Record transactions 1 through 15 on the attached worksheet. Initial balances are already registered in the same. Transaction 1: Purchased from $70.000 direct materials credit and taken to the warehouse. Transaction 2: $67.000 materials are used in the manufacture of products. Transaction 3: $20.000 are paid for wages and wages to production employees. Transaction 4: Pay $38.000 for salaries to employees working in the sales and administration areas

Transaction 5: The purchase of furniture to be used in the sales and administrative offices is paid 5,000,000. Transaction 6: Depreciation of company furniture is recognized, including that purchased for offices in Event 5. The annual depreciation charge is 6.5k. Transaction 7: 4.000,000 are paid for manufacturing equipment. Transaction 8: Depreciation of the company's manufacturing equipment, including that purchased at the event, is recognized

Transaction 9: $8.000 indirect manufacturing costs are recognized; $2.400 were paid in cash and $5.600 were credit Transaction 10: Completed units are transferred to the warehouse for the amount of $102.000. Transaction 11: $4.300 are paid for ads and other promotional expenses. Transaction 12: Merchandise is sold to customers for $160.000; $64.000 cash and $96.000 credit. Transaction 13: Inventory sold on transaction 12 had a cost of $98.000.

Transaction 14: $90,000 is received from customers who have purchased on credit. Transaction 15: $75,000 is paid to creditors. Determines the final balances of each column.

