Answered step by step

Verified Expert Solution

Question

1 Approved Answer

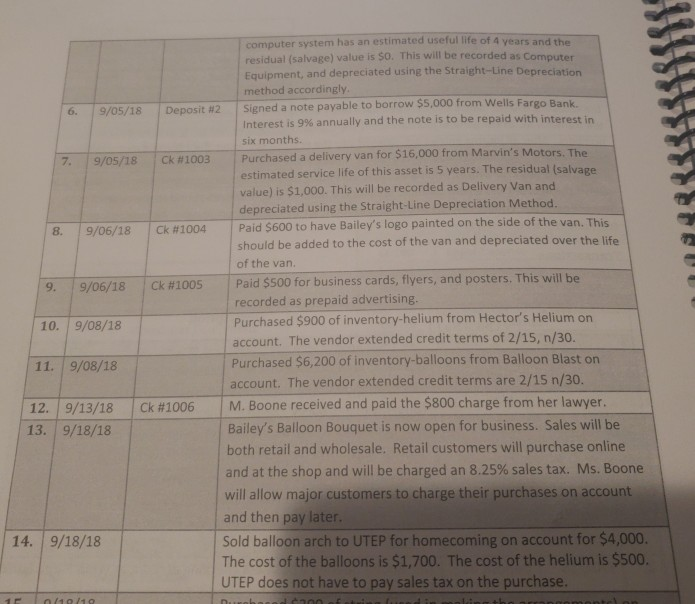

record the following journal entries years and the ill be recorded as Computer computer system has an estimated useful life of 4 residual (salvage) value

record the following journal entries

years and the ill be recorded as Computer computer system has an estimated useful life of 4 residual (salvage) value is SO. This w Equipment, and depreciated using the Straight-Line Depreciation method accordingly Deposit #2 Signed a note payable to borrow $5,000 from wells Far 6, 9/05/18 interest is 9% annually and the note is to be repaid with interest in six months 7: | 9/05/18 | ck #1003 3 Purchased a delivery van for $16,000 from Marvin's Motors | Purchased a del estimated service life of this asset is 5 years. The residual (salvage value) is $1,000. This will be recorded as Delivery Van and depreciated using the Straight-Line Depreciation Method | Paid S600 to have Bailey's logo painted on the side of the van. This ck #1004 8. | 9/06/18 | should be added to the cost of the van and depreciated over the life of the van 9, 19/0 | ck #1005 | Paid S500 for business cards, flyers, and posters. This will be 6/18 recorded as prepaid advertising. Purchased $900 of inventory-helium from Hector's Helium on account. The vendor extended credit terms of 2/15, n/30. Purchased $6,200 of inventory-balloons from Balloon Blast on account. The vendor extended credit terms are 2/15 n/30. | M. Boone received and paid the $800 charge from her lawyer Bailey's Balloon Bouquet is now open for business. Sales will be both retail and wholesale. Retail customers will purchase online and at the shop and will be charged an 8.25% sales tax. Ms. Boone will allow major customers to charge their purchases on account and then pay later Sold balloon arch to UTEP for homecoming on account for $4,000. The cost of the balloons is $1,700. The cost of the helium is $500. UTEP does not have to pay sales tax on the purchase 10. 9/08/18 11. 9/08/18 12. | 9/13/18 13. 9/18/18 | ck #1006 14. 9/18/18Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started