Answered step by step

Verified Expert Solution

Question

1 Approved Answer

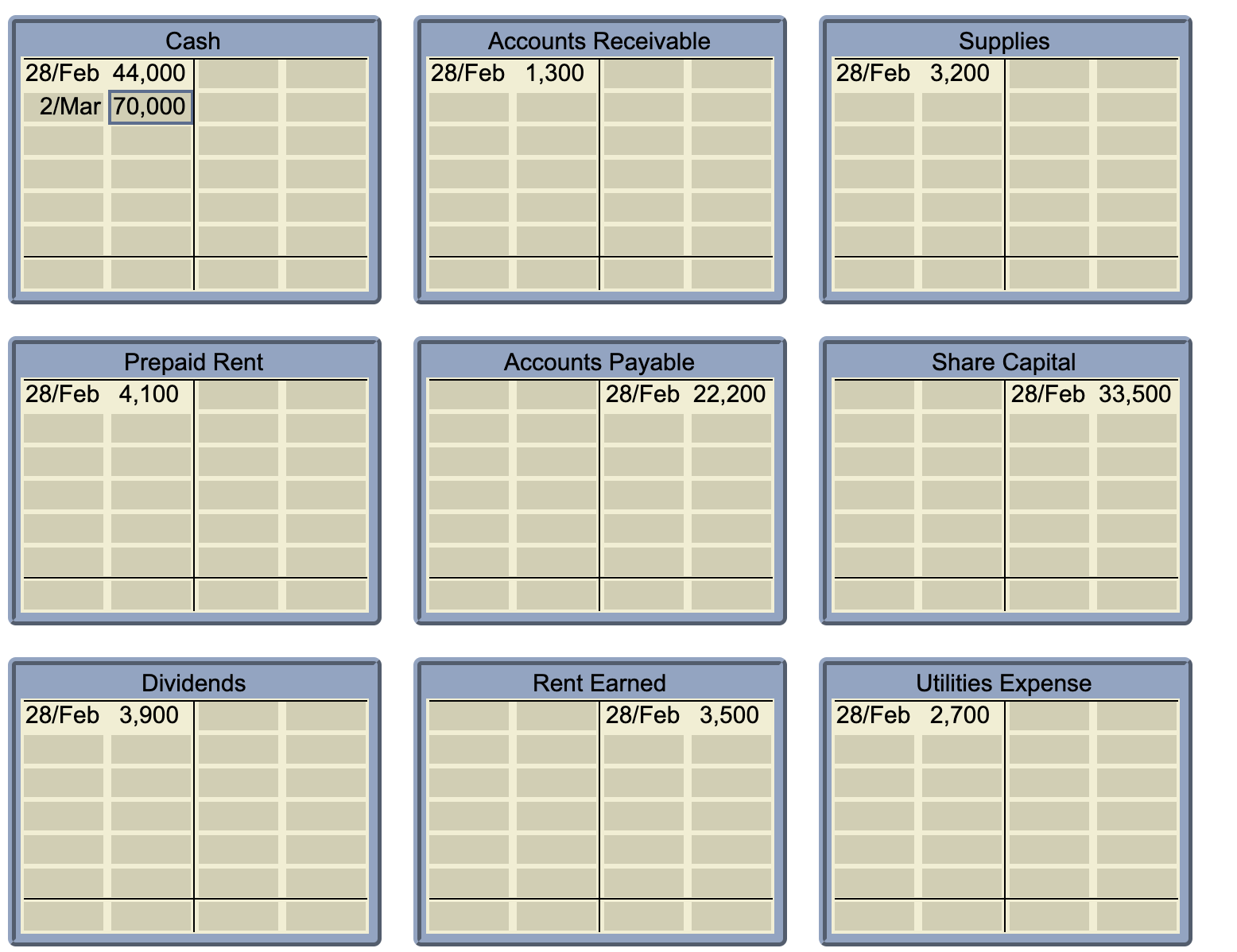

Record these transactions of the Holden Corp. company by recording the debit and credit entries directly in the T-accounts. Use the date for each transaction

Record these transactions of the Holden Corp. company by recording the debit and credit entries directly in the T-accounts. Use the date for each transaction to identify the entries, placing the date in the left-hand cell and the amount in the right-hand cell on the appropriate side of the T-account. Then determine the balance of each account using the starting balances as shown, and write 'Balance' (or 'Bal') next to it, in the left-hand cell on the appropriate side.

- March 2 : Sandra Castell (a shareholder), received share capital in Holden Corp., after investing $70,000 cash into the business.

- March 3 : One of Holden Corp.'s clients rented equipment today for $1,400 on credit.

- March 4 : Holden Corp. bought supplies on credit for $800.

- March 5 : Holden Corp. paid $200 for this month's utilities bill received today.

- March 6 : Holden Corp. received $1,100 towards payment for the services provided in transaction (b).

- March 9 : Holden Corp. bought $800 of supplies paying $200 cash and $600 on account.

- March 11 : Holden Corp. returned $200 of defective supplies today that were originally purchased for cash.

- March 14 : $800 of supplies purchased on credit in transaction (c) were found to be defective. They were returned.

- March 16 : Furniture was rented by a customer for $600 cash.

- March 18 : Holden Corp. paid $700 for supplies purchased today.

\\begin{tabular}{|l|l|l|l|l|} \\hline \\multicolumn{4}{|c|}{ Dividends } \\\\ \\hline 28/Feb & 3,900 & & \\\\ \\hline & & & & \\\\ \\hline & & & & \\\\ \\hline & & & & \\\\ \\hline & & & \\\\ \\hline & & & \\\\ \\hline \\end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started