Answered step by step

Verified Expert Solution

Question

1 Approved Answer

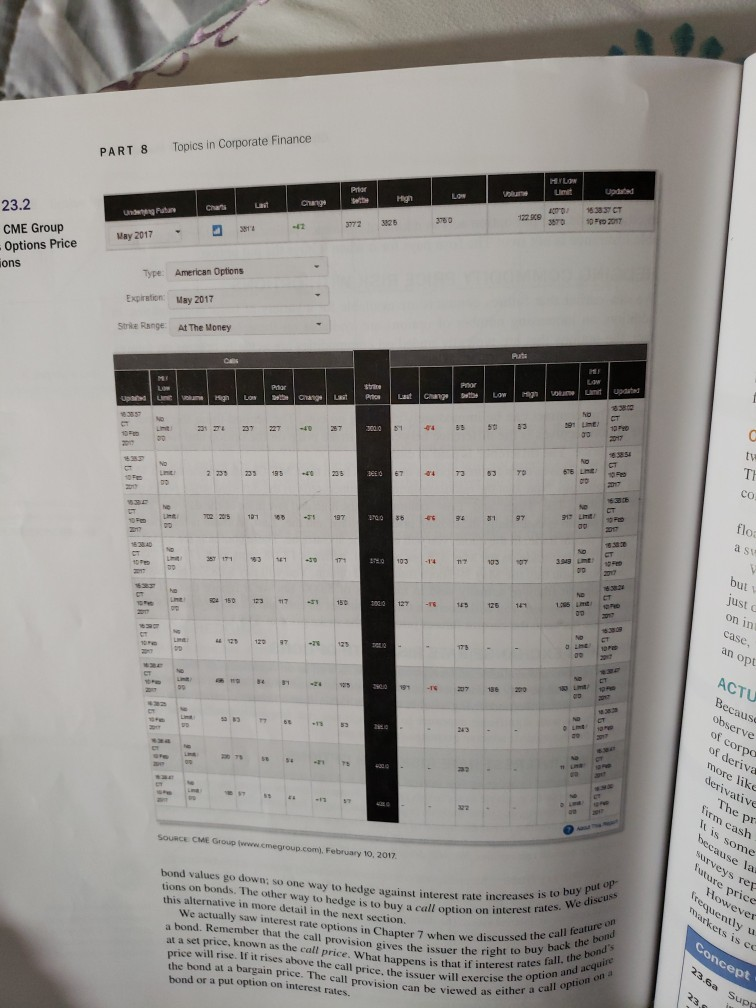

Refer to table 23.2 in the text to answer this question. Suppose you purchase the May 2017 call option on corn futures with a strike

Refer to table 23.2 in the text to answer this question. Suppose you purchase the May 2017 call option on corn futures with a strike price of $3.85. Assume you purchased the option at the last price. How much does your option cost per bushel of corn? What is the total cost? Suppose the price of corn futures is $3.74 per bushel at expiration of the option contract. What is your net profit or loss from this position? What if corn futures prices are $4.13 per bushel at expiration?

refund this question

bond values go dowo, So one way to hedge against interest rate increases is to buy put op tions on bonds. The other way to hedge is to buy a call option on interest rates. We discuss We actually saw interest rate options in Chapter 7 when we discussed the call feature on at a set price, known as the call price. What happens is that if interest rates all the bonds a bond. Remember that the call provision gives the issuer the right to buy back the bond price will rise. If it rises above the call price, the issuer will exercise the option and acque the bond at a bargain price. The call provision can be viewed as either a call option on PART 8 Topics in Corporate Finance MYLOW Pro High Chat Change Uguhan 16383CT -172 99 2010 3670 3772 320 23.2 CME Group Options Price ions May 2017 Type American Options Expiration May 2017 stre Range At The Money PU ME Por Por LOW Stri Pirts wated 17 Up LOW L High LOR ang change 338 3059 10 191 UME: 237 BE 53 30 27 5851 NO 2 233 733 195 20 67 576 LHE yo 6 TI 30 CO he NO 197 --- 197 86 -6 3 97 00 flo 1630 a su 36T 171 41 -30 17 103 117 193 103 - OP OD butv he 504 150 123 417 150 1000 127 125 141 just - DO on in case, 120 97 -28 125 DER 173 179 an op 30 SCO 19 -TS 188 ACTU Because : NO 43 observe of corpo of deriva more lik derivative S. 2 SOURCE CME Group (www.megroup.com, February 10, 2017 The pr Turm cash It is some because la Narveys rer future price However Frequently Tarkets is e this alternative in more detail in the next section Concept 23.6a Supe bond or a put option on interest rates. 23 bond values go dowo, So one way to hedge against interest rate increases is to buy put op tions on bonds. The other way to hedge is to buy a call option on interest rates. We discuss We actually saw interest rate options in Chapter 7 when we discussed the call feature on at a set price, known as the call price. What happens is that if interest rates all the bonds a bond. Remember that the call provision gives the issuer the right to buy back the bond price will rise. If it rises above the call price, the issuer will exercise the option and acque the bond at a bargain price. The call provision can be viewed as either a call option on PART 8 Topics in Corporate Finance MYLOW Pro High Chat Change Uguhan 16383CT -172 99 2010 3670 3772 320 23.2 CME Group Options Price ions May 2017 Type American Options Expiration May 2017 stre Range At The Money PU ME Por Por LOW Stri Pirts wated 17 Up LOW L High LOR ang change 338 3059 10 191 UME: 237 BE 53 30 27 5851 NO 2 233 733 195 20 67 576 LHE yo 6 TI 30 CO he NO 197 --- 197 86 -6 3 97 00 flo 1630 a su 36T 171 41 -30 17 103 117 193 103 - OP OD butv he 504 150 123 417 150 1000 127 125 141 just - DO on in case, 120 97 -28 125 DER 173 179 an op 30 SCO 19 -TS 188 ACTU Because : NO 43 observe of corpo of deriva more lik derivative S. 2 SOURCE CME Group (www.megroup.com, February 10, 2017 The pr Turm cash It is some because la Narveys rer future price However Frequently Tarkets is e this alternative in more detail in the next section Concept 23.6a Supe bond or a put option on interest rates. 23Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started