Question

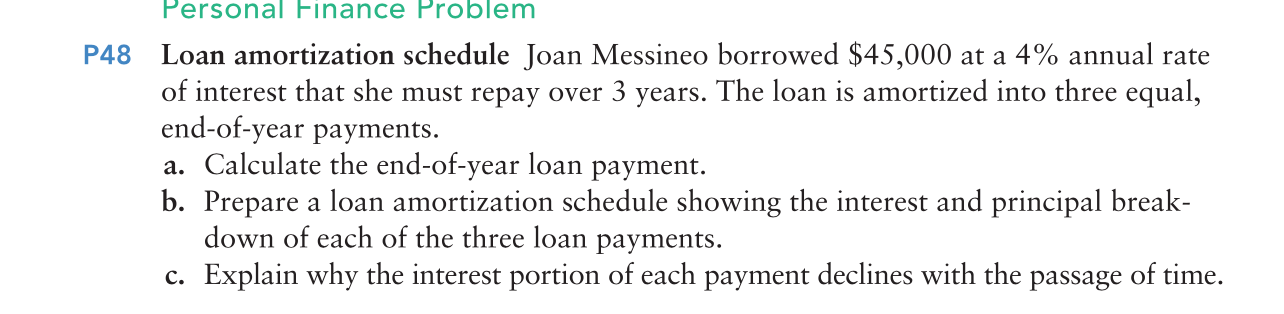

Refer to homework problem 48 (P5-48) from the Time Value of Money chapter in the textbook to answer this question. You were required to solve

Refer to homework problem 48 (P5-48) from the Time Value of Money chapter in the textbook to answer this question. You were required to solve for the loan amortization schedule in this problem based on a 3 year loan with annual payments. If you are considering selecting between a mortgage of either a 15 year mortgage or a 30 year mortgage, what changes must be made to the variables in the problem to solve for the payment? (NOTE: this is only a theory question. Calculations are not necessary.)

What factors would you want to take into consideration to help you choose between either a 15 year loan or a 30 year loan?

Referring to the original problem (48), calculate the loan payment if the payments are due monthly instead of annual payments. Show your calculator keystroke setup and identify your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started