Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Red Snail Satellite Company has a total asset turnover ratio of 8 . 0 0 , net annual sales of $ 2 5 , 0

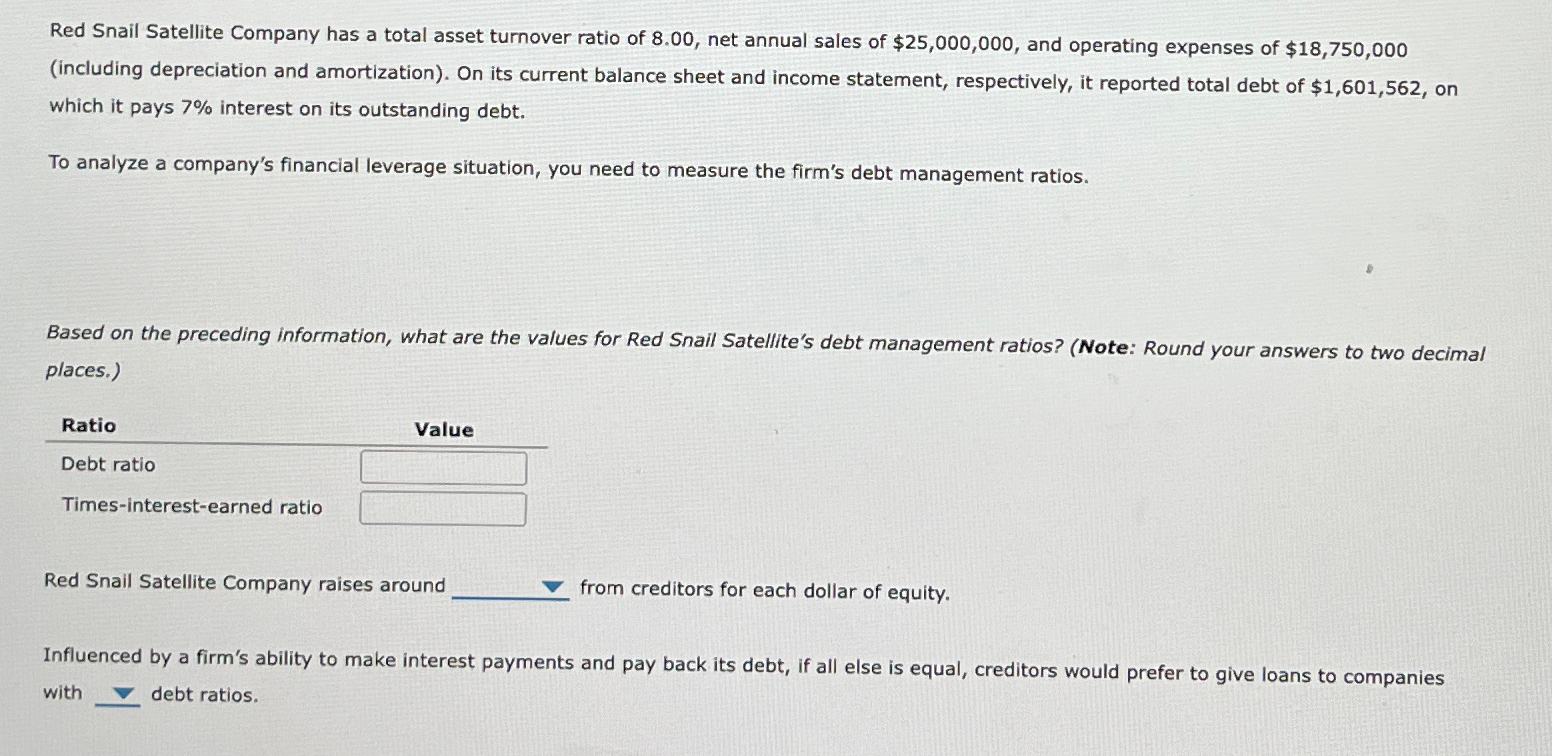

Red Snail Satellite Company has a total asset turnover ratio of net annual sales of $ and operating expenses of $including depreciation and amortization On its current balance sheet and income statement, respectively, it reported total debt of $ on which it pays interest on its outstanding debt.

To analyze a company's financial leverage situation, you need to measure the firm's debt management ratios.

Based on the preceding information, what are the values for Red Snail Satellite's debt management ratios? Note: Round your answers to two decimal places.

Ratio

Value

Debt ratio

Timesinterestearned ratio

Red Snail Satellite Company raises around from creditors for each dollar of equity.

Influenced by a firm's ability to make interest payments and pay back its debt, if all else is equal, creditors would prefer to give loans to companies with debt ratios.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started