Answered step by step

Verified Expert Solution

Question

1 Approved Answer

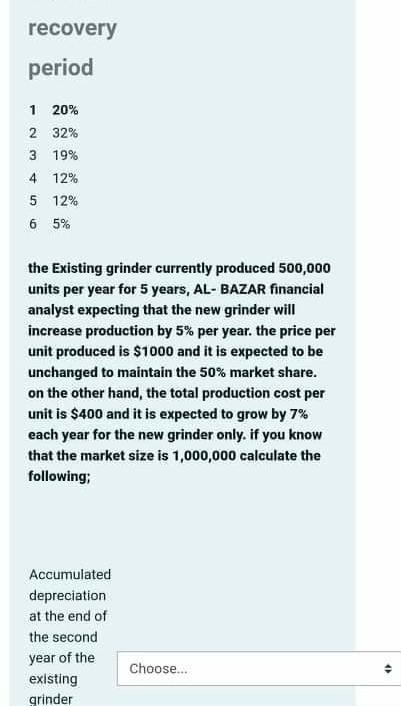

recovery period 1 20% 2 32% 3 19% 4 12% 5 12% 6 5% the Existing grinder currently produced 500,000 units per year for 5

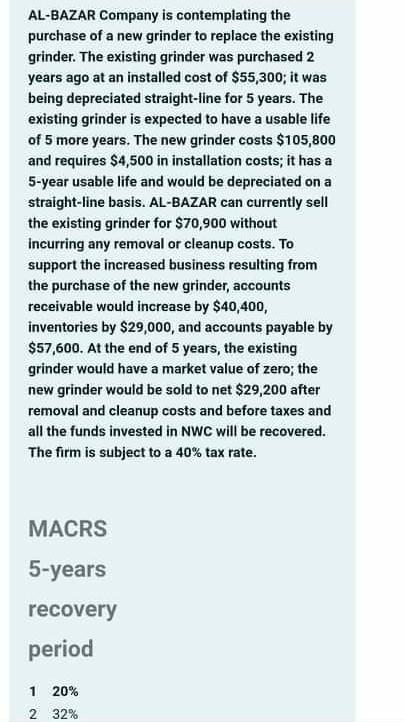

recovery period 1 20% 2 32% 3 19% 4 12% 5 12% 6 5% the Existing grinder currently produced 500,000 units per year for 5 years, AL-BAZAR financial analyst expecting that the new grinder will increase production by 5% per year. the price per unit produced is $1000 and it is expected to be unchanged to maintain the 50% market share. on the other hand, the total production cost per unit is $400 and it is expected to grow by 7% each year for the new grinder only. if you know that the market size is 1,000,000 calculate the following: Accumulated depreciation at the end of the second year of the existing grinder Choose... AL-BAZAR Company is contemplating the purchase of a new grinder to replace the existing grinder. The existing grinder was purchased 2 years ago at an installed cost of $55,300; it was being depreciated straight-line for 5 years. The existing grinder is expected to have a usable life of 5 more years. The new grinder costs $105,800 and requires $4,500 in installation costs; it has a 5-year usable life and would be depreciated on a straight-line basis. AL-BAZAR can currently sell the existing grinder for $70,900 without incurring any removal or cleanup costs. To support the increased business resulting from the purchase of the new grinder, accounts receivable would increase by $40,400, inventories by $29,000, and accounts payable by $57,600. At the end of 5 years, the existing grinder would have a market value of zero; the new grinder would be sold to net $29,200 after removal and cleanup costs and before taxes and all the funds invested in NWC will be recovered. The firm is subject to a 40% tax rate. MACRS 5-years recovery period 1 20% 2 32%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started