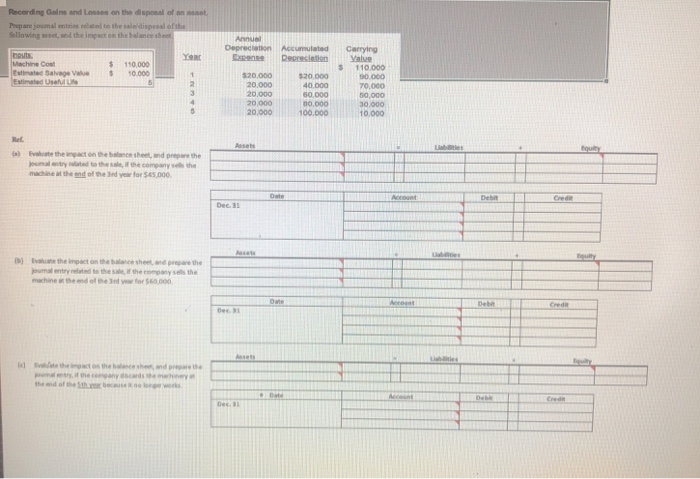

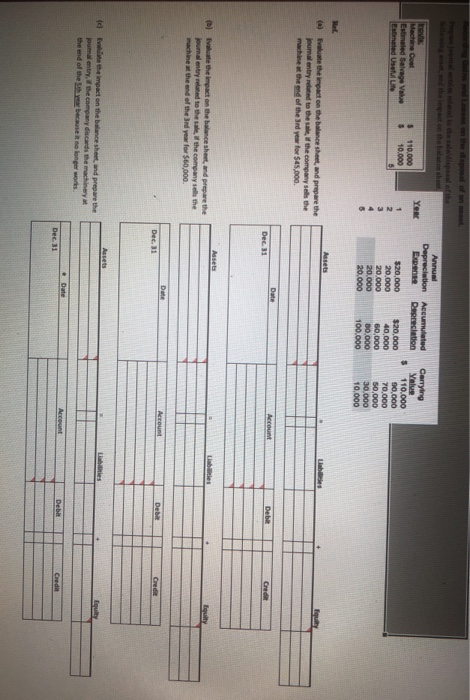

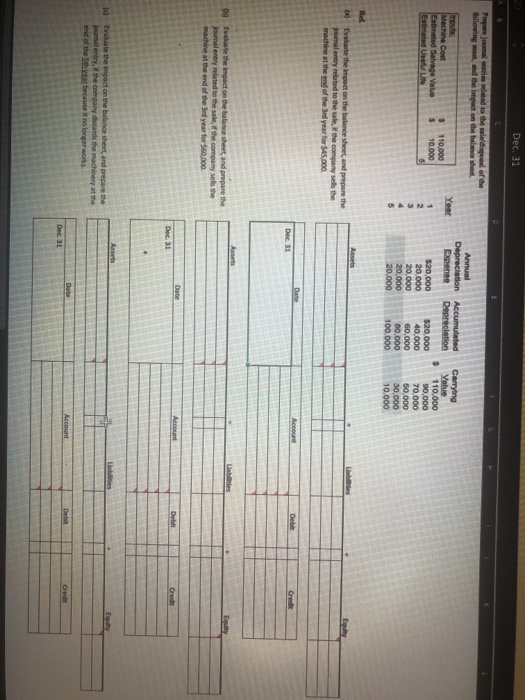

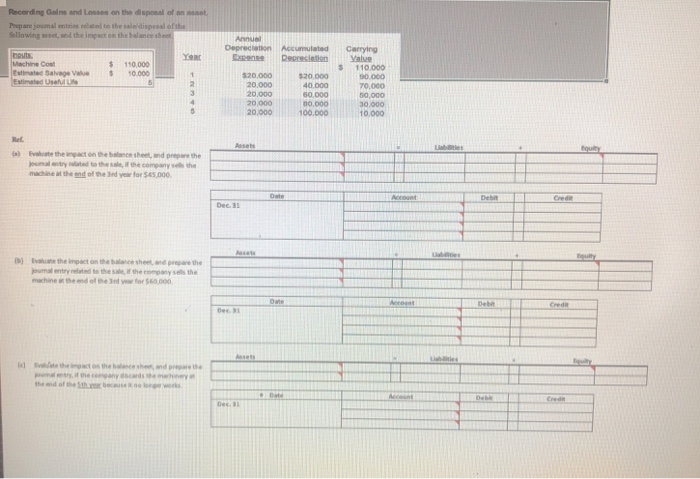

Recording Gains and on the disposto Prepare jumat a te the disposal of the following use the impact on the balance Depreciation Accumulated Depreciation $ nout Machine Cost Estimated Salvage Vw Estimated Us 110.000 10.000 320,000 Carrying Value 110.000 90.000 70.000 59.000 $20.000 40.000 50.000 00.000 100.000 20.000 20.000 10.000 v e the act on the balance shendore the Jual these company the made the end of the year for 55.000 d the impact on the balance she jumatated to the the machine t oned for the the s e d h to the head thead of the Annual Depreciation Accumulated Expense Depreciation Machine Cost Esmaled Savage Vale $ 110,000 10.000 $20,000 20.000 20.000 20.000 20.000 $20,000 40,000 50,000 00.000 100.000 Carrying Yalue 110.000 90.000 70,000 50,000 30.000 10.000 (a) valuate the impact on the balance sheet and prepare the journal entry related to thes , the company is the machine at the end of the ind year for $45.000 Evaluate the impact on the balance sheet and prepare the Journal entry wanted to these the company sells the machine at the end of the year for $60,000 1 Eve the impact on the balance sheet and prepare the Journal entry, the company discards the machinery the end of the the because no longer works Dec. 31 Prepare jouma entre led to the sale disposal of the following and the impact on the balance she Annual Depreciation Expense Year Accumulated Depreciation Machine Cost Estimated Salvage Value $ $ 110,000 10.000 $20,000 20.000 20,000 20.000 20,000 $20,000 40.000 60,000 80.000 100.000 Carrying Value 110.000 90,000 70,000 50.000 30,000 10.000 Evaluate the impact on the balance sheet and prepare the Jumal ently related to the sale, the company sells the machine at the end of the 3rd year for $45,000 Evaluate the impact on the balance sheet and prepare the journal entry related to the sale of the company sells the machine at the end of the 3rd year for $60,000 la vallate the impact on the balance sheet, and prepare the pumal entry, if