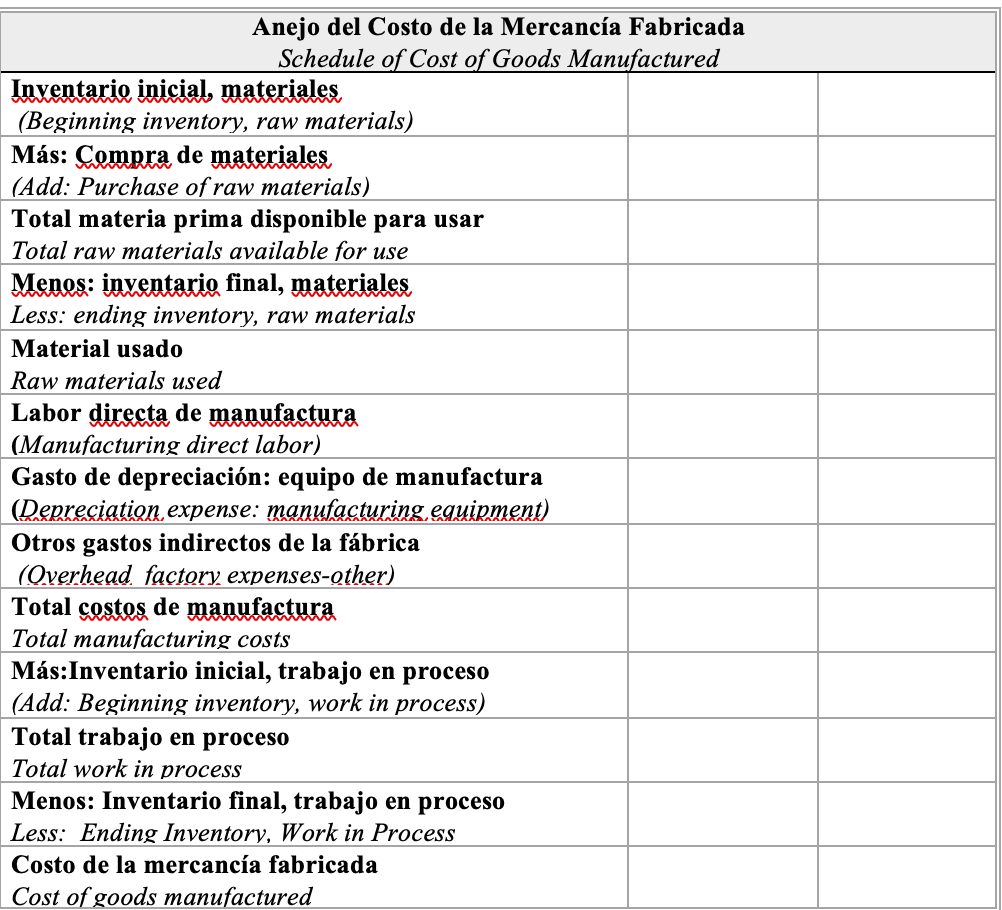

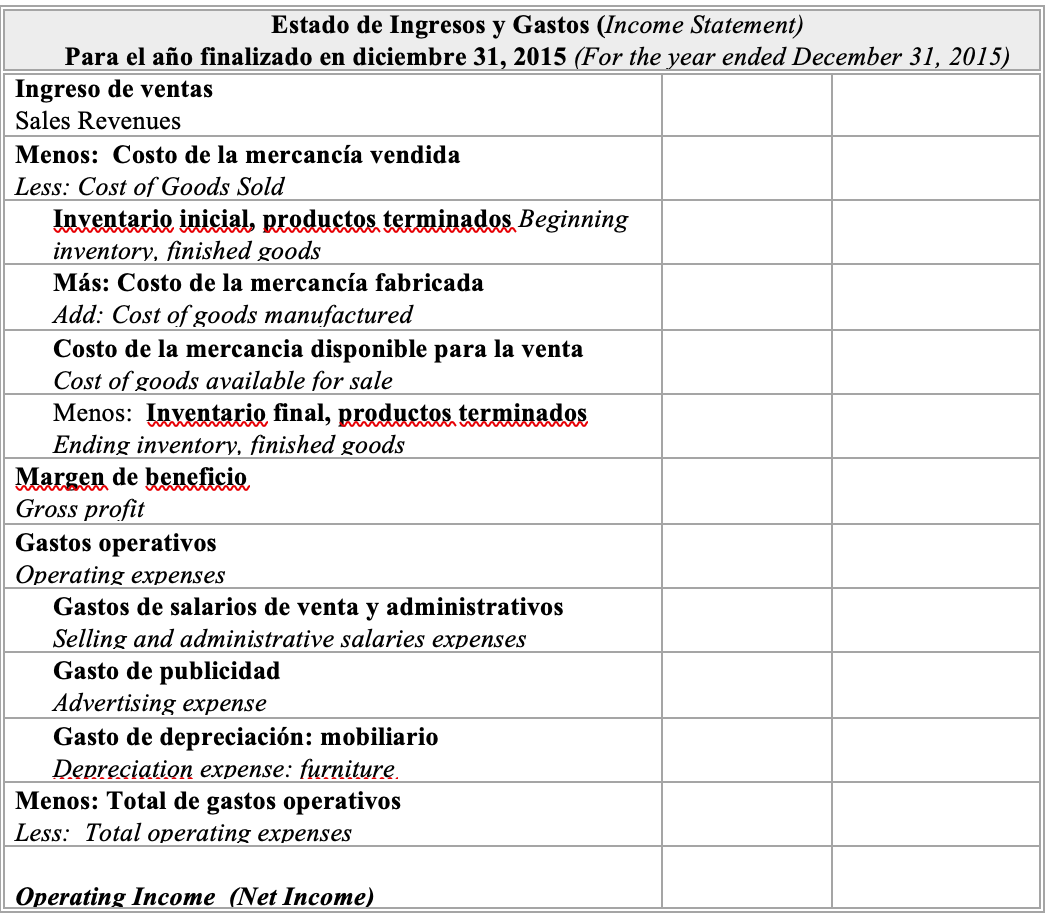

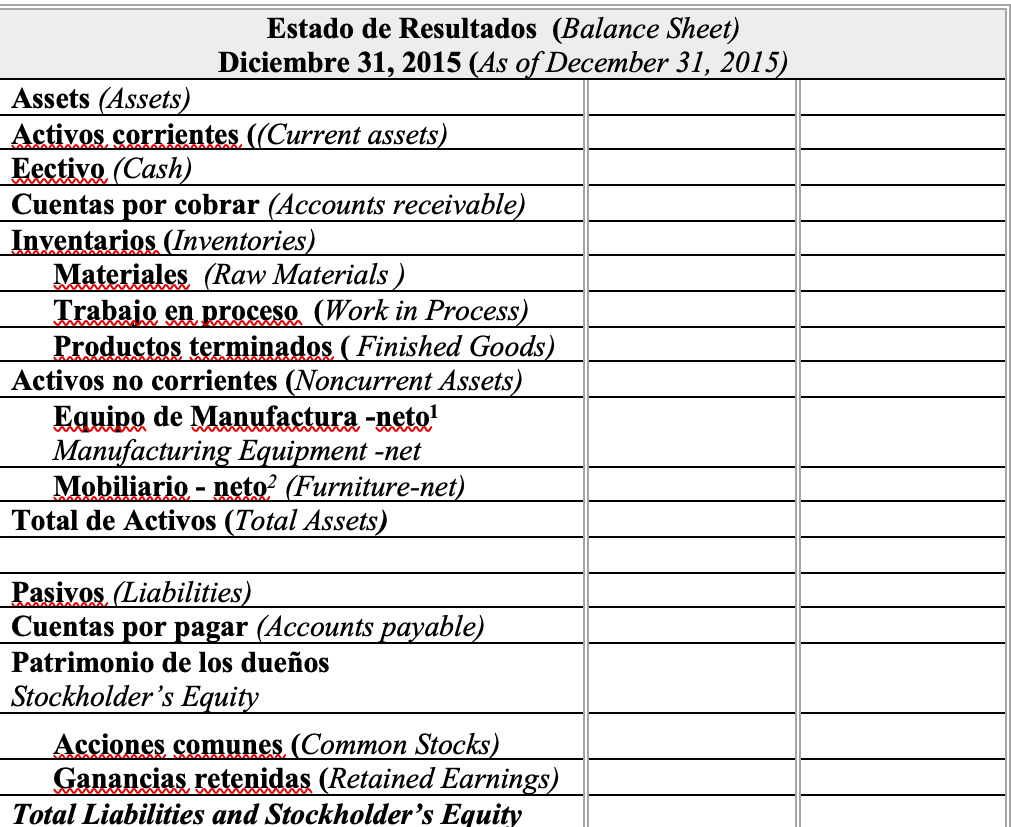

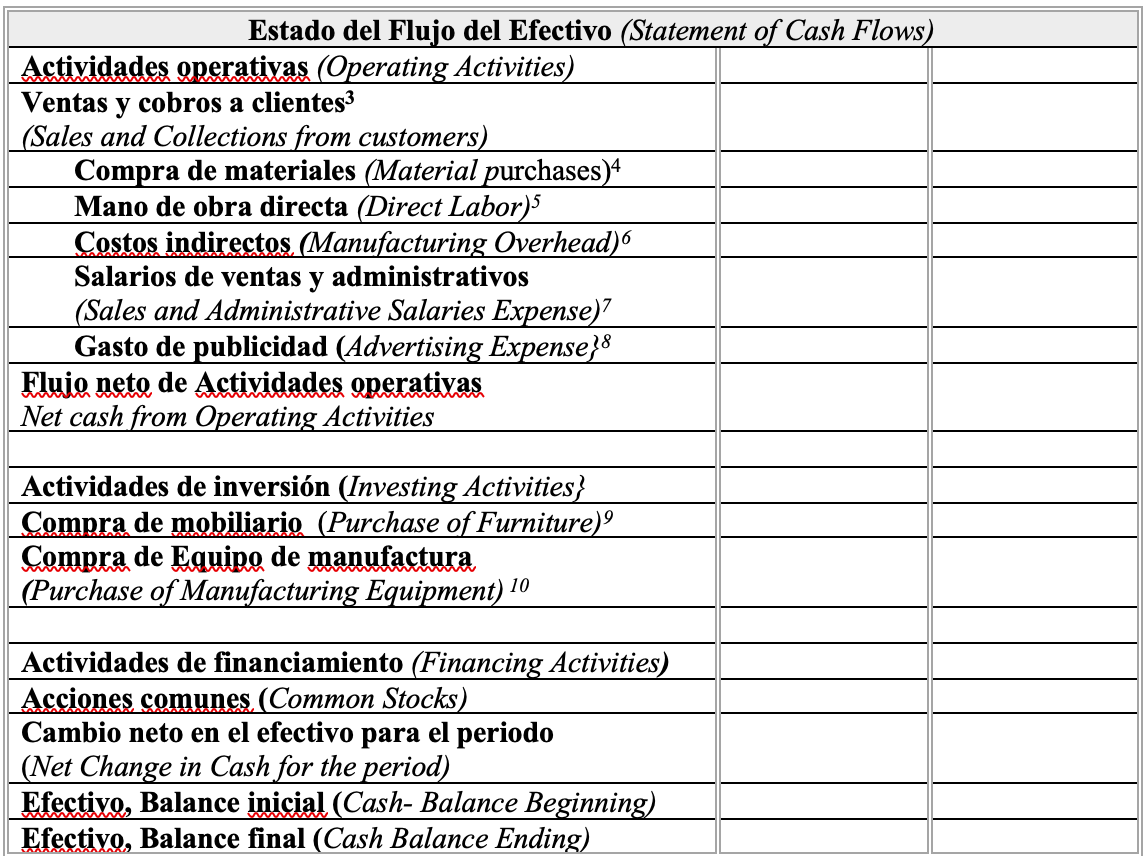

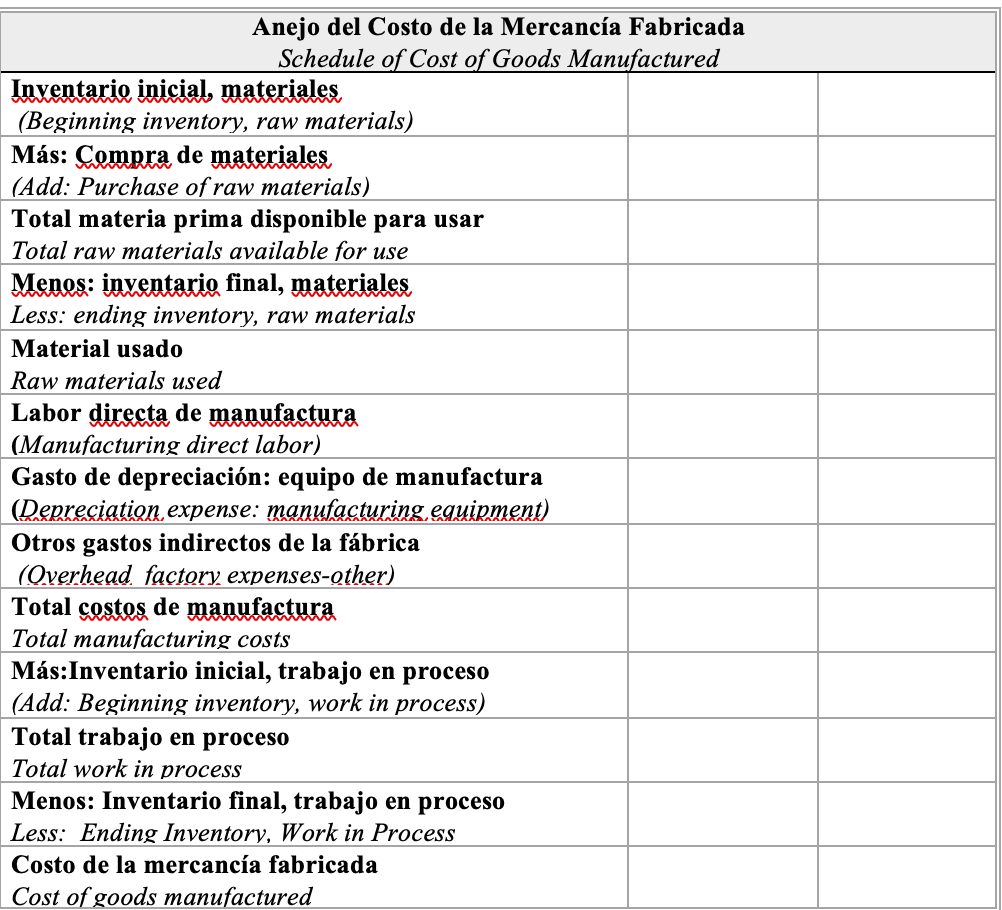

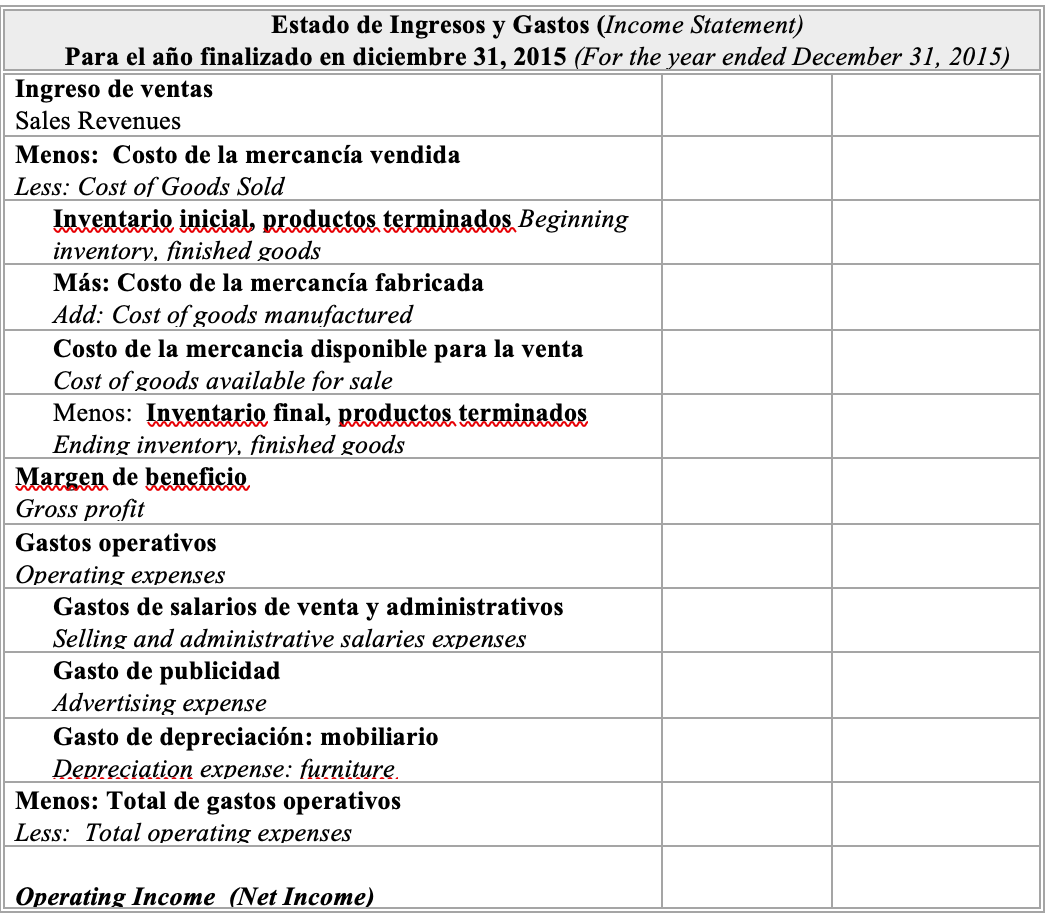

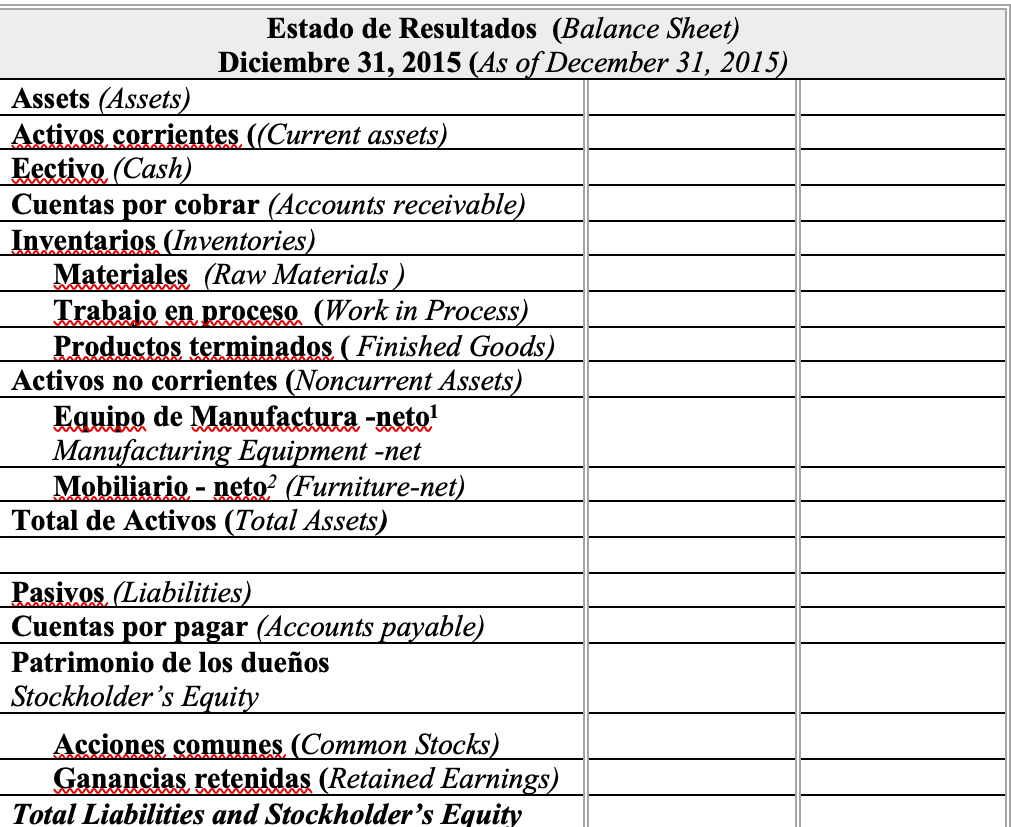

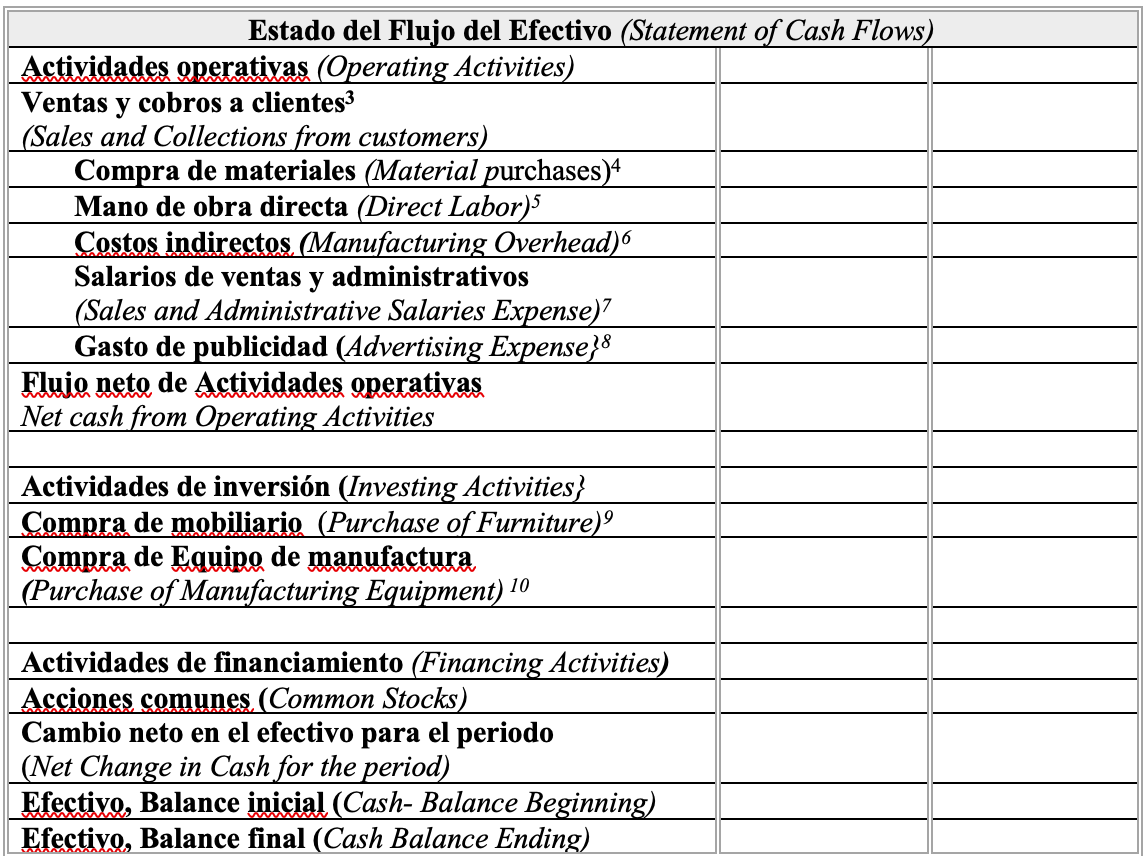

With the info provided complete the tables in the document

Anejo del Costo de la Mercanca Fabricada Schedule of Cost of Goods Manufactured Inventario inicial, materiales, (Beginning inventory, raw materials) Ms: Compra de materiales (Add: Purchase of raw materials) Total materia prima disponible para usar