Answered step by step

Verified Expert Solution

Question

1 Approved Answer

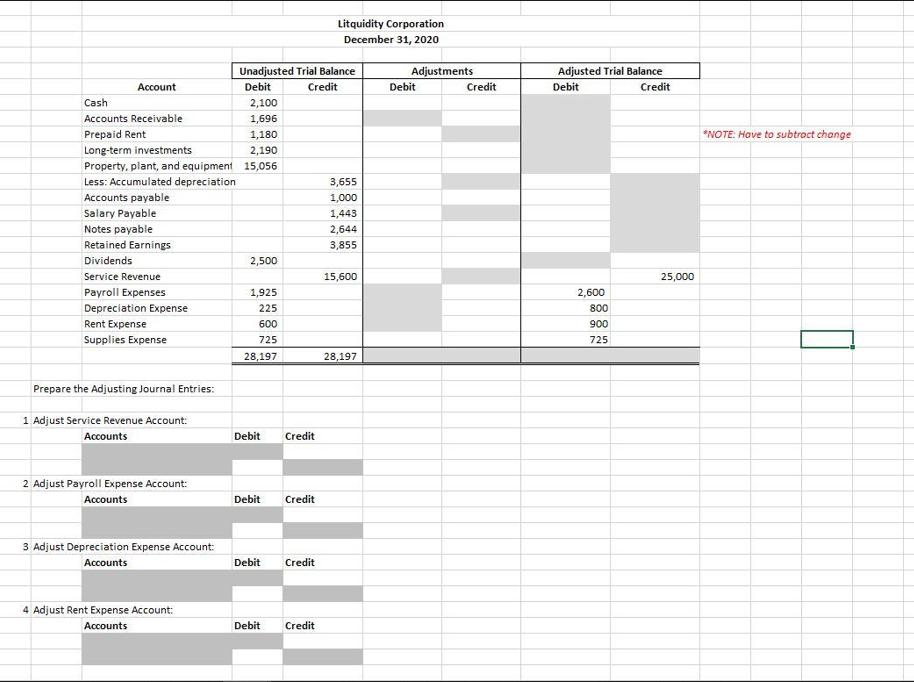

Record the adjusted entries and prepare the adjusted trial balance. Account Cash 2,100 Accounts Receivable 1,696 Prepaid Rent 1,180 Long-term investments 2,190 Property, plant, and

Record the adjusted entries and prepare the adjusted trial balance.

Account Cash 2,100 Accounts Receivable 1,696 Prepaid Rent 1,180 Long-term investments 2,190 Property, plant, and equipment 15,056 Less: Accumulated depreciation Accounts payable Salary Payable Notes payable Retained Earnings Dividends Service Revenue Payroll Expenses Depreciation Expense Rent Expense Supplies Expense Prepare the Adjusting Journal Entries: 1 Adjust Service Revenue Account: Accounts 2 Adjust Payroll Expense Account: Accounts 3 Adjust Depreciation Expense Account: Accounts 4 Adjust Rent Expense Account: Accounts Unadjusted Trial Balance Debit Credit 2,500 1,925 225 600 725 28,197 Debit Credit Debit Credit Debit Credit Litquidity Corporation December 31, 2020 Debit Credit 3,655 1,000 1,443 2,644 3,855 15,600 28,197 Adjustments Debit Credit Adjusted Trial Balance Debit Credit 2,600 800 900 725 25,000 *NOTE: Have to subtract change

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Liquidity Corporation Adjusted Entries and Trial Balance Dec 31 2020 Adjusting Entries 1 Accrued Ser...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started