Question

Record journal entries in the order presented in the problem. Tamarisk Inc acquired 102,000 common shares, which is 25% of the outstanding common shares, of

Record journal entries in the order presented in the problem.

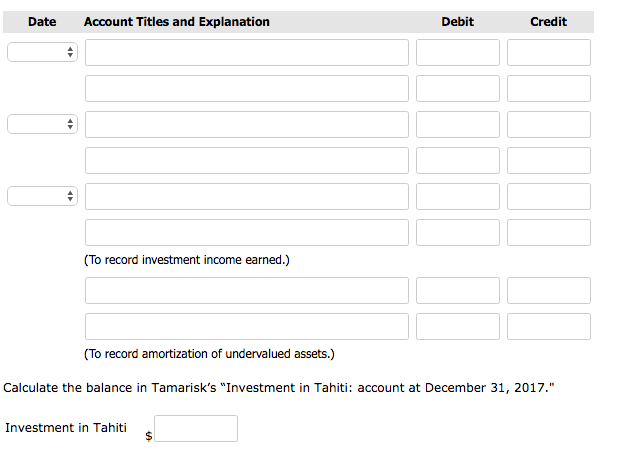

Tamarisk Inc acquired 102,000 common shares, which is 25% of the outstanding common shares, of Tahiti Ltd. on January 1, 2017 for $606,900. At the time of purchase, Tahiti Ltd. depreciable assets were undervalued by $33,600. The depreciable assets had a remaining useful life of 8 years with no salvage value. Tahiti Ltd. declared and paid a cash dividend of $0.33 per share on July 31, 2017. Tahiti Ltd. reported $1.2 million as net income on December 31, 2017 for the year ending on this date. Assuming that Tamarisk Inc. is in a position to exercise significant influence over Tahiti Ltd, and that Tamarisk follows IFRS. Prepare all the journal entries for 2017 in the books of Tamarisk Inc. relating to above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started