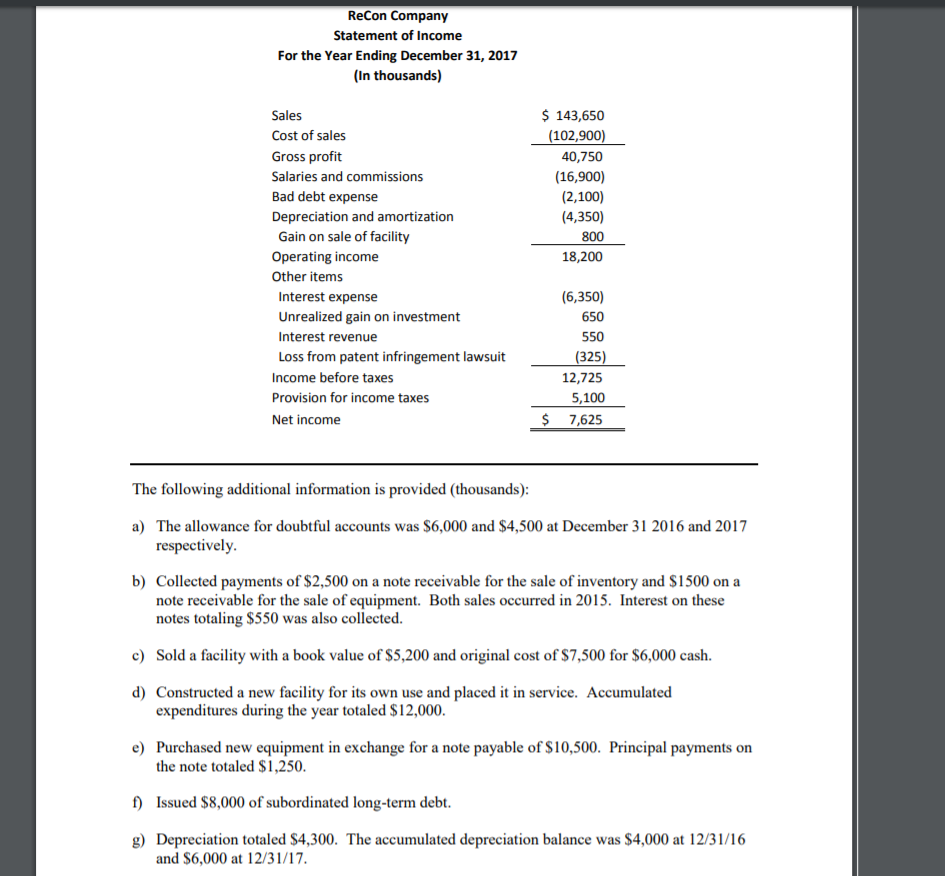

ReCon Company Balance Sheets (In thousands) 12/31/2017 12/31/2016 Current assets: Cash and cash equivalents Trading securities Accounts receivable (net) Notes receivable Inventory Prepaid income tax expense $6,200 2,500 17,500 4,000 12,300 1,100 43,600 43,600 400 $87,600 $27,025 3,150 17,750 Total current assets Property, plant and equipment (net) Intangible assets Total assets 10,250 1,350 59,625 56,600 350 $116,475 Current liabilities $5,500 5,350 800 S5,150 3,200 1,300 1,500 11,150 7,750 7,500 30,500 56,900 Trade accounts payable Accrued wages payable Interest payable Current portion of note payable Total current liabilities 11,650 Notes payable Deferred revenue Long-term debt 4,500 27,500 43,650 Total liabilities Stockholders' equity: Common stock, no par Retained earnings Treasury shares Total stockholders' equity 20,000 23,950 30,000 31,575 2,000 59,675 Total liabilities and stockholders' equity$116,475 43,950 $87,600 ReCon Company Statement of Income For the Year Ending December 31, 2017 (In thousands) Sales Cost of sales Gross profit Salaries and commissions Bad debt expense Depreciation and amortization 143,650 102,900 40,750 (16,900) (2,100) (4,350) 800 18,200 Gain on sale of facility Operating income Other items Interest expense Unrealized gain on investment Interest revenue Loss from patent infringement lawsuit (6,350) 650 550 325 12,725 5,100 $ 7,625 Income before taxes Provision for income taxes Net income The following additional information is provided (thousands) a) The allowance for doubtful accounts was $6,000 and $4,500 at December 31 2016 and 2017 respectivel:y b) Collected payments of $2,500 on a note receivable for the sale of inventory and $1500 on a note receivable for the sale of equipment. Both sales occurred in 2015. Interest on these notes totaling $550 was also collected. Sold a facility with a book value of $5,200 and original cost of $7,500 for $6,000 cash. expenditures during the year totaled $12,000 Purchased new equipment in exchange for a note payable of $10,500. Principal payments on c) d) Constructed a new facility for its own use and placed it in service. Accumulated e) the note totaled $1,250 f) Issued $8,000 of subordinated long-term debt g) Depreciation totaled $4,300. The accumulated depreciation balance was $4,000 at 12/31/16 and S6,000 at 12/31/17 h) Amortization of intangible assets totaled S50 i) Paid S325 to settle a patent infringement lawsuit. j Issued $10,000 of additional common stock of which S5,000 was issued for cash and $5,000 was issued upon conversion of long-term debt. Required: Using the data provided, prepare the 2017 statement of cash flow using both the direct and indirect formats for operating cash flows