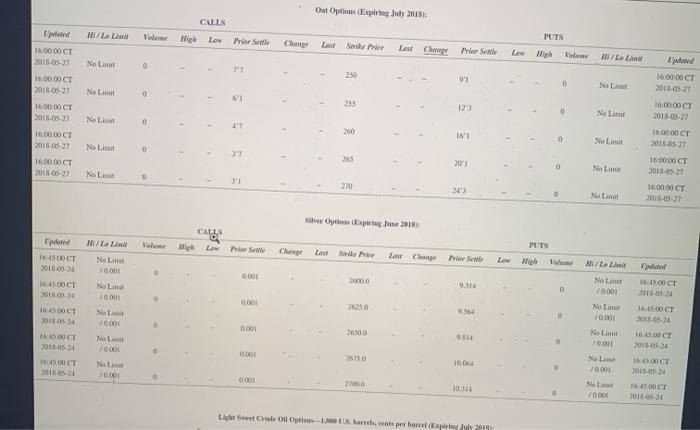

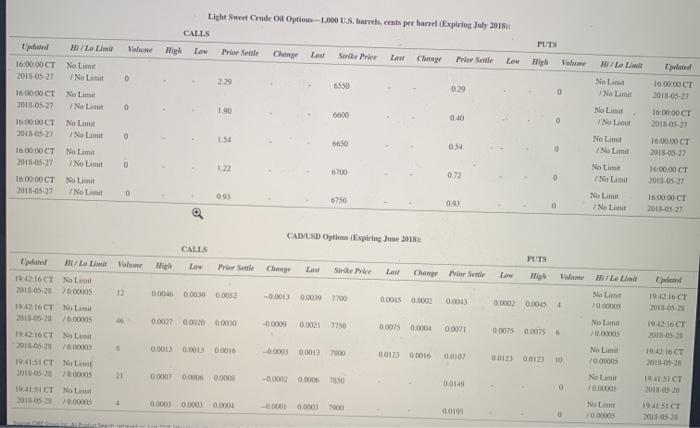

Refer to Figure 24.11 to answer this question. Suppose you purchase a July 2018 call option on crude oil futures with a strike price of 6,700 cents per barrel. Assume 1,000 barrels per contract. a. How much does your option cost per barrel of oil? (Round your final answer to decimal places. Omit $ sign in your response.) Option cost per barrel b. What is the total cost? (Omit $ sign in your response.) Total cost c. Suppose the price of oil futures is 7,750 cents per barrel at expiration of the options contract. What is your net profit or loss from this position? (Input the amount as a positive value. Omit $ sign in your response.) (Click to select) d. What if oll futures prices are 4.950 cents per barrel at expiration? (Input the amount as a positive value. Omit $ sign in your response.) (Click to select) Out Option Expirie July 2013 CALLS /L Volar High Low Prior Sale Last Serier 16 00:00 CT Last Cheap Prior Semle PUTS Low Mile IN /La No Limit 160000 CT 2018-05-27 09 D No Liu 16 00:00 CT 2011-05 No Limit 0 61 285 123 160000 CY 2002 0 No Limit No 0 2 16.00 OO CT 2015-05-27 18.00:00 CT 2015.05 200 16' 16.00.00 2011-05-23 0 No Limit NL 0 37 - 3 201 16.000 CT 2015 OS 0 No Lima 16:00:00 CT 2018-01 NL 270 16.00 OCT 2011-08-22 Stw Os de 2018 CALLS Mih Low Per See PUTN Che La Siber M/L No Lim 100 Last Champ 1.OCT 2018 03:34 Par Se L po o 0.001 DO $ 6500 CT 010 34 OCT Net 70001 No Limit 10.000 D 0.001 2635.0 564 1.400CT S4 Na 0001 D No Lim 10.00 ACT 2018.05.34 0 0.001 26.500 Ne 9514 15.45 CT 2011.05.14 Not 70001 168.00 CE LOL 0 0.001 36150 DOCT 10.04 No 100 0.001 16 OCT 2011-02 COOL 27000 OCT 0 VODO Licht Sweet C-10 per here Light Sweet Crude Ol Options-1.000 U.S.barrels cents per hare (Explring July 2018 CALLS HILL We High Low Prior Senile tptaril 1.00.00 CE 2015-05-27 Change Strike Prike La Chewy PUTS Hiple Prior Sale TW HALL No Lim No Limit 0 2.29 500 ja 16.00.00 CT 2015-05-27 0.29 No Lid No Limit 0 16 0000 CT 2013 05-27 NaL No Limit 0 1.90 6600 0.10 0 No Limit /No La 16.DOCT 2011 160000 CT 2015-05-22 No Lim No Limit 0 1.54 6650 034 No Limit Nam 0 16 000 CT No Limit 2011-05-27 No Limit 16.00 OCT 2018-05-27 0 1.22 Net No Limit 160000 CT 0.72 0 1600:00 CT 2015-05-27 No Limit No Limit 0 09 6250 001 No Lima No Limit 16.00 OCT 2018-03-27 CAD USD Option Expiring Jan 2018 CALLS PUTS Pre Sale Strike Pier La Chaw Por Sale Low /L 1916CT No Limit 2011.05-20 100005 19.1216CT No Limit 000 0.000000 -0.00130.00 Le La No Lim 10 000 7700 pl 19.12.16CT 2015 ODOS 0.000 0000 0.0045 1 00027 0.000 0.0030 00000 0.0031 7750 0.00750.000 0.007 0005 0.0075 No Lima 0.0000 19 OCT 2018. 00012 0.001300036 0000300013 7800 0.0123 0.0016 00107 10 19:16 CTNL 100005 1941 SICT No 2011 000 19:41:51 CTN 2010-100005 No Lim 700 No Limit DO 21 0000000000003 -0.0002 0.0006 350 0.0149 0 1942 16CT 2011-05-18 19:41 SICT 2015-028 115 CT 20150525 00001 0.000000 -0.0001 0.0000 00198 NE MS