Answered step by step

Verified Expert Solution

Question

1 Approved Answer

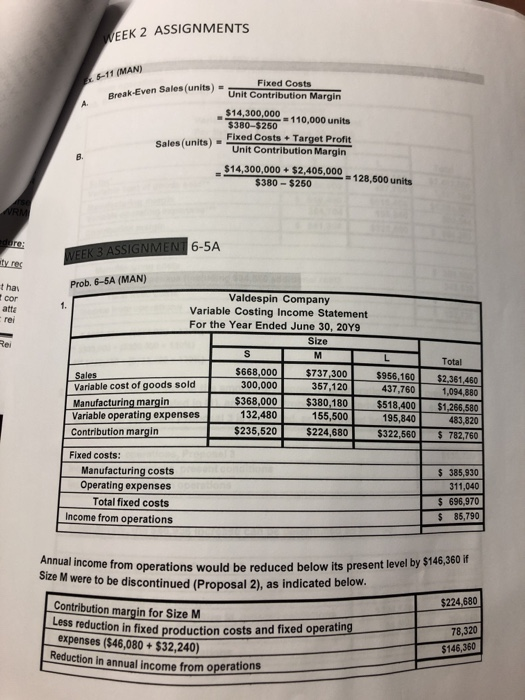

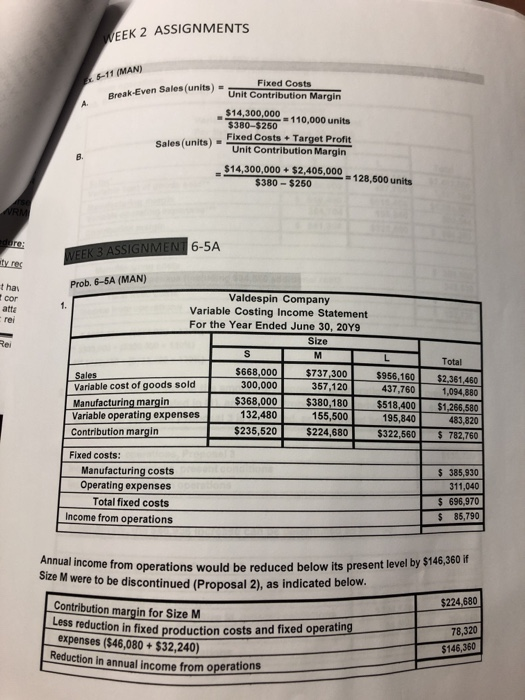

Reduction in annual income from operations WEEK 2 ASSIGNMENTS 5-11 (MAN) Break-Even Sales (units) Fixed Costs Unit Contribution Margin $14,300,000 = 110,000 units $380-$250 Fixed

Reduction in annual income from operations WEEK 2 ASSIGNMENTS 5-11 (MAN) Break-Even Sales (units) Fixed Costs Unit Contribution Margin $14,300,000 = 110,000 units $380-$250 Fixed Costs + Target Profit Sales (units) = Unit Contribution Margin $14,300,000+ $2,405,000 = 128.500 units $380 - $250 NRM WEEK 3 ASSIGNMENT 6-5A atyres Prob. 6-5A (MAN) thai cor atta rei 1. Rei Valdespin Company Variable Costing Income Statement For the Year Ended June 30, 2049 Size S M $668,000 Sales $737,300 Variable cost of goods sold 300,000 357,120 Manufacturing margin $368,000 $380,180 Variable operating expenses 132,480 155,500 Contribution margin $235,520 $224,680 Total $956,160 437,760 $518,400 195,840 $322,560 $2,361,460 1,094,880 $1,266,580 483,820 $ 782,760 Fixed costs: Manufacturing costs Operating expenses Total fixed costs Income from operations $ 385,930 311,040 $ 696,970 $ 85,790 Annual income from operations would be reduced below its present level by $146,360 if Size M were to be discontinued (Proposal 2), as indicated below. $224,680 Contribution margin for Size M Less reduction in fixed production costs and fixed operating expenses (546,080 + $32,240) 78,320 $146,360 Reduction in annual income from operations WEEK 2 ASSIGNMENTS 5-11 (MAN) Break-Even Sales (units) Fixed Costs Unit Contribution Margin $14,300,000 = 110,000 units $380-$250 Fixed Costs + Target Profit Sales (units) = Unit Contribution Margin $14,300,000+ $2,405,000 = 128.500 units $380 - $250 NRM WEEK 3 ASSIGNMENT 6-5A atyres Prob. 6-5A (MAN) thai cor atta rei 1. Rei Valdespin Company Variable Costing Income Statement For the Year Ended June 30, 2049 Size S M $668,000 Sales $737,300 Variable cost of goods sold 300,000 357,120 Manufacturing margin $368,000 $380,180 Variable operating expenses 132,480 155,500 Contribution margin $235,520 $224,680 Total $956,160 437,760 $518,400 195,840 $322,560 $2,361,460 1,094,880 $1,266,580 483,820 $ 782,760 Fixed costs: Manufacturing costs Operating expenses Total fixed costs Income from operations $ 385,930 311,040 $ 696,970 $ 85,790 Annual income from operations would be reduced below its present level by $146,360 if Size M were to be discontinued (Proposal 2), as indicated below. $224,680 Contribution margin for Size M Less reduction in fixed production costs and fixed operating expenses (546,080 + $32,240) 78,320 $146,360

