Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Refer to the balance sheet and to Notes 11 and 13. a. Does Target have trade accounts receivable? (Trade A/R represents amounts owed by customers,

Refer to the balance sheet and to Notes 11 and 13.

a. Does Target have trade accounts receivable? (Trade A/R represents amounts owed by customers, versus other entities (e.g. Internal Revenue Service) or people (e.g. CEO).)

b. Discuss the various receivables Target has.

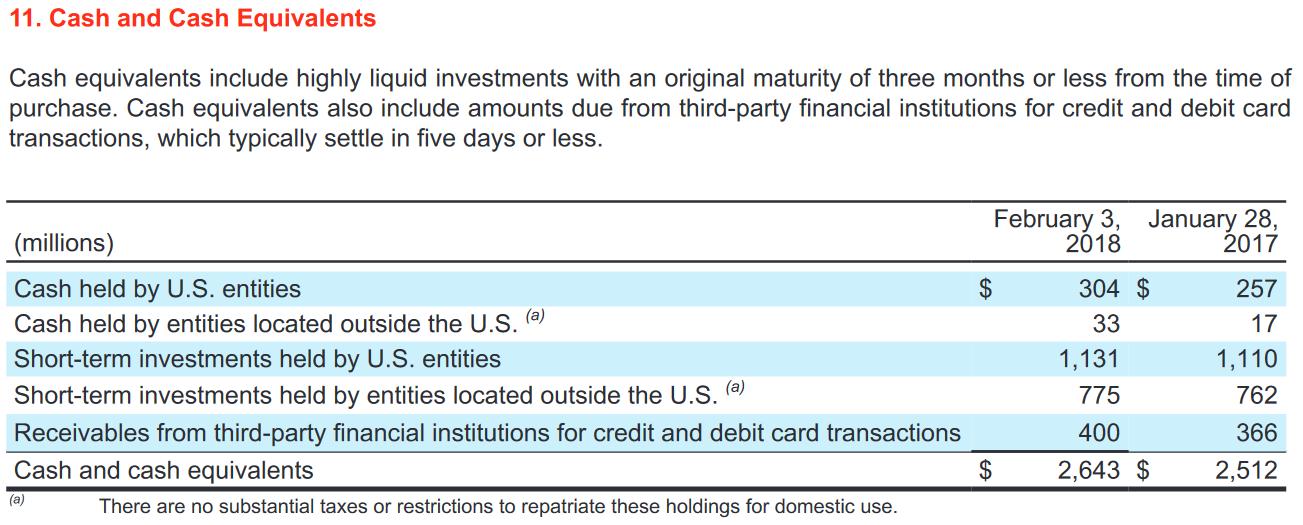

11. Cash and Cash Equivalents Cash equivalents include highly liquid investments with an original maturity of three months or less from the time of purchase. Cash equivalents also include amounts due from third-party financial institutions for credit and debit card transactions, which typically settle in five days or less. February 3, January 28, 2018 (millions) 2017 304 $ Cash held by U.S. entities Cash held by entities located outside the U.S. (e) 257 33 17 Short-term investments held by U.S. entities 1,131 1,110 (a) Short-term investments held by entities located outside the U.S. 775 762 Receivables from third-party financial institutions for credit and debit card transactions 400 366 Cash and cash equivalents 2$ 2,643 $ 2,512 (a) There are no substantial taxes or restrictions to repatriate these holdings for domestic use.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Various Receivable Targets 1 Under Cash and Cash equi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started