Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Record the following transactions for June 2023 Jun. Jan. 4 Jun. 4 Jun. 7 Jun, 8 Jun. 11 Jun, 14 Jun. 15 Jun. 18 Jun.

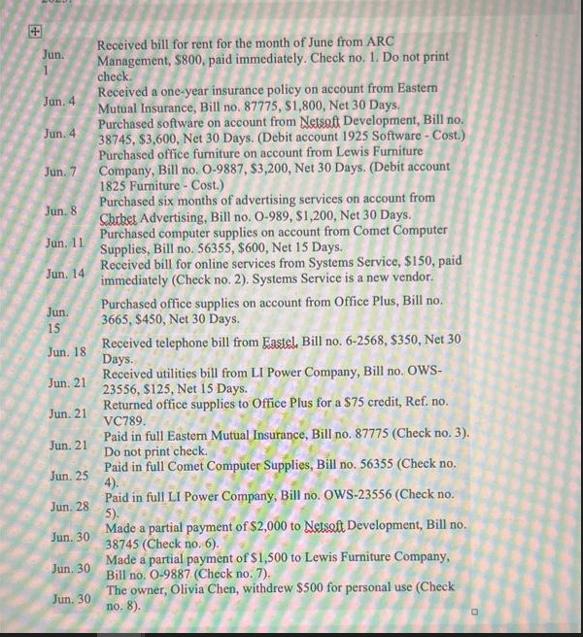

Record the following transactions for June 2023

Jun. Jan. 4 Jun. 4 Jun. 7 Jun, 8 Jun. 11 Jun, 14 Jun. 15 Jun. 18 Jun. 21 Jun. 21 Jun. 21 Jun. 25 Jun, 28 Jun. 30 Jun. 30 Jun. 30 Received bill for rent for the month of June from ARC Management, $800, paid immediately. Check no. 1. Do not print check. Received a one-year insurance policy on account from Eastern Mutual Insurance, Bill no. 87775, $1,800, Net 30 Days, Purchased software on account from Netsoft Development, Bill no. 38745, $3,600, Net 30 Days. (Debit account 1925 Software - Cost.) Purchased office furniture on account from Lewis Furniture Company, Bill no. 0-9887, $3,200, Net 30 Days. (Debit account 1825 Furniture - Cost.) Purchased six months of advertising services on account from Chrbet Advertising, Bill no. O-989, $1,200, Net 30 Days. Purchased computer supplies on account from Comet Computer Supplies, Bill no. 56355, $600, Net 15 Days. Received bill for online services from Systems Service, $150, paid immediately (Check no. 2). Systems Service is a new vendor. Purchased office supplies on account from Office Plus, Bill no. 3665, $450, Net 30 Days. Received telephone bill from Eastel, Bill no. 6-2568, $350, Net 30 Days. Received utilities bill from LI Power Company, Bill no. OWS- 23556, $125, Net 15 Days. Returned office supplies to Office Plus for a $75 credit, Ref. no. VC789. Paid in full Eastern Mutual Insurance, Bill no. 87775 (Check no. 3). Do not print check. Paid in full Comet Computer Supplies, Bill no. 56355 (Check no. Paid in full LI Power Company, Bill no. OWS-23556 (Check no. 5). Made a partial payment of $2,000 to Netsoft Development, Bill no. 38745 (Check no. 6). Made a partial payment of $1,500 to Lewis Furniture Company, Bill no. 0-9887 (Check no. 7). The owner, Olivia Chen, withdrew $500 for personal use (Check no. 8).

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The transactions recorded for the month of June 2023 Date Transaction Description Debit Credit Jun 4 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started