Reduction in annual income from operations WEEK 2 ASSIGNMENTS 5-11 (MAN) Break-Even Sales (units) Fixed Costs Unit Contribution Margin $14,300,000 = 110,000 units $380-$250 Fixed Costs + Target Profit Sales (units) = Unit Contribution Margin $14,300,000+ $2,405,000 = 128.500 units $380 - $250 NRM WEEK 3 ASSIGNMENT 6-5A atyres Prob. 6-5A (MAN) thai cor atta rei 1. Rei Valdespin Company Variable Costing Income Statement For the Year Ended June 30, 2049 Size S M $668,000 Sales $737,300 Variable cost of goods sold 300,000 357,120 Manufacturing margin $368,000 $380,180 Variable operating expenses 132,480 155,500 Contribution margin $235,520 $224,680 Total $956,160 437,760 $518,400 195,840 $322,560 $2,361,460 1,094,880 $1,266,580 483,820 $ 782,760 Fixed costs: Manufacturing costs Operating expenses Total fixed costs Income from operations $ 385,930 311,040 $ 696,970 $ 85,790 Annual income from operations would be reduced below its present level by $146,360 if Size M were to be discontinued (Proposal 2), as indicated below. $224,680 Contribution margin for Size M Less reduction in fixed production costs and fixed operating expenses (546,080 + $32,240) 78,320 $146,360 Reduction in annual income from operations WEEK 2 ASSIGNMENTS 5-11 (MAN) Break-Even Sales (units) Fixed Costs Unit Contribution Margin $14,300,000 = 110,000 units $380-$250 Fixed Costs + Target Profit Sales (units) = Unit Contribution Margin $14,300,000+ $2,405,000 = 128.500 units $380 - $250 NRM WEEK 3 ASSIGNMENT 6-5A atyres Prob. 6-5A (MAN) thai cor atta rei 1. Rei Valdespin Company Variable Costing Income Statement For the Year Ended June 30, 2049 Size S M $668,000 Sales $737,300 Variable cost of goods sold 300,000 357,120 Manufacturing margin $368,000 $380,180 Variable operating expenses 132,480 155,500 Contribution margin $235,520 $224,680 Total $956,160 437,760 $518,400 195,840 $322,560 $2,361,460 1,094,880 $1,266,580 483,820 $ 782,760 Fixed costs: Manufacturing costs Operating expenses Total fixed costs Income from operations $ 385,930 311,040 $ 696,970 $ 85,790 Annual income from operations would be reduced below its present level by $146,360 if Size M were to be discontinued (Proposal 2), as indicated below. $224,680 Contribution margin for Size M Less reduction in fixed production costs and fixed operating expenses (546,080 + $32,240) 78,320 $146,360

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started