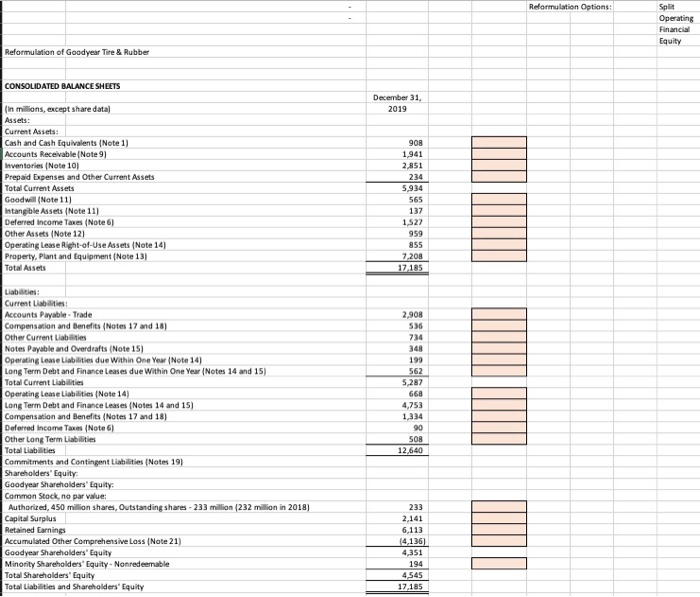

Recoration Options: Sple Operating Financial Equity Reformulation of Goodyear Tire & Rubber CONSOLIDATED BALANCE SHEETS December 31, (in millions, except share data 2019 Current Assets Cash and Cash Equivalents (Note 1) Accounts Receivable Note 9] Inventaries (Note 101 Prepaid Expenses and Other Current Assets Total Current Assets Goodwill (Note 11) Intangible Assets (Note 11) Deferred Income Taxes (Note 6) Other Assets (Note 12) Operating Lease Right-of-Use Assets (Note 14) Property, Plant and Equipment (Note 131 Total Assets 903 1.941 2851 234 5,934 565 137 1527 7208 17.185 2.908 530 734 199 5.287 4,753 1334 Liabities: Current Labs Accounts Payable-Trade Compensation and Benefits (Notes 17 and 18) Other Current Liabilities Notes Payable and Overdrafts (Note 15) Operating Lease Liabilities due Within One Year (Note 14) Long Term Debt and Finance Leases due Within One Year (Notes 14 and 15) Total Current Liabilities Operating Lease Liabilities (Note 14) Long Term Debt and Finance Lease Notes 14 and 151 Compensation and benefits (Notes 17 and 18) Deferred Income Taxes (Note 6) Other Long Term Lab Total Liabilities Commitments and Contingent e s (Notes 19) Shareholders' Equity Goodyear Shareholders' Equity Common Stock, no par value Authorized, 450 milion shares, Outstanding shares - 233 million (232 million in 2018) Capital Surplus Retained Earning Accumulated Other Comprehensive Loss (Note 21) Goodyear Shareholders' Equity Minority Shareholders' Equity - Nonredeemable Total Shareholders' Equity Total Liabilities and Shareholders' Equity SOS 12 640 2.141 6.113 14 1361 4.351 194 4.545 17,185 Recoration Options: Sple Operating Financial Equity Reformulation of Goodyear Tire & Rubber CONSOLIDATED BALANCE SHEETS December 31, (in millions, except share data 2019 Current Assets Cash and Cash Equivalents (Note 1) Accounts Receivable Note 9] Inventaries (Note 101 Prepaid Expenses and Other Current Assets Total Current Assets Goodwill (Note 11) Intangible Assets (Note 11) Deferred Income Taxes (Note 6) Other Assets (Note 12) Operating Lease Right-of-Use Assets (Note 14) Property, Plant and Equipment (Note 131 Total Assets 903 1.941 2851 234 5,934 565 137 1527 7208 17.185 2.908 530 734 199 5.287 4,753 1334 Liabities: Current Labs Accounts Payable-Trade Compensation and Benefits (Notes 17 and 18) Other Current Liabilities Notes Payable and Overdrafts (Note 15) Operating Lease Liabilities due Within One Year (Note 14) Long Term Debt and Finance Leases due Within One Year (Notes 14 and 15) Total Current Liabilities Operating Lease Liabilities (Note 14) Long Term Debt and Finance Lease Notes 14 and 151 Compensation and benefits (Notes 17 and 18) Deferred Income Taxes (Note 6) Other Long Term Lab Total Liabilities Commitments and Contingent e s (Notes 19) Shareholders' Equity Goodyear Shareholders' Equity Common Stock, no par value Authorized, 450 milion shares, Outstanding shares - 233 million (232 million in 2018) Capital Surplus Retained Earning Accumulated Other Comprehensive Loss (Note 21) Goodyear Shareholders' Equity Minority Shareholders' Equity - Nonredeemable Total Shareholders' Equity Total Liabilities and Shareholders' Equity SOS 12 640 2.141 6.113 14 1361 4.351 194 4.545 17,185