Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two individuals, Frank and Sam, form a new corporation. The following transactions are made pursuant to agreement of incorporation. In exchange for 2/3 (66.67

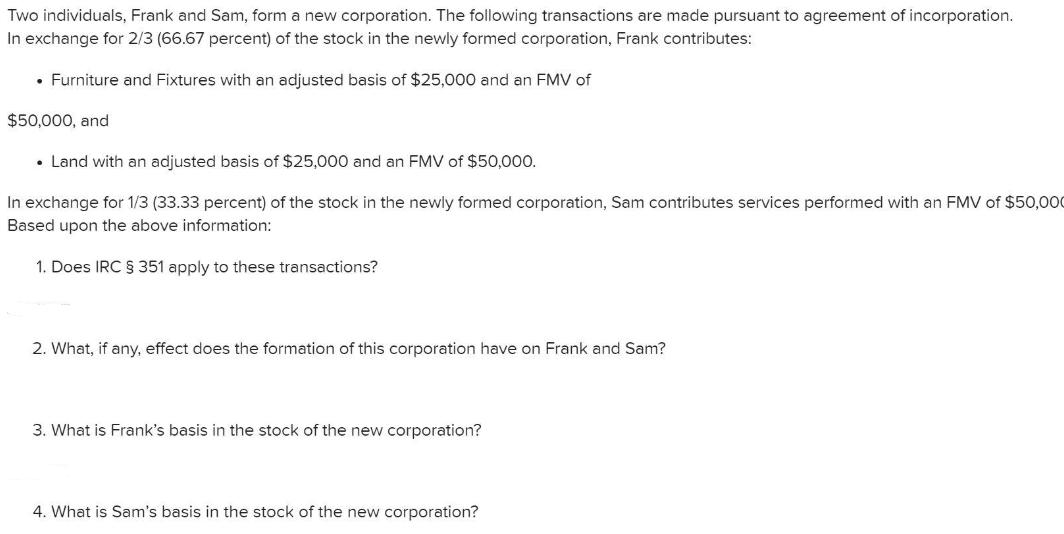

Two individuals, Frank and Sam, form a new corporation. The following transactions are made pursuant to agreement of incorporation. In exchange for 2/3 (66.67 percent) of the stock in the newly formed corporation, Frank contributes: Furniture and Fixtures with an adjusted basis of $25,000 and an FMV of $50,000, and Land with an adjusted basis of $25,000 and an FMV of $50,000. In exchange for 1/3 (33.33 percent) of the stock in the newly formed corporation, Sam contributes services performed with an FMV of $50,000 Based upon the above information: 1. Does IRC 351 apply to these transactions? 2. What, if any, effect does the formation of this corporation have on Frank and Sam? 3. What is Frank's basis in the stock of the new corporation? 4. What is Sam's basis in the stock of the new corporation?

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Section 351 of the Internal Revenue Code does not apply to the aforementioned transactions 2 Neither Frank nor Sam will be affected in any way by the establishment of the corporation 3 The co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started