Question

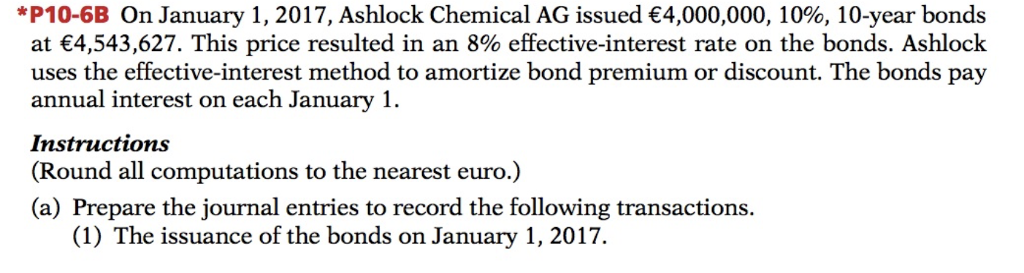

Refer to the data for problem 10-6B on page 526, except assume that interest is paid semi-annually on January 1 and July 1. Ignore the

Refer to the data for problem 10-6B on page 526, except assume that interest is paid semi-annually on January 1 and July 1. Ignore the instructions in the textbook, and rounding to two decimal places, answer the following instead:

PARTS A AND B HAVE BEEN ANSWERED WITH SOLUTION BELOW EACH PART RESPECTIVELY

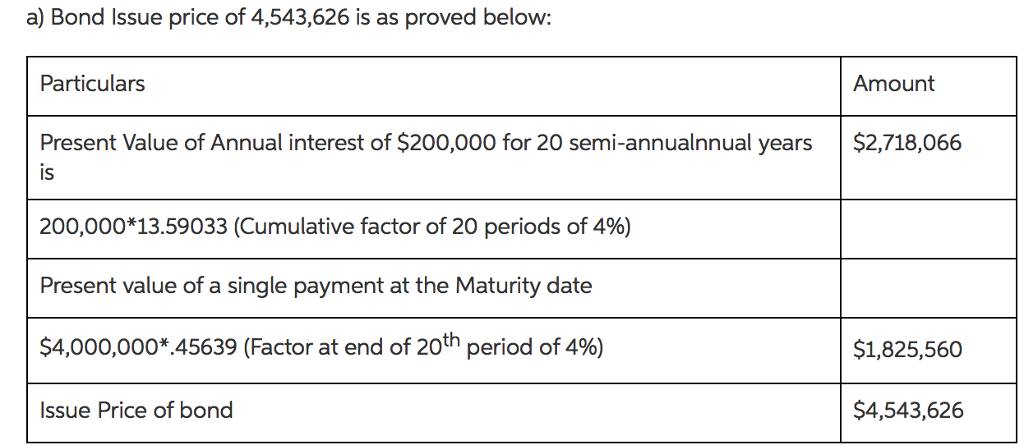

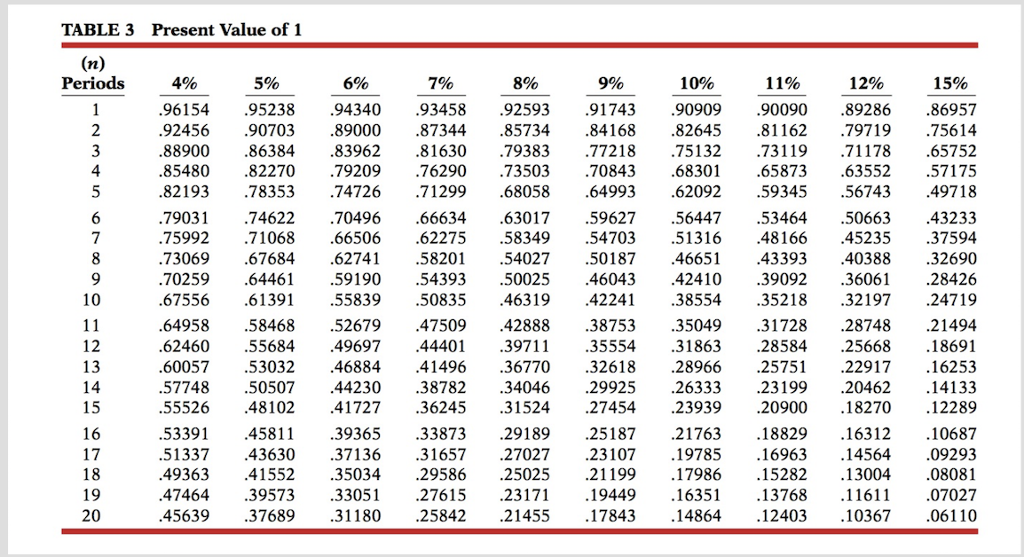

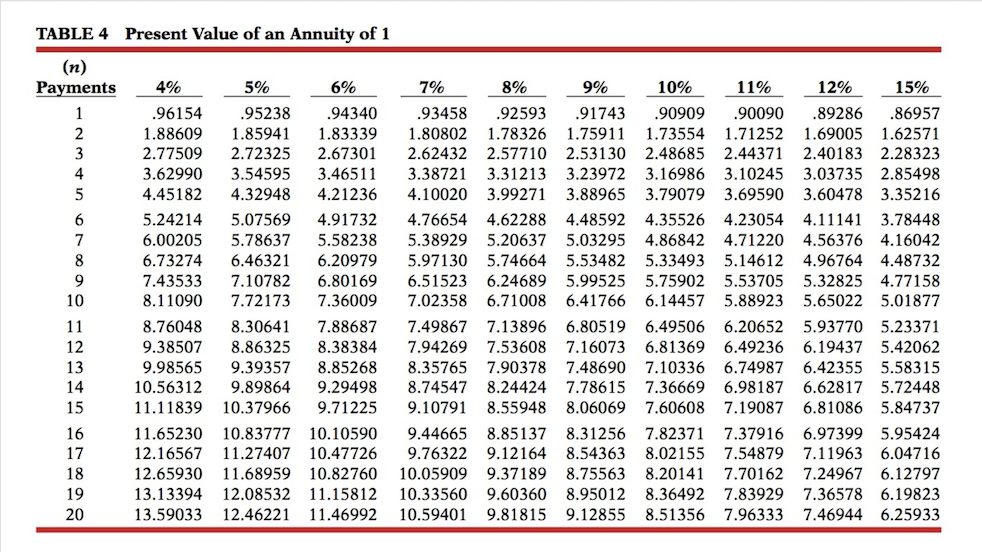

a. Use Tables 3 & 4 in Appendix E of the textbook (pp. E8 and E10), and your knowledge of time value of money, to prove why the bonds were issued at $4,543,626.

*THIS HAS BEEN ANSWERED PREVIOUSLY AND SHOWN BELOW*

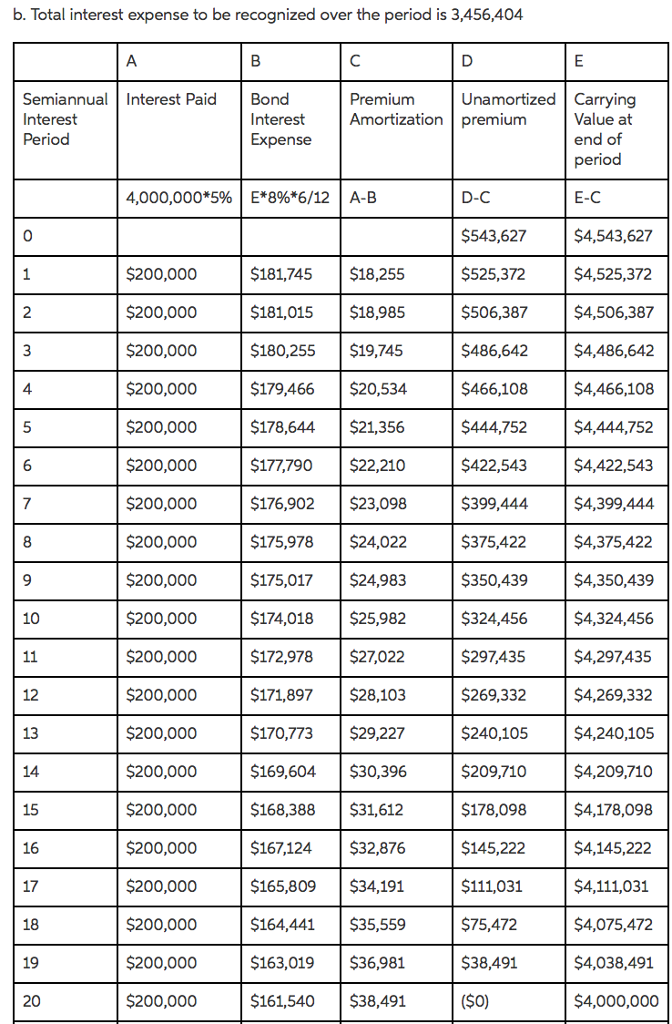

b. Assuming the bonds are redeemed at maturity, what is the total amount of interest expense to be recognized over the life of the bonds? Show your work.

*THIS HAS BEEN ANSWERED PREVIOUSLY AND SHOWN BELOW*

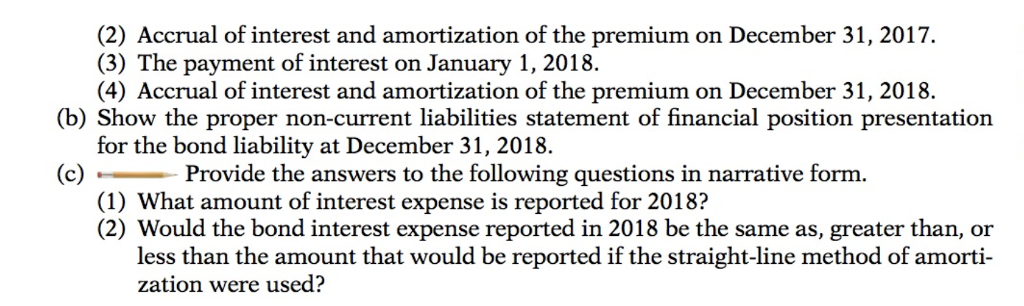

c. Assume the company has an annual accounting period ending the end of February.

i. Prepare the AJE required on February 28, 2017.

ii. Prepare the journal entry to record the payment of interest on July 1, 2017.

d. Ignore c). Assume the annual accounting period ends on December 31 instead.

i. Prepare the journal entry to record the payment of interest on July 1, 2017.

ii. Prepare the AJE required on December 31, 2017

iii. Prepare the journal entry to record the payment of interest on January 1, 2018.

iv. What is the carrying value of the bonds on January 1, 2018? Show your calculations or marks will be lost.

e. Assume that after interest is paid on January 1, 2018, the company buys back the bonds. On that date, the market interest rate was 12%.

i. Calculate what the company must pay to redeem the bonds. (Hint: This requires time value of money calculations.)

ii. Prepare the journal entry to record the redemption

iii. Using a residual analysis, explain why a gain/loss must be recognized; also explain where on the SOCI the gain/loss would appear.

iv. Assume a gain was realised. Assess the immediate impact on the debt/asset ratio. What will be the impact on the interest cover ratio for the financial year ending December 31, 2018 (compared with the previous financial year)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started