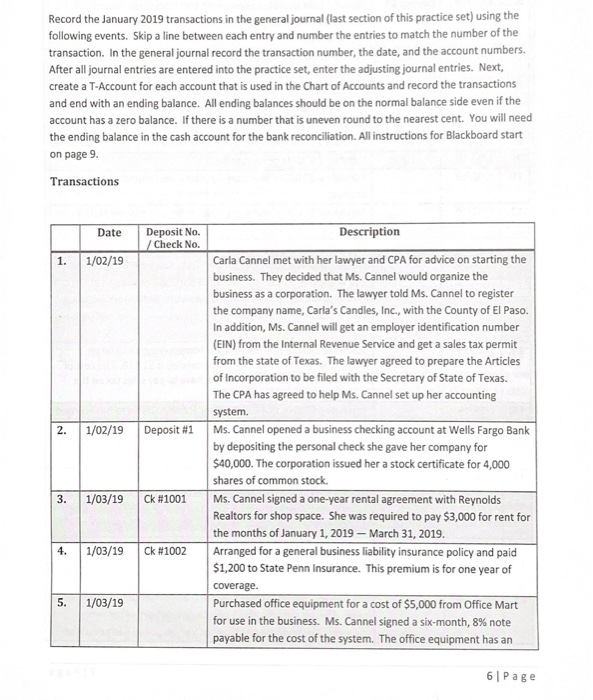

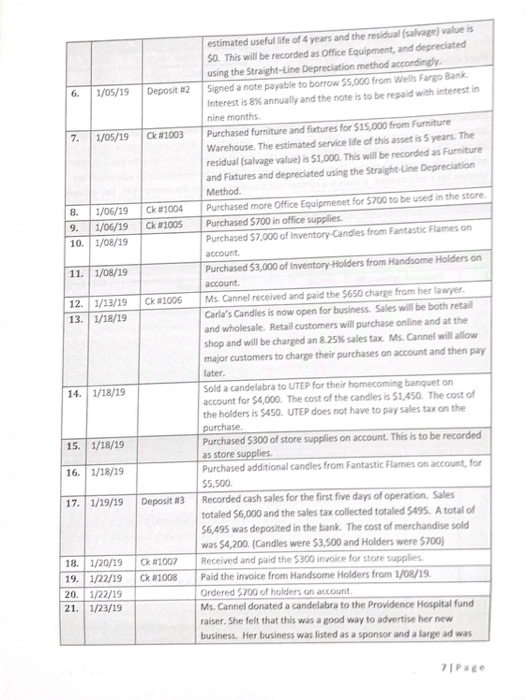

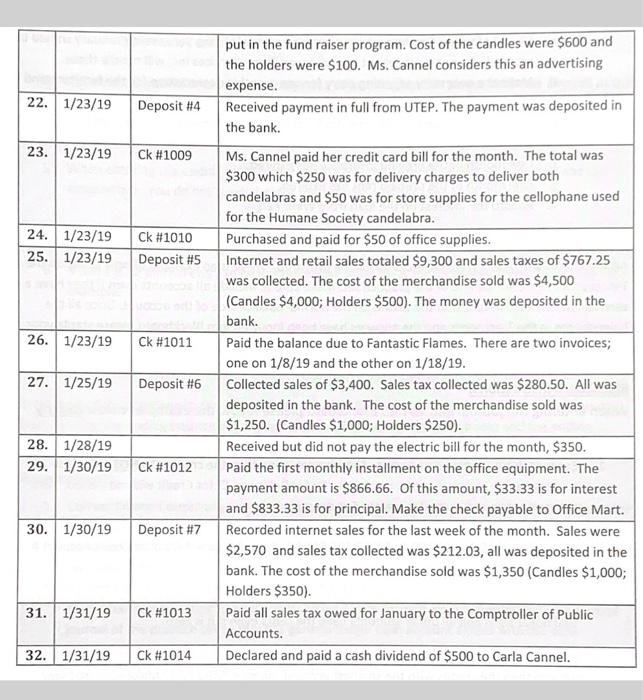

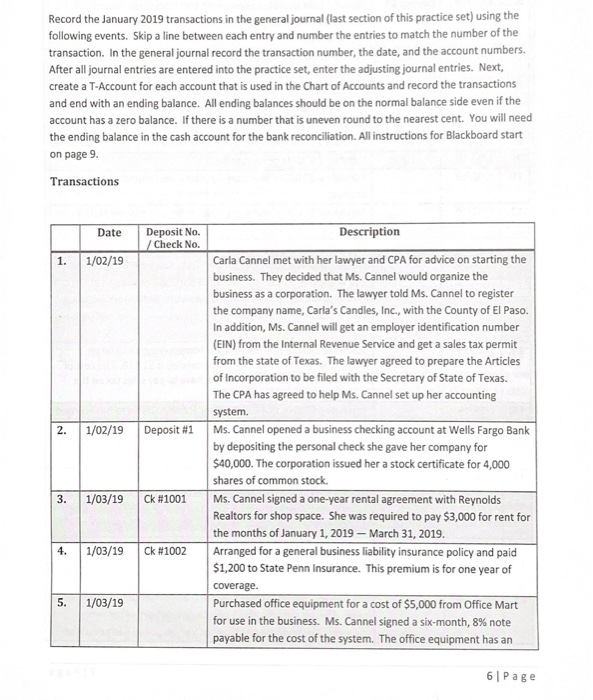

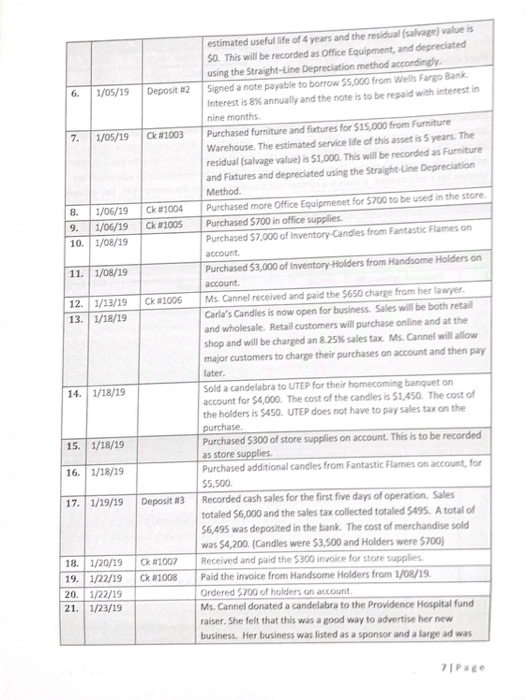

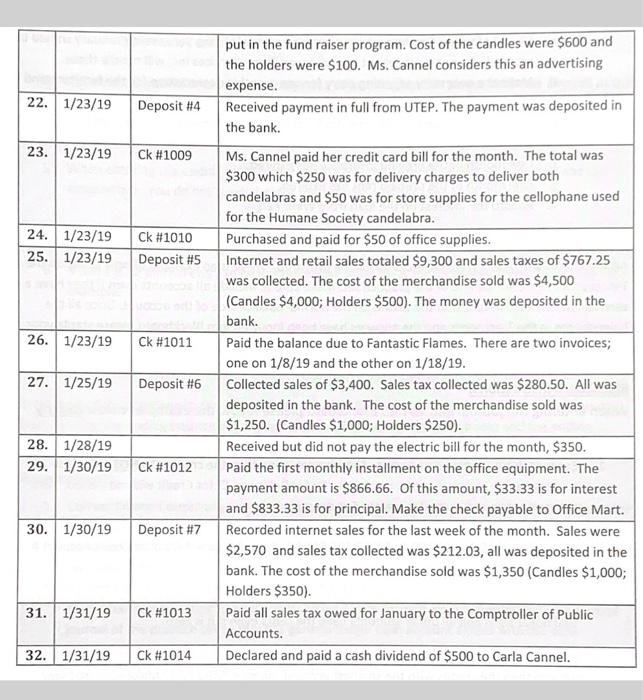

Record the January 2019 transactions in the general journal (last section of this practice set) using the following events. Skip a line between each entry and number the entries to match the number of the transaction. In the general journal record the transaction number, the date, and the account numbers After all journal entries are entered into the practice set, enter the adjusting journal entries. Next, create a T-Account for each account that is used in the Chart of Accounts and record the transactions and end with an ending balance. All ending balances should be on the normal balance side even if the account has a zero balance. If there is a number that is uneven round to the nearest cent. You will need the ending balance in the cash account for the bank reconciliation. All instructions for Blackboard start on page 9. Transactions Description Date Deposit No. Check No. Carla Cannel met with her lawyer and CPA for advice on starting the business. They decided that Ms. Cannel would organize the business as a corporation. The lawyer told Ms. Cannel to register the company name, Carla's Candles, Inc., with the County of El Paso. In addition, Ms. Cannel will get an employer identification number (EIN) from the Internal Revenue Service and get a sales tax permit from the state of Texas. The lawyer agreed to prepare the Articles of Incorporation to be filed with the Secretary of State of Texas. The CPA has agreed to help Ms. Cannel set up her accounting system 1. 