Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Recording Impairment and Revaluation of Assets Held for Sale Gates Inc., a calendar-year firm, currently uses a plant asset in operations that originally cost

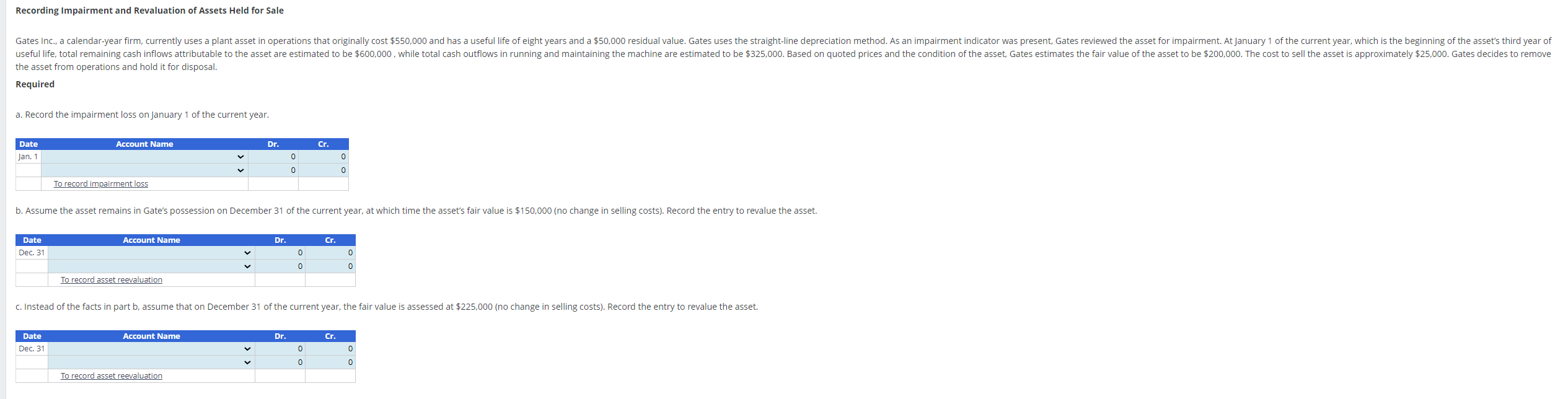

Recording Impairment and Revaluation of Assets Held for Sale Gates Inc., a calendar-year firm, currently uses a plant asset in operations that originally cost $550,000 and has a useful life of eight years and a $50,000 residual value. Gates uses the straight-line depreciation method. As an impairment indicator was present, Gates reviewed the asset for impairment. At January 1 of the current year, which is the beginning of the asset's third year of useful life, total remaining cash inflows attributable to the asset are estimated to be $600,000, while total cash outflows in running and maintaining the machine are estimated to be $325,000. Based on quoted prices and the condition of the asset, Gates estimates the fair value of the asset to be $200,000. The cost to sell the asset is approximately $25,000. Gates decides to remove the asset from operations and hold it for disposal. Required a. Record the impairment loss on January 1 of the current year. Date Jan. 1 Account Name To record impairment loss Dr. Cr. 0 0 0 0 b. Assume the asset remains in Gate's possession on December 31 of the current year, at which time the asset's fair value is $150,000 (no change in selling costs). Record the entry to revalue the asset. Date Dec. 31 Account Name To record asset reevaluation Dr. Cr. 0 0 0 0 c. Instead of the facts in part b, assume that on December 31 of the current year, the fair value is assessed at $225,000 (no change in selling costs). Record the entry to revalue the asset. Date Dec. 31 Account Name To record asset reevaluation Dr. Cr. 0 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started