Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To begin this chapter, open the Red Company model 1-Red Company 15e if it is not already open on your computer. 7-DPont tab Reset

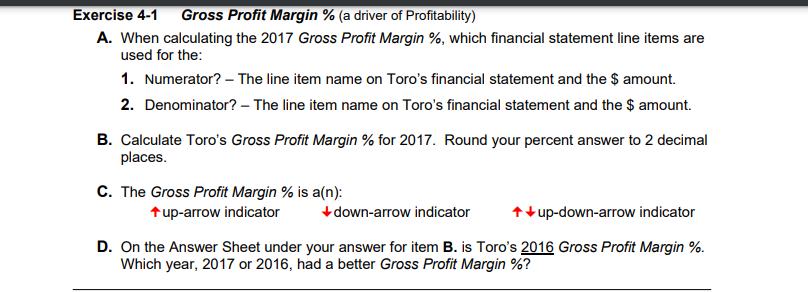

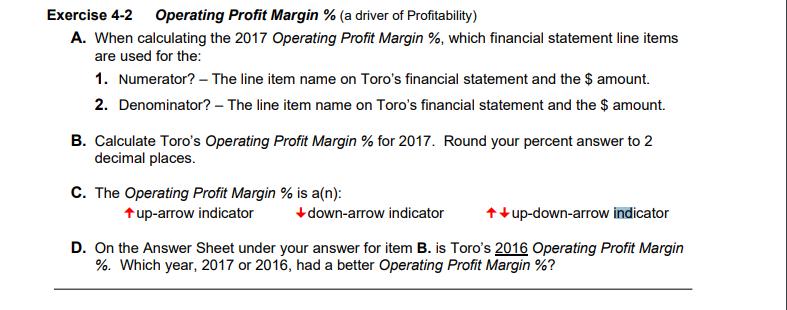

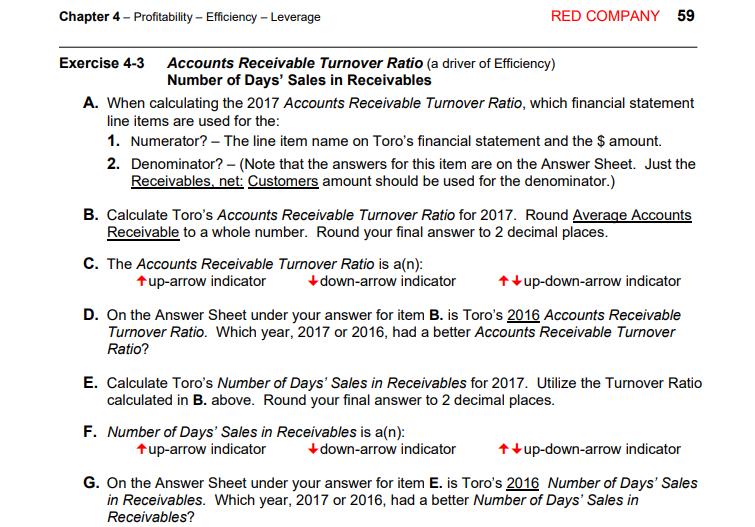

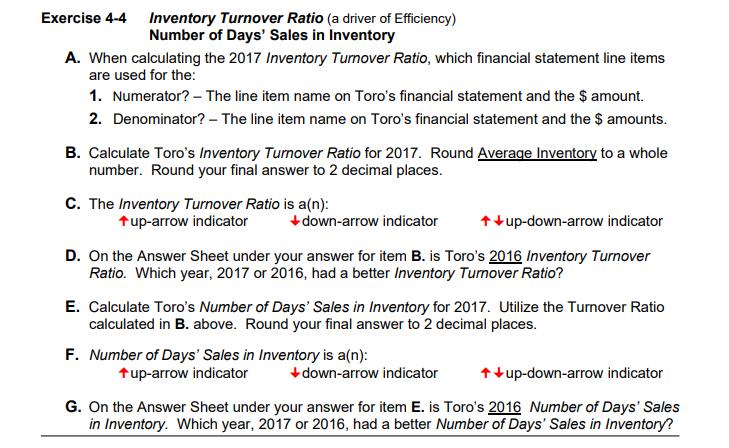

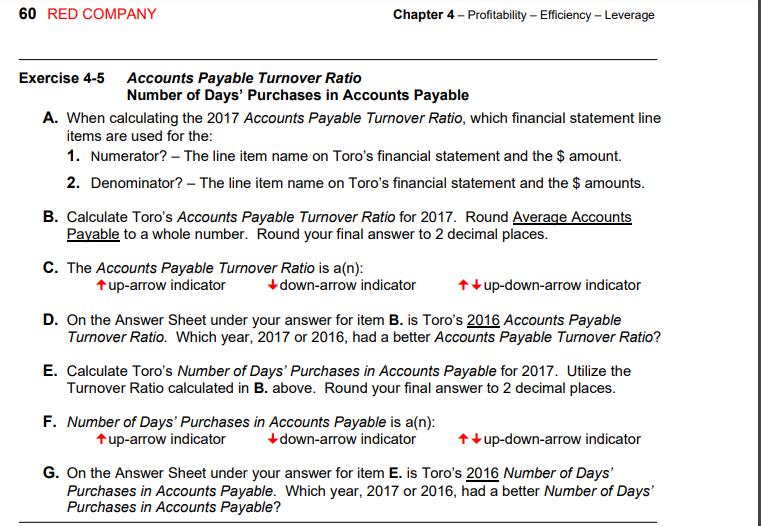

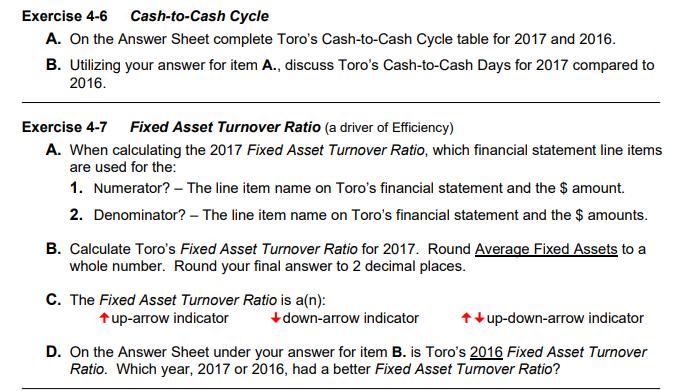

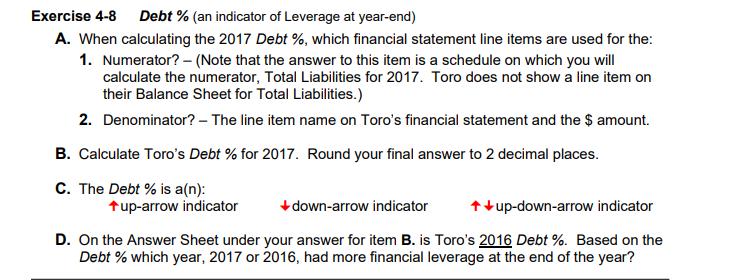

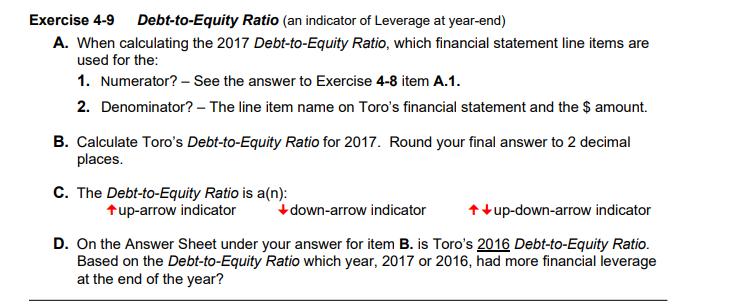

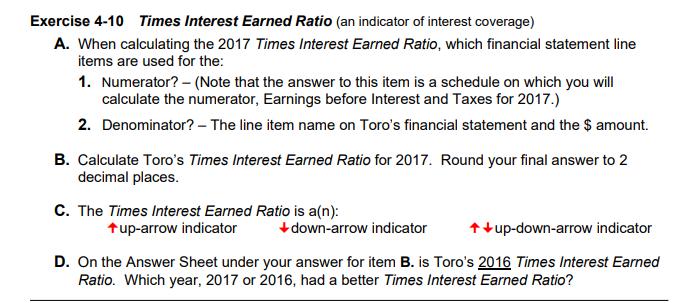

To begin this chapter, open the Red Company model 1-Red Company 15e if it is not already open on your computer. 7-DPont tab Reset the Model In the last chapter, you learned how the Return on Equity % is driven by: Net Profit Margin % Profitability Total Assets Turnover Ratio Efficiency Assets-to-Equity Ratio Leverage In this chapter, you will "drill down" into each of these three elements of Return on Equity %. You will be adding thirteen new tools to your financial statement analysis tool-kit. These new tools will enable you to analyze: Profitability, Efficiency, and Leverage. Exercise 4-1 Gross Profit Margin % (a driver of Profitability) A. When calculating the 2017 Gross Profit Margin %, which financial statement line items are used for the: 1. Numerator? - The line item name on Toro's financial statement and the $ amount. 2. Denominator? - The line item name on Toro's financial statement and the $ amount. B. Calculate Toro's Gross Profit Margin % for 2017. Round your percent answer to 2 decimal places. C. The Gross Profit Margin % is a(n): +up-arrow indicator down-arrow indicator ++up-down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro's 2016 Gross Profit Margin %. Which year, 2017 or 2016, had a better Gross Profit Margin %? Exercise 4-2 Operating Profit Margin % (a driver of Profitability) A. When calculating the 2017 Operating Profit Margin %, which financial statement line items are used for the: 1. Numerator? - The line item name on Toro's financial statement and the $ amount. 2. Denominator? - The line item name on Toro's financial statement and the $ amount. B. Calculate Toro's Operating Profit Margin % for 2017. Round your percent answer to 2 decimal places. C. The Operating Profit Margin % is a(n): +up-arrow indicator down-arrow indicator ++up-down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro's 2016 Operating Profit Margin %. Which year, 2017 or 2016, had a better Operating Profit Margin %? Chapter 4 - Profitability - Efficiency - Leverage Exercise 4-3 A. When calculating the 2017 Accounts Receivable Turnover Ratio, which financial statement line items are used for the: 1. Numerator? - The line item name on Toro's financial statement and the $ amount. Accounts Receivable Turnover Ratio (a driver of Efficiency) Number of Days' Sales in Receivables RED COMPANY 59 2. Denominator? - (Note that the answers for this item are on the Answer Sheet. Just the Receivables, net: Customers amount should be used for the denominator.) B. Calculate Toro's Accounts Receivable Turnover Ratio for 2017. Round Average Accounts Receivable to a whole number. Round your final answer to 2 decimal places. C. The Accounts Receivable Turnover Ratio is a(n): + up-arrow indicator down-arrow indicator ++up-down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro's 2016 Accounts Receivable Turnover Ratio. Which year, 2017 or 2016, had a better Accounts Receivable Turnover Ratio? E. Calculate Toro's Number of Days' Sales in Receivables for 2017. Utilize the Turnover Ratio calculated in B. above. Round your final answer to 2 decimal places. F. Number of Days' Sales in Receivables is a(n): +up-arrow indicator down-arrow indicator ++up-down-arrow indicator G. On the Answer Sheet under your answer for item E. is Toro's 2016 Number of Days' Sales in Receivables. Which year, 2017 or 2016, had a better Number of Days' Sales in Receivables? Exercise 4-4 Inventory Turnover Ratio (a driver of Efficiency) Number of Days' Sales in Inventory A. When calculating the 2017 Inventory Turnover Ratio, which financial statement line items are used for the: 1. Numerator? - The line item name on Toro's financial statement and the $ amount. 2. Denominator? - The line item name on Toro's financial statement and the $ amounts. B. Calculate Toro's Inventory Turnover Ratio for 2017. Round Average Inventory to a whole number. Round your final answer to 2 decimal places. C. The Inventory Turnover Ratio is a(n): tup-arrow indicator down-arrow indicator ++up-down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro's 2016 Inventory Turnover Ratio. Which year, 2017 or 2016, had a better Inventory Turnover Ratio? E. Calculate Toro's Number of Days' Sales in Inventory for 2017. Utilize the Turnover Ratio calculated in B. above. Round your final answer to 2 decimal places. F. Number of Days' Sales in Inventory is a(n): +up-arrow indicator ++up-down-arrow indicator G. On the Answer Sheet under your answer for item E. is Toro's 