Question

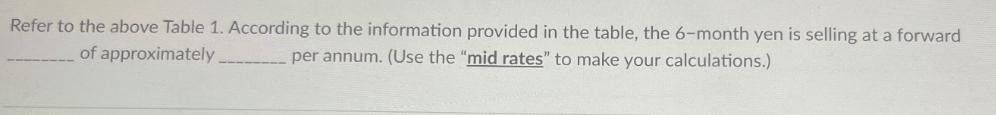

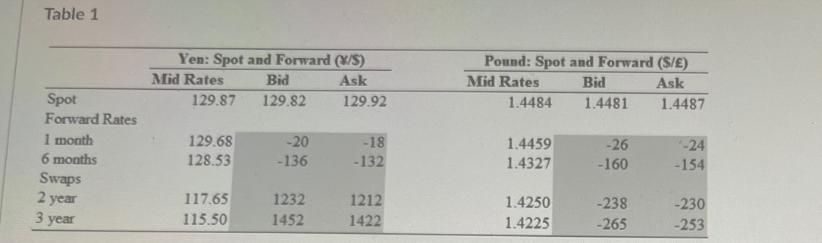

Refer to the above Table 1. According to the information provided in the table, the 6-month yen is selling at a forward of approximately

Refer to the above Table 1. According to the information provided in the table, the 6-month yen is selling at a forward of approximately per annum. (Use the "mid rates" to make your calculations.) Table 1 Yen: Spot and Forward (/S) Pound: Spot and Forward (S/E) Mid Rates Bid Ask Mid Rates Bid Ask Spot 129.87 129.82 129.92 1.4484 1.4481 1.4487 Forward Rates 1 month 129.68 -20 -18 1.4459 -26 -24 6 months 128.53 -136 -132 1.4327 -160 -154 Swaps 2 year 117.65 1232 1212 1.4250 -238 -230 3 year 115.50 1452 1422 1.4225 -265 -253

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the 6month forward rate for yen per annum using the mid rates provided in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Multinational Finance Evaluating Opportunities Costs and Risks of Operations

Authors: Kirt C. Butler

5th edition

1118270126, 978-1118285169, 1118285166, 978-1-119-2034, 978-1118270127

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App