Answered step by step

Verified Expert Solution

Question

1 Approved Answer

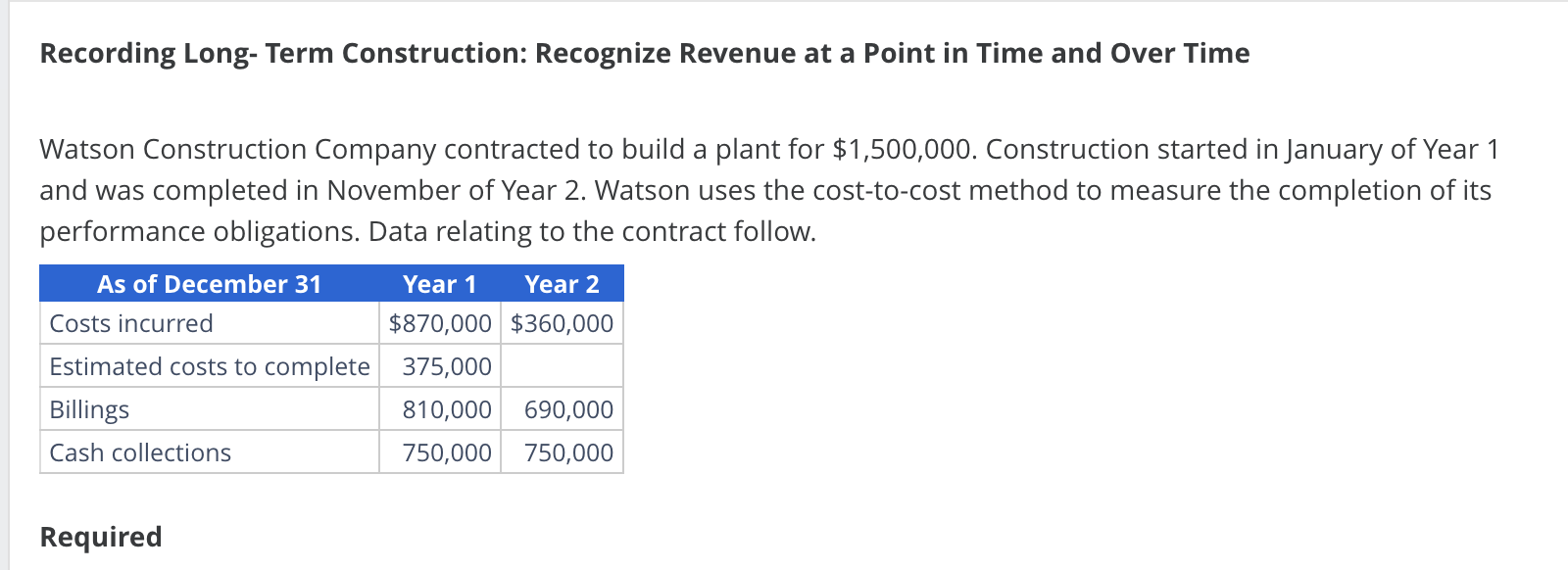

Recording Long- Term Construction: Recognize Revenue at a Point in Time and Over Time Watson Construction Company contracted to build a plant for $1,500,000. Construction

