-

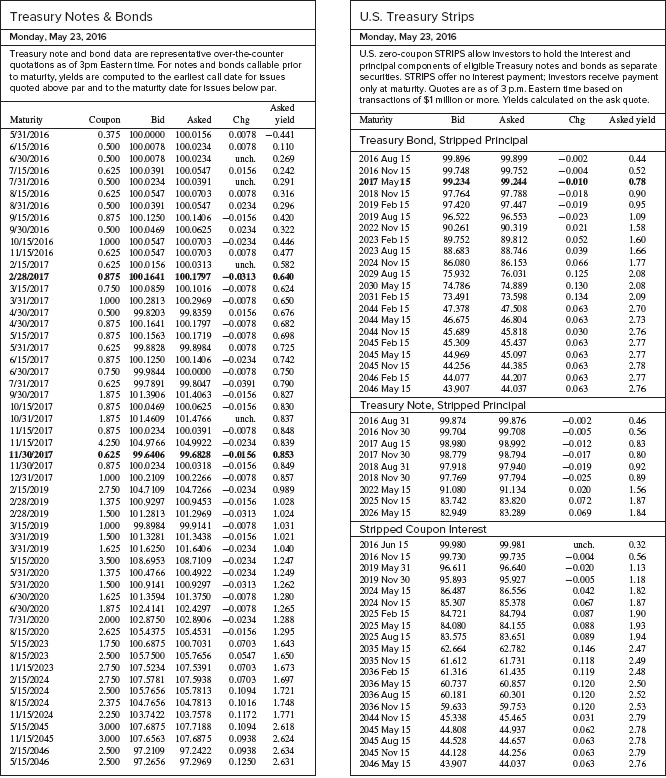

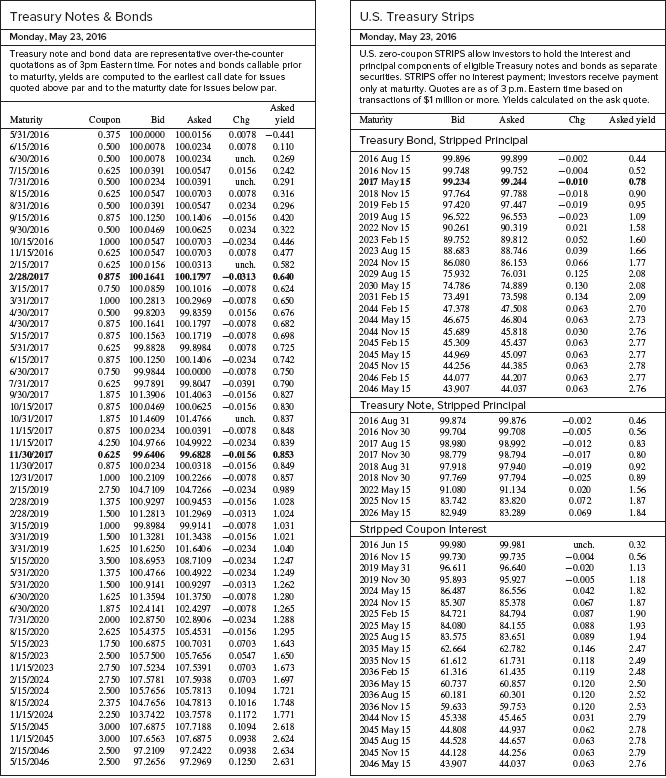

Refer again to Table 61. (above)

a) Verify the asked price on the 0.875 percent November 30,2017 T-note for Monday, May 23, 2016. The asked yield on the note is 0.849 percent and the note matures on November 30, 2017. Settlement occurs one business day after purchase (i.e., you would take possession of the note on Wednesday, May 24, 2016). b) Verify the asked yield on the 0.625 percent July 31, 2017 T-note for May 23, 2016. The asked price is 99.8047 and the note matures on July 31, 2017.

