Question

Record the necessary adjusting journal entries 2. Post the Journal entries to the T-accounts 3. Create an adjusted trial balance 4. Create an income statement,

Record the necessary adjusting journal entries

2. Post the Journal entries to the T-accounts

3. Create an adjusted trial balance

4. Create an income statement, statement of retained earnings, and a balance sheet with the info below:

1. Supplies used in January is $350.

2. Rent expense for the month is $2,000.

3. Insurance expense for the month is $1,000.

4. Depreciation expense for the month is $500.

5. Interest expense for the month is $150 and will not be paid until February 15.

6. Salaries totaling $2,000 have been earned but not paid to employees.

7. The company has earned $1,000 of Unearned Revenues.

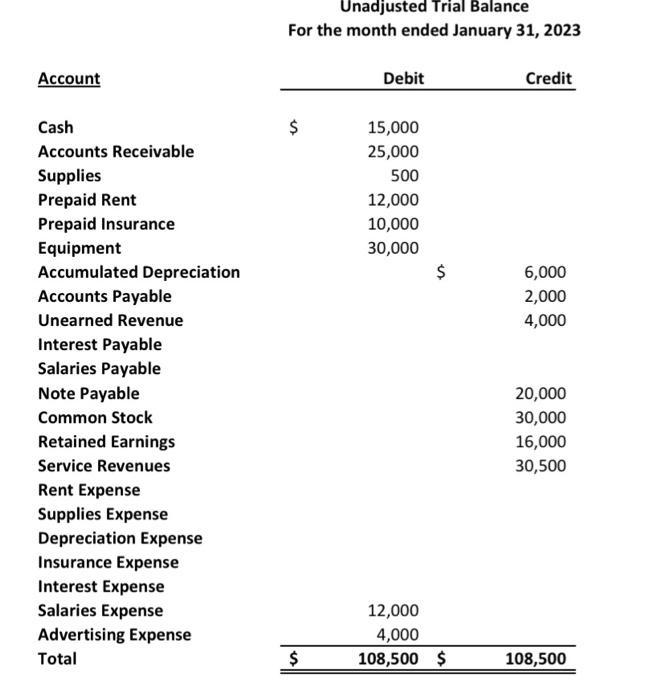

Account Cash Accounts Receivable Supplies Prepaid Rent Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Interest Payable Salaries Payable Note Payable Common Stock Retained Earnings Service Revenues Rent Expense Supplies Expense Depreciation Expense Insurance Expense Interest Expense Salaries Expense Advertising Expense Total Unadjusted Trial Balance For the month ended January 31, 2023 $ $ Debit 15,000 25,000 500 12,000 10,000 30,000 $ 12,000 4,000 108,500 $ Credit 6,000 2,000 4,000 20,000 30,000 16,000 30,500 108,500

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To record the necessary adjusting journal entries we need to consider the given information Here are the adjusting entries 1 Supplies used in January is 350 Debit Supplies Expense 350 Credit Supplies ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started