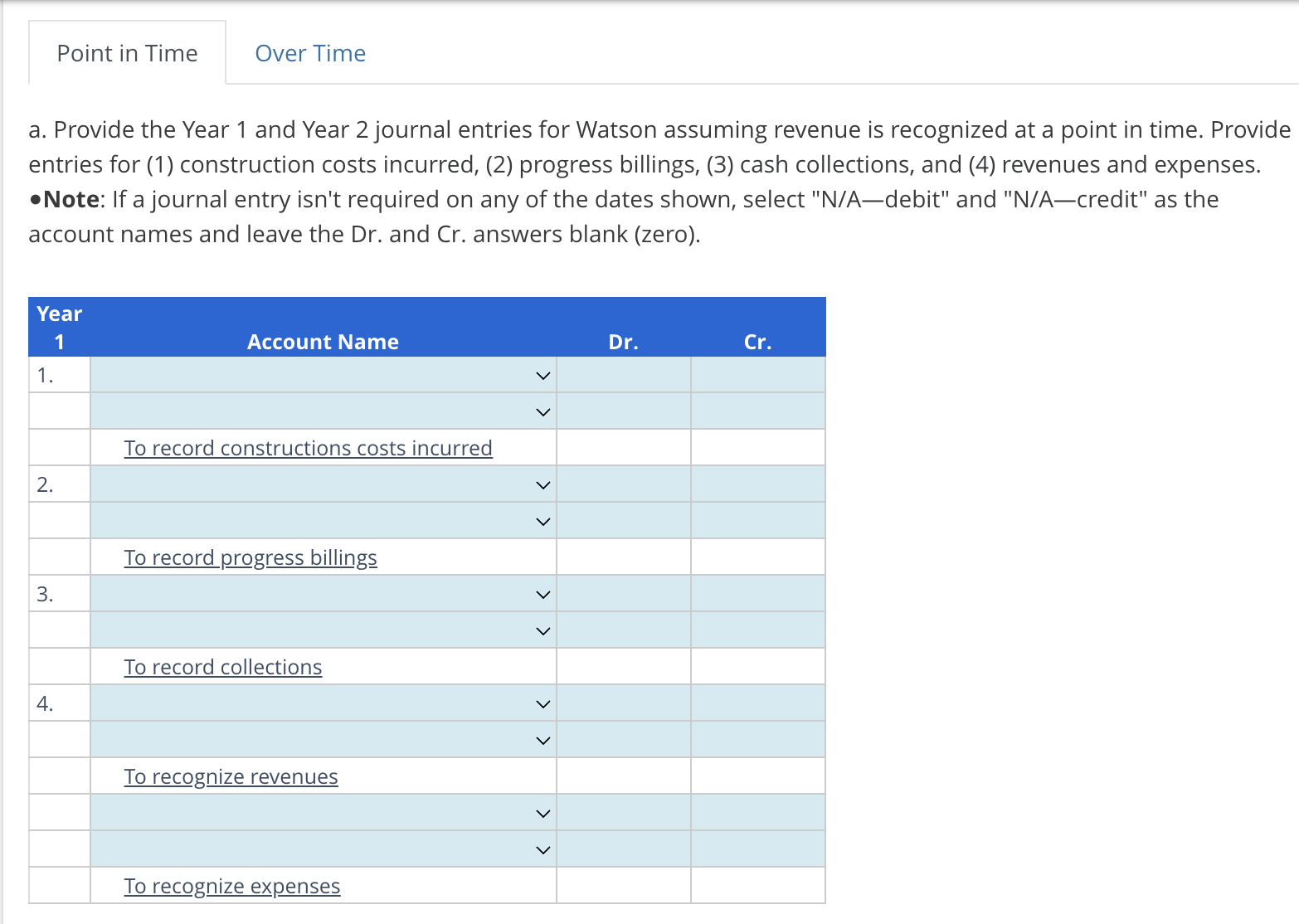

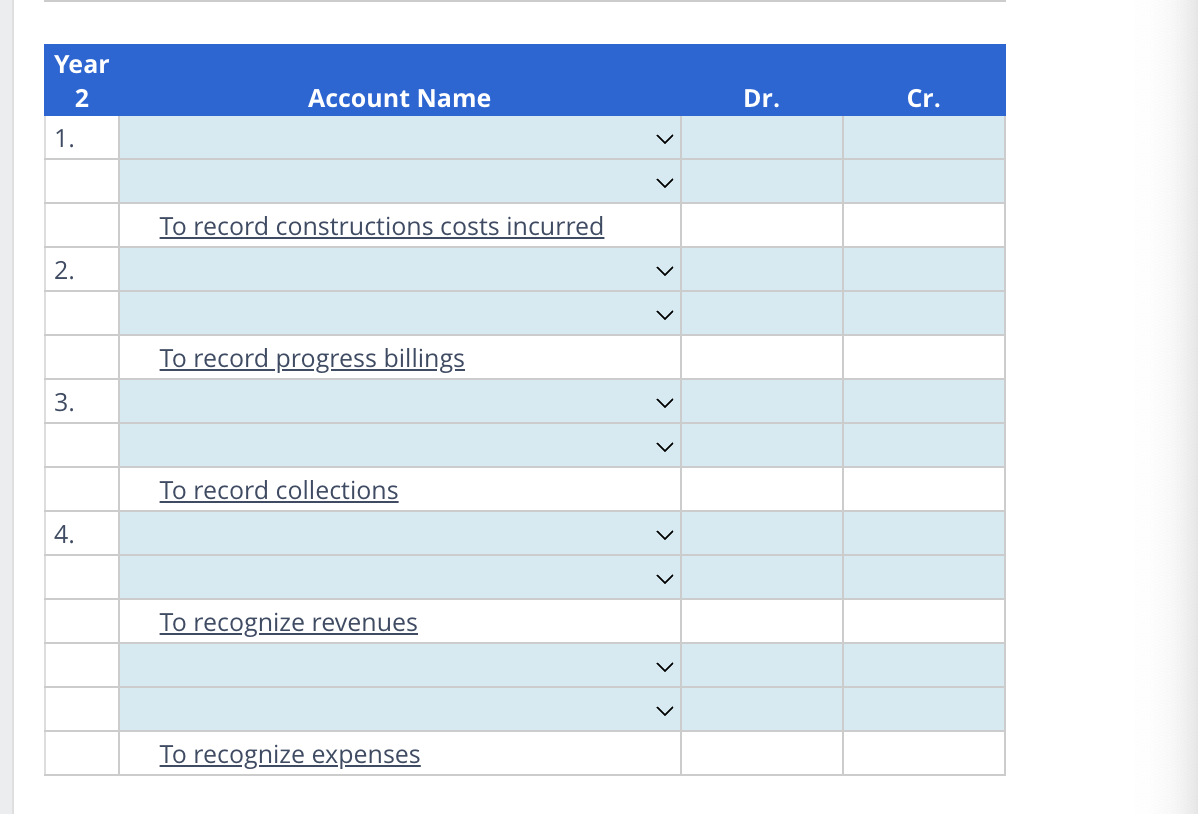

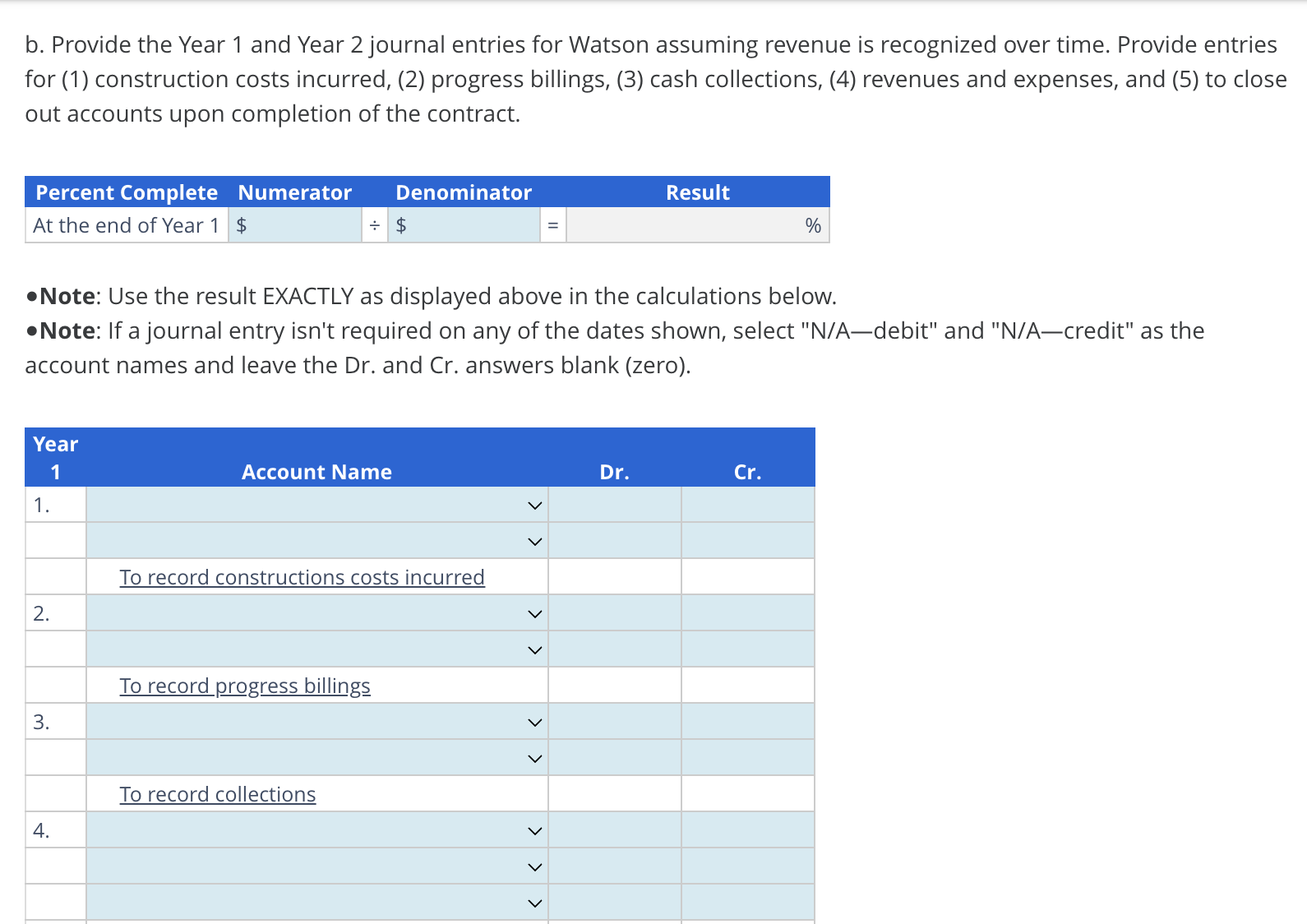

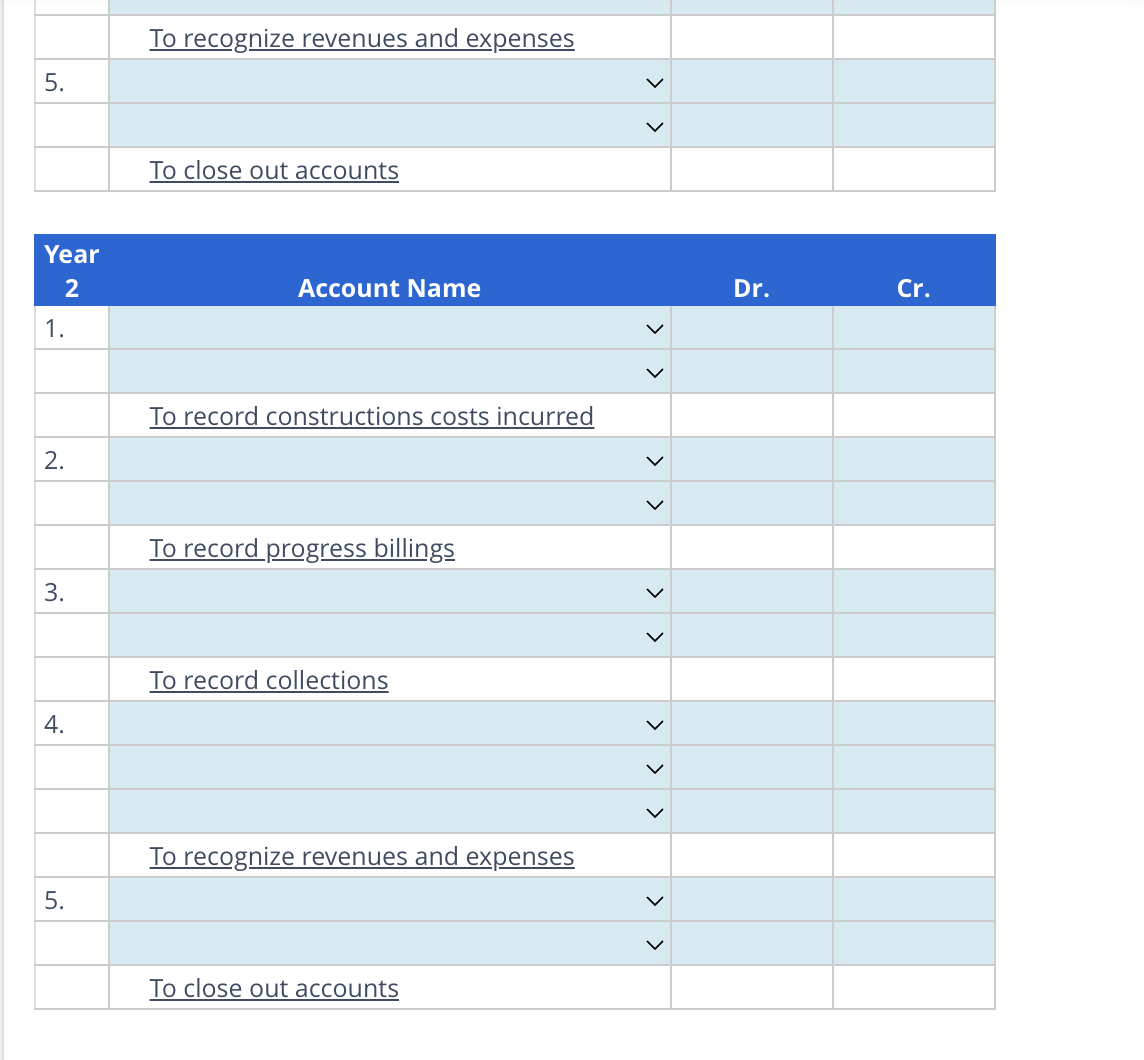

Recording Long- Term Construction: Recognize Revenue at a Point in Time and Over Time Watson Construction Company contracted to build a plant for $1,500,000. Construction started in January of Year 1 and was completed in November of Year 2. Watson uses the cost-to-cost method to measure the completion of its performance obligations. Data relating to the contract follow. Required b. Provide the Year 1 and Year 2 journal entries for Watson assuming revenue is recognized over time. Provide entries for (1) construction costs incurred, (2) progress billings, (3) cash collections, (4) revenues and expenses, and (5) to close out accounts upon completion of the contract. - Note: Use the result EXACTLY as displayed above in the calculations below. -Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/Acredit" as the account names and leave the Dr. and Cr. answers blank (zero). a. Provide the Year 1 and Year 2 journal entries for Watson assuming revenue is recognized at a point in time. Provide entries for (1) construction costs incurred, (2) progress billings, (3) cash collections, and (4) revenues and expenses. - Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/Acredit" as the account names and leave the Dr. and Cr. answers blank (zero). \begin{tabular}{|l|l|l|} \hline & To recognize