Treasury Notes & Bonds May 23, 2016 U.S. Treasury Strips Treasury note and bond data are representaive over-the-counter quotatons as of 3pm Eastern tlme. For notes and bonds callable prtor to maturity. ylelds are computed to the earllest call date for issues quoted above par and to the maturty date for Issues below par U.S. zero-coupon STRIPS allow Investors to hold the Interest and princlpal components of ellglble Treasury notes and bonds as separate securttes. STRIPS offer no Interest payment; Investors recelve payment only at matuty. Quotes are as of 3 p.m. Eastern tme based on transactions of $1 millon or more. Ylelds calculated on the ask quote. Asked Maturity 531/2016 Co Asked yield 0.375 1000000 100.0156 0.0078-0.441 0.500 1000078 100.0234 0.0078 0.110 0.500 1000078 100.0234 0.625 100039 100.0547 0.0156 0.242 0.500 1000234 100.0391 0.625 1000547 100.0703 0.0078 0.316 0.500 10003 100.0547 0.0234 0.296 0.875 100.1250 100.14060.0156 0.420 0.500 1000469 1000625 0.0234 0.322 1000 1000547 100.003.0234 0.446 0.625 1000547 100.0703 0.0078 0.477 0.625 1000156 100.0313 0875 1001641 100.11970.0313 0.640 0.750 1000859 100.1016.0078 0.624 1000 100.2813 100.2969.0078 0.650 0.500 99.8203 99.8359 0.0156 0.676 0.875 100.1641 100.1797 .0078 0.682 0.875 100.1563 100.17190.0078 0.698 0.625 99.8828 99.8984 0.0078 0.725 0.875 100.1250 100.14060.0234 0.742 0.750 99.9844 100.0000-0.0078 0.750 0.625 99.78 99.8047 -0.03 0.790 1875 101.3906 101.4063.0156 0.827 0.875 1000469 100.06250.0156 0.830 1.875 1014609 101.4766 0.875 1000234 100.039.0078 0.848 4.250 104.9766 1049922-.0234 0.839 0625 99.6406 99.6828-0.0156 0853 0.875 1000234 100.03180.0156 0.849 1000 100.2109 100.22660.0078 0.857 2.750 104.7109 104.7266-0.0234 0.989 1.375 100.9297 100.9453 -0.0156 1.028 1.500 101.2813 101.29690.0313 1.024 1000 99.8984 99.9140.0078 1.031 1.500 101.328 101.3438-0.0156 1.021 1.625 101.6250 101.6406.0234 1.040 3.500 108.6953 108.7109-0.0234 1.247 1.375 1004766 100.49220.0234 1.249 1.500 100.914 100.9297-0.0313 262 1.625 101.3594 101.3750-0.0078 280 1875 1024141 102.4297.0078 1.265 2.000 102.8750 102.8906 -.0234 1.288 2.625 1054375 105.453 -0.0156 .295 1.750 100.6875 1007031 0.0703 .643 2.500 105.7500 105.7656 0.0547 1.650 2.750 107.5234 107.539 0.0703 673 2.750 107.578 107.5938 0.0703 .697 2.500 105.7656 105.7813 0.104 1.721 2.375 104.7656 104.7813 0.1016 1.748 2.250 103.7422 103.7578 0.1172 1.771 3.000 107.6875 107.7188 0.1094 2.618 3.000 107.6563 107.6875 0.0938 2.624 2.500 97.2109 97.2422 0.0938 2.634 2.500 97.2656 97.2969 0.1250 2.631 Treasury Bond, Stripped Princlpal 7/15/2016 7/31/2016 2016 Nov 15 2017 May15 2018 Nov 15 2019 Feb15 99.752 99.234 831/2016 -0.023 2022 Nov 15 2023 Feb 15 90261 89.752 0152016 1152016 152017 86.080 2031 Feb15 2044 Feb 15 73491 47.378 331/2017 20 2017 430v201 15/2017 531/2017 15201 630V2017 7/31/2017 9302017 10V152017 10V3 1/2017 11/152017 11/152017 11/302017 47.508 0063 0063 2045 Feb15 0063 0063 0.063 0063 0063 2045 Nov 15 2046 Feb 15 e. Stripped Principal 2016 Aug 31 2016 Nov 30 2017 Aug 1 2017 Nov 30 2018 Aug 3 2018 Nov 30 1231/2017 2025 Nov 15 331/2019 331/2019 2016 Nov 15 2019 May 31 2019 Nov 30 -0.004 -0.020 -0.005 2024 Nov 15 84.721 2025 Aug 15 2035 May 1!5 2035 Nov 15 61.731 0.119 248 2.50 2.52 2036 May 1!5 2036 Aug 2036 Nov 15 2044 Nov 15 60.737 15 60.301 45465 44.937 45.338 2045 Aug 15 0063 