Question

Recording Import and Export Transactions Walsh Corporation imports raw materials from other countries and exports finished goods to customers throughout the world. Information regarding four

Recording Import and Export Transactions

Walsh Corporation imports raw materials from other countries and exports finished goods to customers throughout the world. Information regarding four such transactions occurring in the last accounting period, all denominated in units of foreign currency, is given below:

| Country | Amount | Spot Rate at Transaction Date | Spot Rate at Payment Date |

|---|---|---|---|

| 1. Import from Taiwan | 110,000 Taiwan dollars | $0.033 | $0.038 |

| 2. Import from Poland | 620,000 zloty | 0.300 | 0.285 |

| 3. Export to Brazil | 500,000 real | 0.296 | 0.263 |

| 4. Export to Switzerland | 830,000 Swiss francs | 0.750 | 0.786 |

Prepare the journal entries made by Walsh to record the above events on the transaction date and on the payment date.

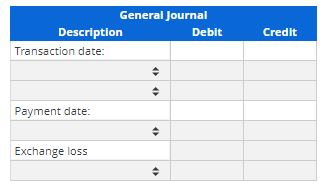

Import Transaction 1

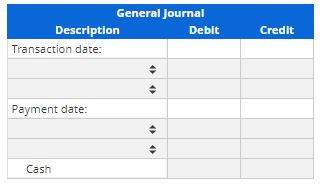

Import Transaction 2

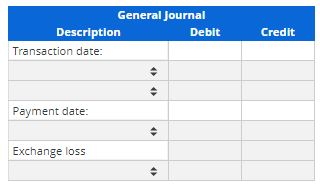

Export Transaction 3

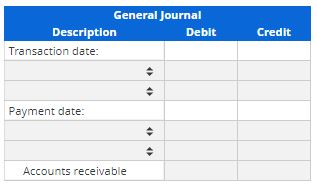

Export Transaction 4

Account titles from drop down to choose from (FOR IMPORT Transactions): Inventory, Cash, Exchange Gain, Accounts Payable

Account titles from drop down to choose from (FOR EXPORT Transactions): Cash, Sales, Accounts Receivable, Inventory, Exchange Gain

Please use the provided information to complete both import and export tables. Show all work. Thank you!!!

General Journal Description Debit Transaction date: Credit Payment date: Exchange loss General Journal Description Debit Transaction date: Credit Payment date: Cash General Journal Description Debit Transaction date: Credit Payment date: Exchange loss General Journal Description Debit Transaction date: Credit Payment date: Accounts receivableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started