the company discards the machinery at the end of the year because it no longer works Recording Gains and on the disposto Prepare jumat a te the disposal of the following use the impact on the balance Depreciation Accumulated Depreciation $ nout Machine Cost Estimated Salvage Vw Estimated Us 110.000 10.000 320,000 Carrying Value 110.000 90.000 70.000 59.000 $20.000 40.000 50.000 00.000 100.000 20.000 20.000 10.000 v e the act on the balance shendore the Jual these company the made the end of the year for 55.000 d the impact on the balance she jumatated to the the machine t oned for the the s e d h to the head thead of the Annual Depreciation Accumulated Expense Depreciation Machine Cost Esmaled Savage Vale $ 110,000 10.000 $20,000 20.000 20.000 20.000 20.000 $20,000 40,000 50,000 00.000 100.000 Carrying Yalue 110.000 90.000 70,000 50,000 30.000 10.000 (a) valuate the impact on the balance sheet and prepare the journal entry related to thes , the company is the machine at the end of the ind year for $45.000 Evaluate the impact on the balance sheet and prepare the Journal entry wanted to these the company sells the machine at the end of the year for $60,000 1 Eve the impact on the balance sheet and prepare the Journal entry, the company discards the machinery the end of the the because no longer works Dec. 31 Prepare jouma entre led to the sale disposal of the following and the impact on the balance she Annual Depreciation Expense Year Accumulated Depreciation Machine Cost Estimated Salvage Value $ $ 110,000 10.000 $20,000 20.000 20,000 20.000 20,000 $20,000 40.000 60,000 80.000 100.000 Carrying Value 110.000 90,000 70,000 50.000 30,000 10.000 Evaluate the impact on the balance sheet and prepare the Jumal ently related to the sale, the company sells the machine at the end of the 3rd year for $45,000 Evaluate the impact on the balance sheet and prepare the journal entry related to the sale of the company sells the machine at the end of the 3rd year for $60,000 la vallate the impact on the balance sheet, and prepare the pumal entry, if the company discards the machinery at the end of the year because it no longer works