revenues and expenses & \\ \hline 5. & & \\ \hline & & \\ \hline & To close out accounts & \\ \hline \end{tabular} Recording Long- Term Construction: Recognize Revenue at a Point in Time and Over Time Watson Construction Company contracted to build a plant for $1,500,000. Construction started in January of Year 1 and was completed in November of Year 2. Watson uses the cost-to-cost method to measure the completion of its performance obligations. Data relating to the contract follow. Required b. Provide the Year 1 and Year 2 journal entries for Watson assuming revenue is recognized over time. Provide entries for (1) construction costs incurred, (2) progress billings, (3) cash collections, (4) revenues and expenses, and (5) to close out accounts upon completion of the contract. - Note: Use the result EXACTLY as displayed above in the calculations below. -Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/Acredit" as the account names and leave the Dr. and Cr. answers blank (zero). a. Provide the Year 1 and Year 2 journal entries for Watson assuming revenue is recognized at a point in time. Provide entries for (1) construction costs incurred, (2) progress billings, (3) cash collections, and (4) revenues and expenses. - Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/Acredit" as the account names and leave the Dr. and Cr. answers blank (zero). \begin{tabular}{|l|l|l|} \hline & To recognize revenues and expenses & \\ \hline 5. & & \\ \hline & & \\ \hline & To close out accounts & \\ \hline \end{tabular}