2016 Number of Days' Sales in Inventory. Which year, 2017 or 2016, had a better Number of Days' Sales in Inventory? +down-arrow indicator 60 RED COMPANY Exercise 4-5 Accounts Payable Turnover Ratio Chapter 4 - Profitability-Efficiency - Leverage Number of Days' Purchases in Accounts Payable A. When calculating the 2017 Accounts Payable Turnover Ratio, which financial statement line items are used for the: 1. Numerator? - The line item name on Toro's financial statement and the $ amount. 2. Denominator? - The line item name on Toro's financial statement and the $ amounts. B. Calculate Toro's Accounts Payable Turnover Ratio for 2017. Round Average Accounts Payable to a whole number. Round your final answer to 2 decimal places. C. The Accounts Payable Turnover Ratio is a(n): + up-arrow indicator down-arrow indicator ++up-down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro's 2016 Accounts Payable Turnover Ratio. Which year, 2017 or 2016, had a better Accounts Payable Turnover Ratio? E. Calculate Toro's Number of Days' Purchases in Accounts Payable for 2017. Utilize the Turnover Ratio calculated in B. above. Round your final answer to 2 decimal places. F. Number of Days' Purchases in Accounts Payable is a(n): +up-arrow indicator down-arrow indicator ++up-down-arrow indicator G. On the Answer Sheet under your answer for item E. is Toro's 2016 Number of Days' Purchases in Accounts Payable. Which year, 2017 or 2016, had a better Number of Days' Purchases in Accounts Payable? Exercise 4-6 Cash-to-Cash Cycle A. On the Answer Sheet complete Toro's Cash-to-Cash Cycle table for 2017 and 2016. B. Utilizing your answer for item A., discuss Toro's Cash-to-Cash Days for 2017 compared to 2016. Exercise 4-7 Fixed Asset Turnover Ratio (a driver of Efficiency) A. When calculating the 2017 Fixed Asset Turnover Ratio, which financial statement line items are used for the: 1. Numerator? - The line item name on Toro's financial statement and the $ amount. 2. Denominator? - The line item name on Toro's financial statement and the $ amounts. B. Calculate Toro's Fixed Asset Turnover Ratio for 2017. Round Average Fixed Assets to a whole number. Round your final answer to 2 decimal places. C. The Fixed Asset Turnover Ratio is a(n): + up-arrow indicator +down-arrow indicator ++up-down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro's 2016 Fixed Asset Turnover Ratio. Which year, 2017 or 2016, had a better Fixed Asset Turnover Ratio? Exercise 4-8 Debt % (an indicator of Leverage at year-end) A. When calculating the 2017 Debt %, which financial statement line items are used for the: 1. Numerator? - (Note that the answer to this item is a schedule on which you will calculate the numerator, Total Liabilities for 2017. Toro does not show a line item on their Balance Sheet for Total Liabilities.) 