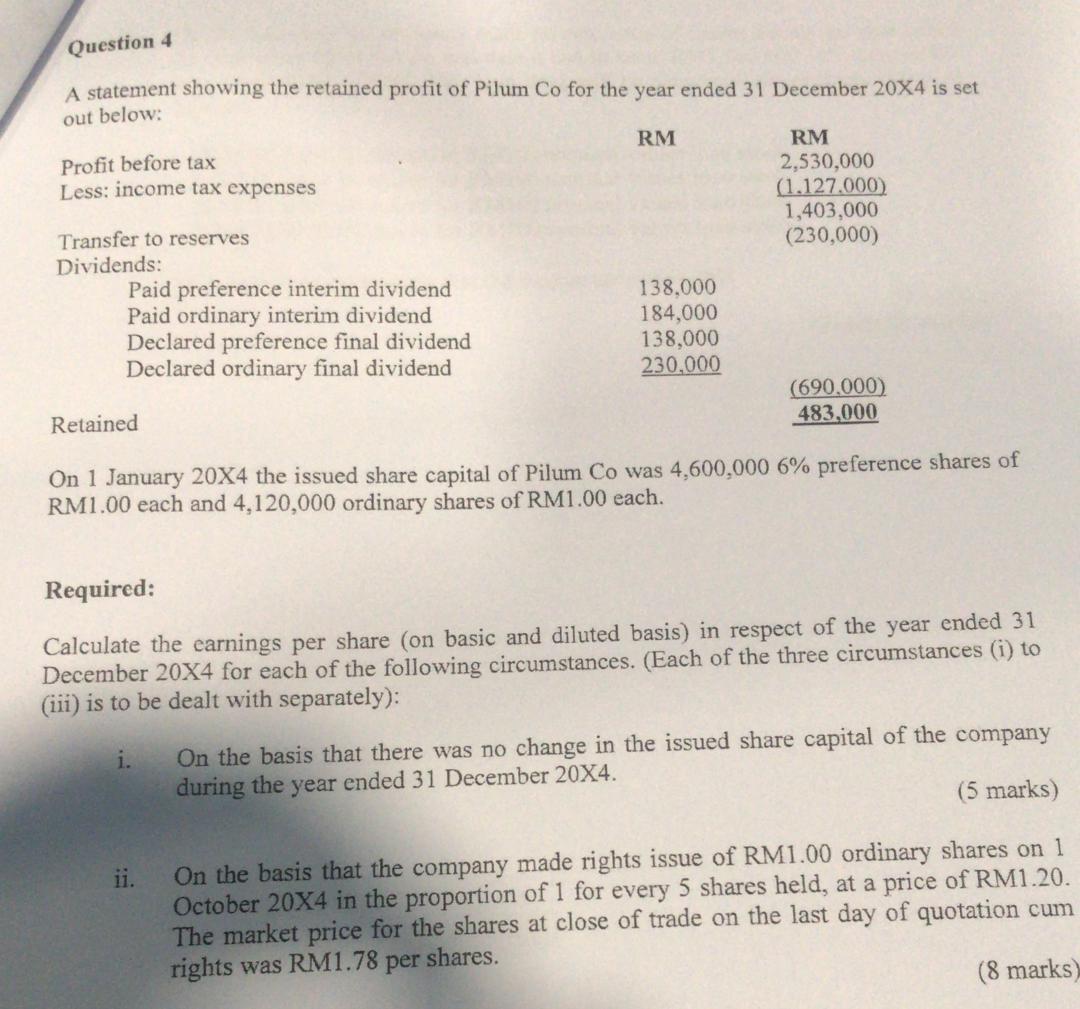

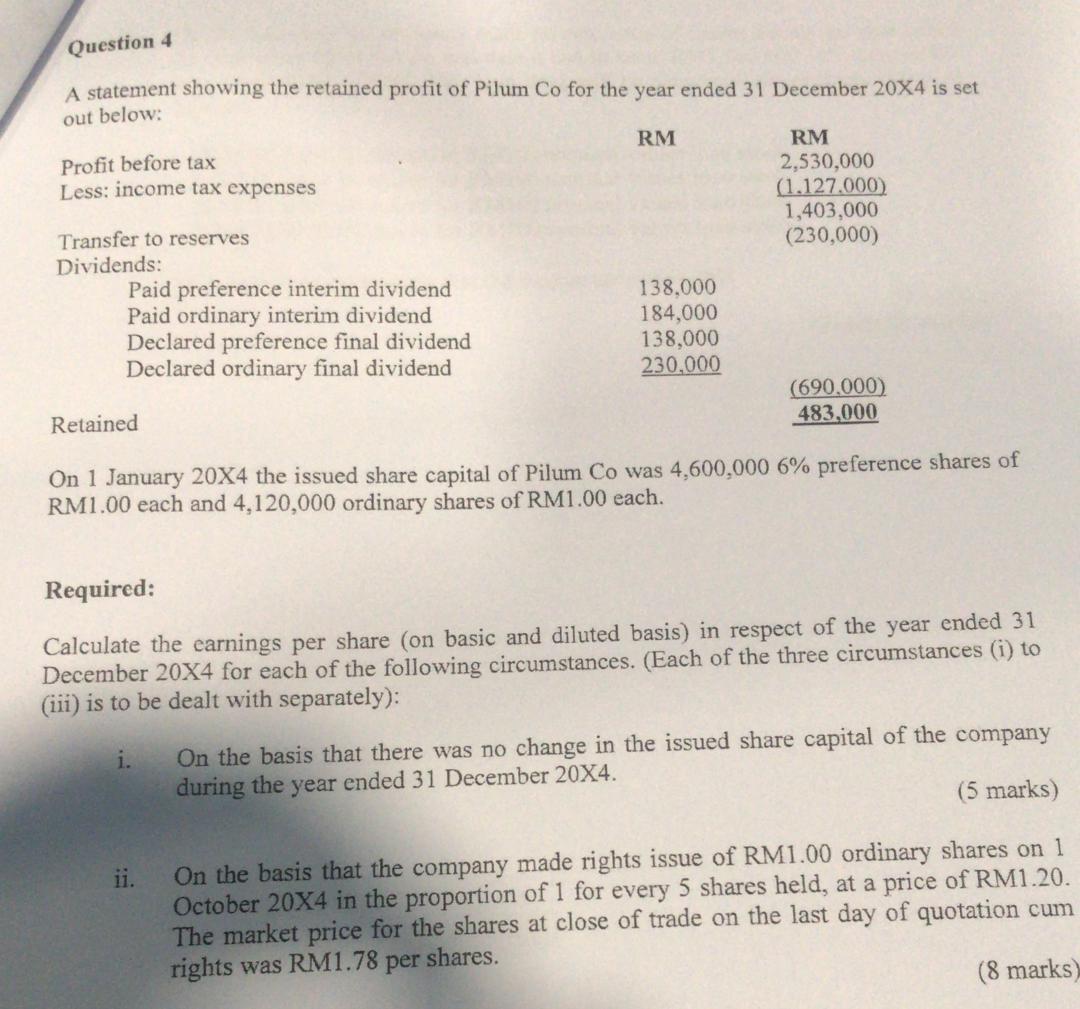

Question 4 A statement showing the retained profit of Pilum Co for the year ended 31 December 20X4 is set out below: RM Profit before tax Less: income tax expenses RM 2,530,000 (1.127.000) 1,403,000 (230,000) Transfer to reserves Dividends: Paid preference interim dividend Paid ordinary interim dividend Declared preference final dividend Declared ordinary final dividend 138.000 184,000 138,000 230,000 (690.000) 483,000 Retained On 1 January 20X4 the issued share capital of Pilum Co was 4,600,000 6% preference shares of RM1.00 each and 4,120,000 ordinary shares of RM1.00 each. Required: Calculate the earnings per share (on basic and diluted basis) in respect of the year ended 31 December 20X4 for each of the following circumstances. (Each of the three circumstances (i) to (iii) is to be dealt with separately): i. On the basis that there was no change in the issued share capital of the company during the year ended 31 December 20X4. (5 marks) ii. On the basis that the company made rights issue of RM1.00 ordinary shares on 1 October 20X4 in the proportion of 1 for every 5 shares held, at a price of RM1.20. The market price for the shares at close of trade on the last day of quotation cum rights was RM1.78 per shares. (8 marks Question 4 A statement showing the retained profit of Pilum Co for the year ended 31 December 20X4 is set out below: RM Profit before tax Less: income tax expenses RM 2,530,000 (1.127.000) 1,403,000 (230,000) Transfer to reserves Dividends: Paid preference interim dividend Paid ordinary interim dividend Declared preference final dividend Declared ordinary final dividend 138.000 184,000 138,000 230,000 (690.000) 483,000 Retained On 1 January 20X4 the issued share capital of Pilum Co was 4,600,000 6% preference shares of RM1.00 each and 4,120,000 ordinary shares of RM1.00 each. Required: Calculate the earnings per share (on basic and diluted basis) in respect of the year ended 31 December 20X4 for each of the following circumstances. (Each of the three circumstances (i) to (iii) is to be dealt with separately): i. On the basis that there was no change in the issued share capital of the company during the year ended 31 December 20X4. (5 marks) ii. On the basis that the company made rights issue of RM1.00 ordinary shares on 1 October 20X4 in the proportion of 1 for every 5 shares held, at a price of RM1.20. The market price for the shares at close of trade on the last day of quotation cum rights was RM1.78 per shares. (8 marks