Recording Long- Term Construction: Recognize Revenue at a Point in Time and Over Time Watson Construction Company contracted to build a plant for $1,500,000. Construction started in January of Year 1 and was completed in November of Year 2. Watson uses the cost-to-cost method to measure the completion of its performance obligations. Data relating to the contract follow. Required b. Provide the Year 1 and Year 2 journal entries for Watson assuming revenue is recognized over time. Provide entries for (1) construction costs incurred, (2) progress billings, (3) cash collections, (4) revenues and expenses, and (5) to close out accounts upon completion of the contract. - Note: Use the result EXACTLY as displayed above in the calculations below. -Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/Acredit" as the account names and leave the Dr. and Cr. answers blank (zero). a. Provide the Year 1 and Year 2 journal entries for Watson assuming revenue is recognized at a point in time. Provide entries for (1) construction costs incurred, (2) progress billings, (3) cash collections, and (4) revenues and expenses. - Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/Acredit" as the account names and leave the Dr. and Cr. answers blank (zero). \begin{tabular}{|l|l|l|} \hline & To recognize revenues and expenses & \\ \hline 5. & & \\ \hline & & \\ \hline & To close out accounts & \\ \hline \end{tabular} Recording Long- Term Construction: Recognize Revenue at a Point in Time and Over Time Watson Construction Company contracted to build a plant for $1,500,000. Construction started in January of Year 1 and was completed in November of Year 2. Watson uses the cost-to-cost method to measure the completion of its performance obligations. Data relating to the contract follow. Required b. Provide the Year 1 and Year 2 journal entries for Watson assuming revenue is recognized over time. Provide entries for (1) construction costs incurred, (2) progress billings, (3) cash collections, (4) revenues and expenses, and (5) to close out accounts upon completion of the contract. - Note: Use the result EXACTLY as displayed above in the calculations below. -Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/Acredit" as the account names and leave the Dr. and Cr. answers blank (zero). a. Provide the Year 1 and Year 2 journal entries for Watson assuming revenue is recognized at a point in time. Provide entries for (1) construction costs incurred, (2) progress billings, (3) cash collections, and (4) revenues and expenses. - Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/Acredit" as the account names and leave the Dr. and Cr. answers blank (zero). \begin{tabular}{|l|l|l|} \hline & To recognize revenues and expenses & \\ \hline 5. & & \\ \hline & & \\ \hline & To close out accounts & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started