Answered step by step

Verified Expert Solution

Question

1 Approved Answer

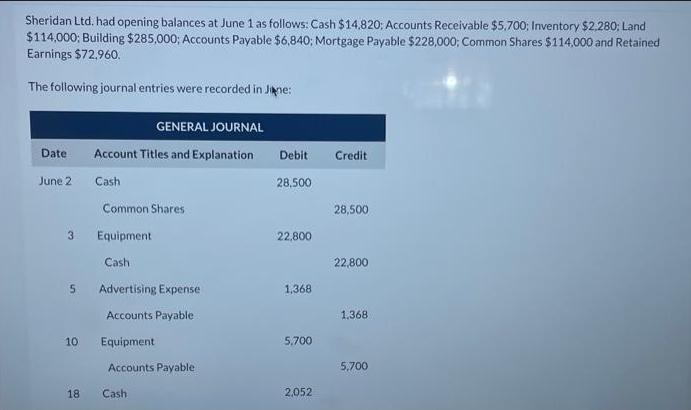

Sheridan Ltd. had opening balances at June 1 as follows: Cash $14,820; Accounts Receivable $5,700; Inventory $2,280; Land $114,000; Building $285,000; Accounts Payable $6,840;

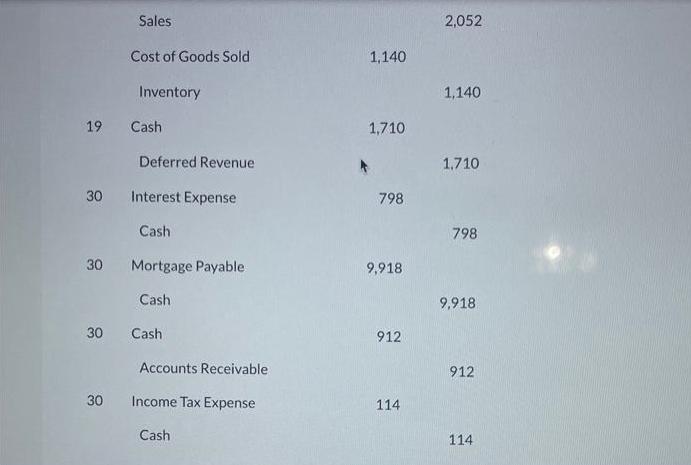

Sheridan Ltd. had opening balances at June 1 as follows: Cash $14,820; Accounts Receivable $5,700; Inventory $2,280; Land $114,000; Building $285,000; Accounts Payable $6,840; Mortgage Payable $228,000; Common Shares $114,000 and Retained Earnings $72.960. The following journal entries were recorded in Jane: Date June 2 3 5 10 18 GENERAL JOURNAL Account Titles and Explanation Cash Common Shares Equipment Cash Advertising Expense Accounts Payable Equipment Accounts Payable Cash Debit 28,500 22,800 1,368 5,700 2,052 Credit 28,500 22,800 1,368 5,700 30 30 19 Cash 30 Sales 30 Cost of Goods Sold Inventory Deferred Revenue Interest Expense Cash Mortgage Payable Cash Cash Accounts Receivable Income Tax Expense Cash 1,140 1,710 798 9,918 912 114 2,052 1,140 1.710 798 9,918 912 114 Enter the opening balances in the T-Accounts at June 1 and Post the June journal entries to the T-Accounts and determine the ending balances in each account. (Post entries in the order displayed in the problem statement.) Sheridan Ltd. had opening balances at June 1 as follows: Cash $14,820; Accounts Receivable $5,700; Inventory $2,280; Land $114,000; Building $285,000; Accounts Payable $6,840; Mortgage Payable $228,000; Common Shares $114,000 and Retained Earnings $72.960. The following journal entries were recorded in Jane: Date June 2 3 5 10 18 GENERAL JOURNAL Account Titles and Explanation Cash Common Shares Equipment Cash Advertising Expense Accounts Payable Equipment Accounts Payable Cash Debit 28,500 22,800 1,368 5,700 2,052 Credit 28,500 22,800 1,368 5,700 30 30 19 Cash 30 Sales 30 Cost of Goods Sold Inventory Deferred Revenue Interest Expense Cash Mortgage Payable Cash Cash Accounts Receivable Income Tax Expense Cash 1,140 1,710 798 9,918 912 114 2,052 1,140 1.710 798 9,918 912 114 Enter the opening balances in the T-Accounts at June 1 and Post the June journal entries to the T-Accounts and determine the ending balances in each account. (Post entries in the order displayed in the problem statement.) Sheridan Ltd. had opening balances at June 1 as follows: Cash $14,820; Accounts Receivable $5,700; Inventory $2,280; Land $114,000; Building $285,000; Accounts Payable $6,840; Mortgage Payable $228,000; Common Shares $114,000 and Retained Earnings $72.960. The following journal entries were recorded in Jane: Date June 2 3 5 10 18 GENERAL JOURNAL Account Titles and Explanation Cash Common Shares Equipment Cash Advertising Expense Accounts Payable Equipment Accounts Payable Cash Debit 28,500 22,800 1,368 5,700 2,052 Credit 28,500 22,800 1,368 5,700 30 30 19 Cash 30 Sales 30 Cost of Goods Sold Inventory Deferred Revenue Interest Expense Cash Mortgage Payable Cash Cash Accounts Receivable Income Tax Expense Cash 1,140 1,710 798 9,918 912 114 2,052 1,140 1.710 798 9,918 912 114 Enter the opening balances in the T-Accounts at June 1 and Post the June journal entries to the T-Accounts and determine the ending balances in each account. (Post entries in the order displayed in the problem statement.)

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started