1/02/19 2. | 1/02/19 | Deposit #1 | Ms. Cannel opened a business checking account at Wells Fargo Bank by depositing the personal check she gave her company for 40,000. The corporation issued her a stock certificate for 4,000 shares of common stock. 3. | 1/03/19 | Ck #1001 | Ms. Cannel signed a one-year rental agreement with Reynolds Realtors for shop space. She was required to pay $3,000 for rent for the months of January 1, 2019-March 31, 2019. 4. | 1/03/19 | ck #1002 | Arranged for a general business liability insurance policy and paid 1,200 to State Penn Insurance. This premium is for one year of coverage. Purchased office equipment for a cost of $5,000 from Office Mart for use in the business. Ms. Cannel signed a six-month, 8% note payable for the cost of the system. The office equipment has an 5. 1/03/19 61 Page estimated useful life of 4 years and the residual (salvage) value is SO. This will be recorded as Office Equipment, and depreciated using the Straight-Line Depreciation method accordingly Signed a note payable to borrow ss,000 from Wels Fago Interest is 8% annually and the note is to be repaid with interest in nine months. 6-1 1/05/19 Deposit #2 Purchased furniture and fixtures for S 15,000 from Furniture Warehouse. The estimated service life of this asset is 5 years. The residual (salvage value) is $1,000. This will be recorded as Furniture and Fixtures and depreciated using the Straight-Line Depreciation Method. 7. | 1/05/19 | ck #1003 Purchased more office Equipmenet for S700 to be used in the store. 