Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Red plc, a public limited company, providing construction services to the market and is based in the United Kingdom. The company has grown significantly

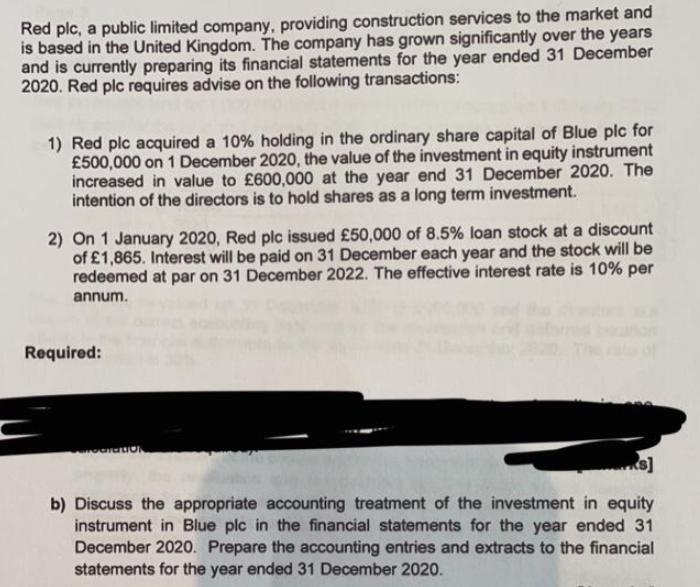

Red plc, a public limited company, providing construction services to the market and is based in the United Kingdom. The company has grown significantly over the years and is currently preparing its financial statements for the year ended 31 December 2020. Red plc requires advise on the following transactions: 1) Red plc acquired a 10% holding in the ordinary share capital of Blue plc for 500,000 on 1 December 2020, the value of the investment in equity instrument increased in value to 600,000 at the year end 31 December 2020. The intention of the directors is to hold shares as a long term investment. 2) On 1 January 2020, Red plc issued 50,000 of 8.5% loan stock at a discount of 1,865. Interest will be paid on 31 December each year and the stock will be redeemed at par on 31 December 2022. The effective interest rate is 10% per annum. Required: b) Discuss the appropriate accounting treatment of the investment in equity instrument in Blue plc in the financial statements for the year ended 31 December 2020. Prepare the accounting entries and extracts to the financial statements for the year ended 31 December 2020.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

bAccounting treatment of the investment in equity instrument in Blue plc in the financial statements for the year ended 31 Dec 2020 Given that the int...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started