Answered step by step

Verified Expert Solution

Question

1 Approved Answer

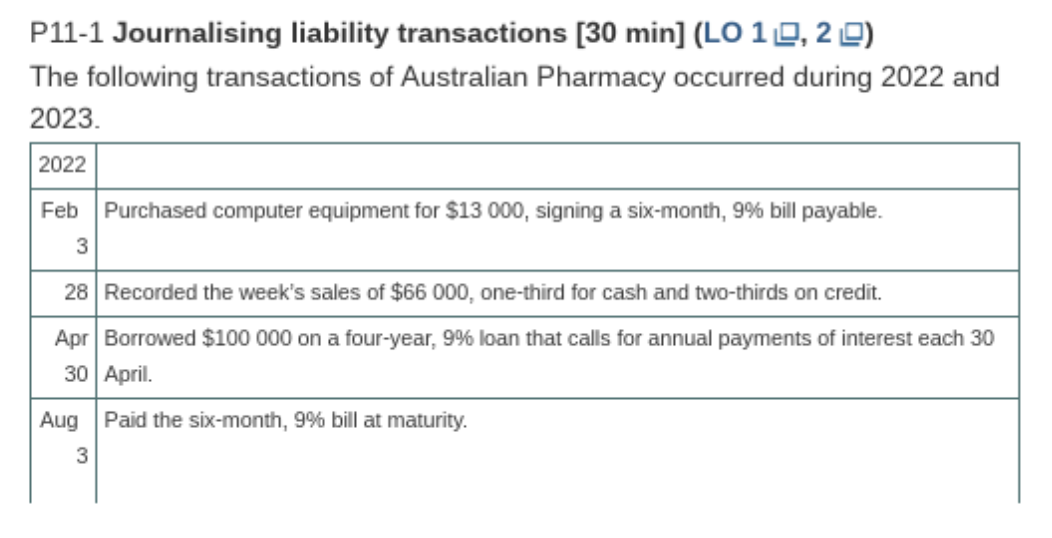

Record the transactions as journal entries P11-1 Journalising liability transactions [30 min] (LO 19, 20) The following transactions of Australian Pharmacy occurred during 2022 and

Record the transactions as journal entries

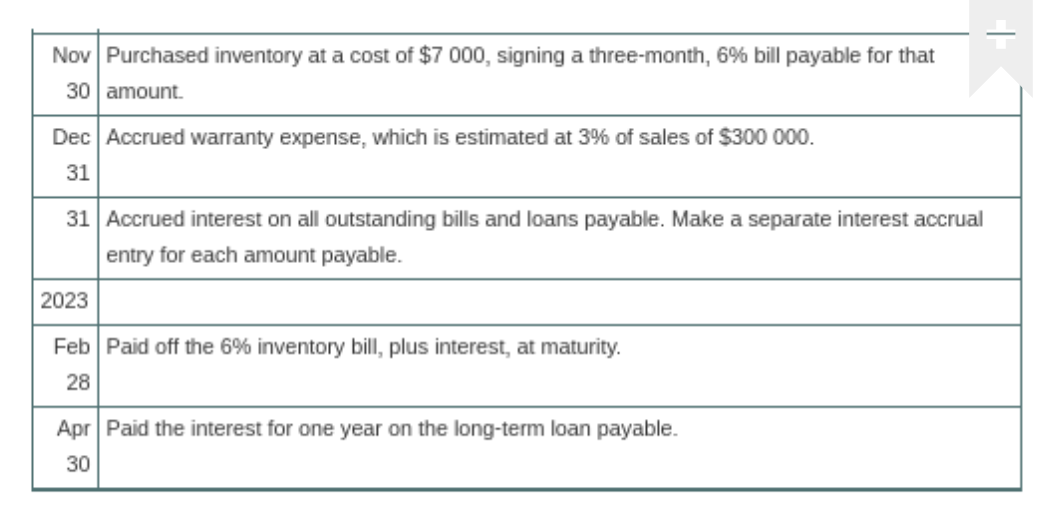

P11-1 Journalising liability transactions [30 min] (LO 19, 20) The following transactions of Australian Pharmacy occurred during 2022 and 2023. 2022 Feb Purchased computer equipment for $13 000, signing a six-month, 9% bill payable. 3 28 Recorded the week's sales of $66 000, one-third for cash and two-thirds on credit. Apr Borrowed $100 000 on a four-year, 9% loan that calls for annual payments of interest each 30 30 April . Aug Paid the six-month, 9% bill at maturity. 3 Nov Purchased inventory at a cost of $7 000, signing a three-month, 6% bill payable for that 30 amount. Dec Accrued warranty expense, which is estimated at 3% of sales of $300 000. 31 31 Accrued interest on all outstanding bills and loans payable. Make a separate interest accrual entry for each amount payable. 2023 Feb Paid off the 6% inventory bill, plus interest, at maturity. 28 Apr Paid the interest for one year on the long-term loan payable. 30Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started