8, 1/06/19 9. 1/06/19 10. 1/08/19 Ck #1004 Ck #1005 Purchased s 700 in office supplies. Purchased $7,000 of Inventony-Candles from Fantastic Flames on account 11. 1/08/19 Purchased $3,000 of Inventory-Holders from Handsome Holders on account. lawyer 13. 1/18/19 Carla's Candles is now open for business. Sales will be both retail and wholesale. Retail customers will purchase online and at the shop and will be charged an 825% sales tax. Ms. Cannel will allow major customers to charge their purchases on account and then pay later. 14. 1/18/19 Sold a candelabra to UTEP for their homecoming banquet on account for $4,000. The cost of the candles is $1,450. The cost of the holders is $450. UTEP does not have to pay sales tax on the purchase Purchased $300 of store supplies on account. This is to be recorded as store supplies Purchased additional candles from Fantastic Flames on account, for 15. 1/18/19 16. 1/18/19 17. | 1/19/19 $5,500 | Deposit #3 | Recorded cash sales for the first five days of operation. Sales totaled $6,000 and the sales tax collected totaled $495. A total of 6,495 was deposited in the bank. The cost of merchandise sold was $4,200. (Candles were $3,500 and Holders were 5700) 18.11/20/19 19, 1 1/22/19 Ck #1007 ck #1008 Received and paid the S300 r voice for store supplies. Paid the invoice from Handsome Holders frorn 1/08/19 Ordered $700 of holders on account 21. 1/23/is Ms. Cannel donated a candelabra to the Providence Hospital fund raiser. She felt that this was a good way to advertise her new business. Her business was listed as a sponsor and a large ad was Page