Question

Recording Revenue and Receivables Under a Consignment Arrangement On March 15, 2020, Drexel Corp. provides goods to a retailer through consignment where Drexel Corp. retains

Recording Revenue and Receivables Under a Consignment Arrangement

On March 15, 2020, Drexel Corp. provides goods to a retailer through consignment where Drexel Corp. retains ownership of the goods until the goods are sold to the retailers customer. Sale to the final customer is documented when the goods are scanned at the cash register of the retailer. Drexel Corp. receives a daily report on the number of units sold by the retailer to the end customer. Any unsold product can be returned to Drexel Corp. at anytime. Drexel Corp. has the right through the contract to recall any goods shipped and to transfer the goods to another retailer as a way to increase the rate of sales to the final customer. After the sale of the products to the final customer, the retailer cannot return the items to Drexel Corp. During March of 2020, Drexel Corp. transferred 2,880 units to the retailer, and the retailer sold 2,400 units. The product cost Drexel Corp. $80 per unit and the product was sold for $115 per unit to the end customer. The retailer sent a payment to Drexel Corp. for the cash collected on the sale of product less a 10% commission on April 7, 2020.

a. At what point should Drexel Corp. recognize revenue?

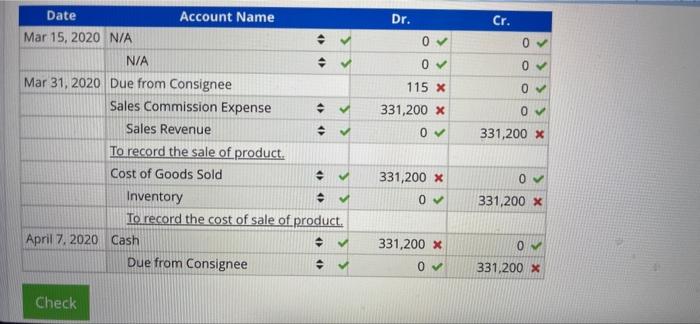

b. Record Drexels entries on March 15, 2020, March 31, 2020, and April 7, 2020.

Note: If a journal entry (or a line of the journal entry) isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started