Total raw materials available for use Menos: inventario final, materiales, Less: ending inventory, raw materials Material usado Raw materials used Labor directa de manufactura (Manufacturing direct labor) Gasto de depreciacin: equipo de manufactura (Depreciation, expense: manufacturing equipment) Otros gastos indirectos de la fbrica (Overhead factory expenses-other) Total costos de manufactura Total manufacturing costs Ms:Inventario inicial, trabajo en proceso (Add: Beginning inventory, work in process) Total trabajo en proceso Total work in process Menos: Inventario final, trabajo en proceso Less: Ending Inventory, Work in Process Costo de la mercanca fabricada Cost of goods manufactured Estado de Ingresos y Gastos (Income Statement) Para el ao finalizado en diciembre 31, 2015 (For the year ended December 31, 2015) Ingreso de ventas Sales Revenues Menos: Costo de la mercanca vendida Less: Cost of Goods Sold Inventario inicial, productos terminados Beginning inventory, finished goods Ms: Costo de la mercanca fabricada Add: Cost of goods manufactured Costo de la mercancia disponible para la venta Cost of goods available for sale Menos: Inventario final, productos terminados Ending inventory, finished goods Margen de beneficio, Gross profit Gastos operativos Operating expenses Gastos de salarios de venta y administrativos Selling and administrative salaries expenses Gasto de publicidad Advertising expense Gasto de depreciacin: mobiliario Depreciation expense: furniture. Menos: Total de gastos operativos Less: Total operating expenses Operating Income (Net Income) Estado de Resultados (Balance Sheet) Diciembre 31, 2015 (As of December 31, 2015) Assets (Assets) Activos corrientes. ((Current assets) Eectivo (Cash) Cuentas por cobrar (Accounts receivable) Inventarios (Inventories) Materiales (Raw Materials) Trabajo en proceso (Work in Process) Productos terminados (Finished Goods) Activos no corrientes (Noncurrent Assets) Equipo de Manufactura -neto? Manufacturing Equipment -net Mobiliario - neto? (Furniture-net) Total de Activos (Total Assets) Pasivos. (Liabilities) Cuentas por pagar (Accounts payable) Patrimonio de los dueos Stockholder's Equity Acciones comunes (Common Stocks) Ganancias retenidas (Retained Earnings) Total Liabilities and Stockholder's Equity Estado del Flujo del Efectivo (Statement of Cash Flows) Actividades operativas (Operating Activities) Ventas y cobros a clientes3 (Sales and Collections from customers) Compra de materiales (Material purchases)4 Mano de obra directa (Direct Labor) Costos indirectos (Manufacturing Overhead) Salarios de ventas y administrativos (Sales and Administrative Salaries Expense)? Gasto de publicidad (Advertising Expense38 Fluio neto de Actividades operativas Net cash from Operating Activities Actividades de inversin (Investing Activities} Compra de mobiliario (Purchase of Furniture) Compra de Equipo de manufactura, | (Purchase of Manufacturing Equipment) 10 Actividades de financiamiento (Financing Activities) Acciones comunes. (Common Stocks) Cambio neto en el efectivo para el periodo (Net Change in Cash for the period) Efectivo, Balance inicial (Cash- Balance Beginning) Efectivo, Balance final (Cash Balance Ending)