Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Redbird Consulting, Inc. was formed on January 1, 2020, and recorded its transactions throughout the year. Now it is the end of the year,

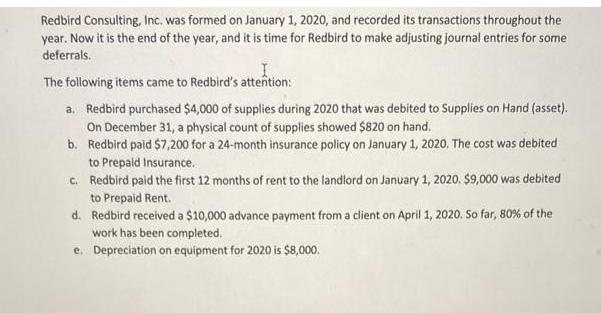

Redbird Consulting, Inc. was formed on January 1, 2020, and recorded its transactions throughout the year. Now it is the end of the year, and it is time for Redbird to make adjusting journal entries for some deferrals. I The following items came to Redbird's attention: a. Redbird purchased $4,000 of supplies during 2020 that was debited to Supplies on Hand (asset). On December 31, a physical count of supplies showed $820 on hand. Redbird paid $7,200 for a 24-month insurance policy on January 1, 2020. The cost was debited to Prepaid Insurance. c. Redbird paid the first 12 months of rent to the landlord on January 1, 2020. $9,000 was debited to Prepaid Rent. d. Redbird received a $10,000 advance payment from a client on April 1, 2020. So far, 80% of the work has been completed. e. Depreciation on equipment for 2020 is $8,000.

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution I STEP1 Journal Entries Transaction Accounts titles and details Debit Credit Dec31 S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started