Treasury Notes & Bonds May 23, 2016 U.S. Treasury Strips Treasury note and bond data are representaive over-the-counter quotatons as of 3pm Eastern tlme. For notes and bonds callable prtor to maturity. ylelds are computed to the earllest call date for issues quoted above par and to the maturty date for Issues below par U.S. zero-coupon STRIPS allow Investors to hold the Interest and princlpal components of ellglble Treasury notes and bonds as separate securttes. STRIPS offer no Interest payment; Investors recelve payment only at matuty. Quotes are as of 3 p.m. Eastern tme based on transactions of $1 millon or more. Ylelds calculated on the ask quote. Asked Maturity 531/2016 Co Asked yield 0.375 1000000 100.0156 0.0078-0.441 0.500 1000078 100.0234 0.0078 0.110 0.500 1000078 100.0234 0.625 100039 100.0547 0.0156 0.242 0.500 1000234 100.0391 0.625 1000547 100.0703 0.0078 0.316 0.500 10003 100.0547 0.0234 0.296 0.875 100.1250 100.14060.0156 0.420 0.500 1000469 1000625 0.0234 0.322 1000 1000547 100.003.0234 0.446 0.625 1000547 100.0703 0.0078 0.477 0.625 1000156 100.0313 0875 1001641 100.11970.0313 0.640 0.750 1000859 100.1016.0078 0.624 1000 100.2813 100.2969.0078 0.650 0.500 99.8203 99.8359 0.0156 0.676 0.875 100.1641 100.1797 .0078 0.682 0.875 100.1563 100.17190.0078 0.698 0.625 99.8828 99.8984 0.0078 0.725 0.875 100.1250 100.14060.0234 0.742 0.750 99.9844 100.0000-0.0078 0.750 0.625 99.78 99.8047 -0.03 0.790 1875 101.3906 101.4063.0156 0.827 0.875 1000469 100.06250.0156 0.830 1.875 1014609 101.4766 0.875 1000234 100.039.0078 0.848 4.250 104.9766 1049922-.0234 0.839 0625 99.6406 99.6828-0.0156 0853 0.875 1000234 100.03180.0156 0.849 1000 100.2109 100.22660.0078 0.857 2.750 104.7109 104.7266-0.0234 0.989 1.375 100.9297 100.9453 -0.0156 1.028 1.500 101.2813 101.29690.0313 1.024 1000 99.8984 99.9140.0078 1.031 1.500 101.328 101.3438-0.0156 1.021 1.625 101.6250 101.6406.0234 1.040 3.500 108.6953 108.7109-0.0234 1.247 1.375 1004766 100.49220.0234 1.249 1.500 100.914 100.9297-0.0313 262 1.625 101.3594 101.3750-0.0078 280 1875 1024141 102.4297.0078 1.265 2.000 102.8750 102.8906 -.0234 1.288 2.625 1054375 105.453 -0.0156 .295 1.750 100.6875 1007031 0.0703 .643 2.500 105.7500 105.7656 0.0547 1.650 2.750 107.5234 107.539 0.0703 673 2.750 107.578 107.5938 0.0703 .697 2.500 105.7656 105.7813 0.104 1.721 2.375 104.7656 104.7813 0.1016 1.748 2.250 103.7422 103.7578 0.1172 1.771 3.000 107.6875 107.7188 0.1094 2.618 3.000 107.6563 107.6875 0.0938 2.624 2.500 97.2109 97.2422 0.0938 2.634 2.500 97.2656 97.2969 0.1250 2.631 Treasury Bond, Stripped Princlpal 7/15/2016 7/31/2016 2016 Nov 15 2017 May15 2018 Nov 15 2019 Feb15 99.752 99.234 831/2016 -0.023 2022 Nov 15 2023 Feb 15 90261 89.752 0152016 1152016 152017 86.080 2031 Feb15 2044 Feb 15 73491 47.378 331/2017 20 2017 430v201 15/2017 531/2017 15201 630V2017 7/31/2017 9302017 10V152017 10V3 1/2017 11/152017 11/152017 11/302017 47.508 0063 0063 2045 Feb15 0063 0063 0.063 0063 0063 2045 Nov 15 2046 Feb 15 e. Stripped Principal 2016 Aug 31 2016 Nov 30 2017 Aug 1 2017 Nov 30 2018 Aug 3 2018 Nov 30 1231/2017 2025 Nov 15 331/2019 331/2019 2016 Nov 15 2019 May 31 2019 Nov 30 -0.004 -0.020 -0.005 2024 Nov 15 84.721 2025 Aug 15 2035 May 1!5 2035 Nov 15 61.731 0.119 248 2.50 2.52 2036 May 1!5 2036 Aug 2036 Nov 15 2044 Nov 15 60.737 15 60.301 45465 44.937 45.338 2045 Aug 15 0063