2. Denominator? - The line item name on Toro's financial statement and the $ amount. B. Calculate Toro's Debt % for 2017. Round your final answer to 2 decimal places. C. The Debt % is a(n): down-arrow indicator ++up-down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro's 2016 Debt %. Based on the Debt % which year, 2017 or 2016, had more financial leverage at the end of the year? +up-arrow indicator Exercise 4-9 Debt-to-Equity Ratio (an indicator of Leverage at year-end) A. When calculating the 2017 Debt-to-Equity Ratio, which financial statement line items are used for the: 1. Numerator? - See the answer to Exercise 4-8 item A.1. 2. Denominator? - The line item name on Toro's financial statement and the $ amount. B. Calculate Toro's Debt-to-Equity Ratio for 2017. Round your final answer to 2 decimal places. C. The Debt-to-Equity Ratio is a(n): +up-arrow indicator down-arrow indicator ++up-down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro's 2016 Debt-to-Equity Ratio. Based on the Debt-to-Equity Ratio which year, 2017 or 2016, had more financial leverage at the end of the year? Exercise 4-10 Times Interest Earned Ratio (an indicator of interest coverage) A. When calculating the 2017 Times Interest Earned Ratio, which financial statement line items are used for the: 1. Numerator? - (Note that the answer to this item is a schedule on which you will calculate the numerator, Earnings before Interest and Taxes for 2017.) 2. Denominator? - The line item name on Toro's financial statement and the $ amount. B. Calculate Toro's Times Interest Earned Ratio for 2017. Round your final answer to 2 decimal places. C. The Times Interest Earned Ratio is a(n): +up-arrow indicator down-arrow indicator ++up-down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro's 2016 Times Interest Earned Ratio. Which year, 2017 or 2016, had a better Times Interest Earned Ratio?

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

F Number of Days Purchases in Accounts Payable is an downarrow indicator G On the Answer Sheet under your answer for item E is Toros 2016 Number of Days Purchases in Accounts Payable Which year 2017 o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started