Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Refer to the financial statements and other data in Problem 13-1. Assume that you are an account executive for a large brokerage house and that

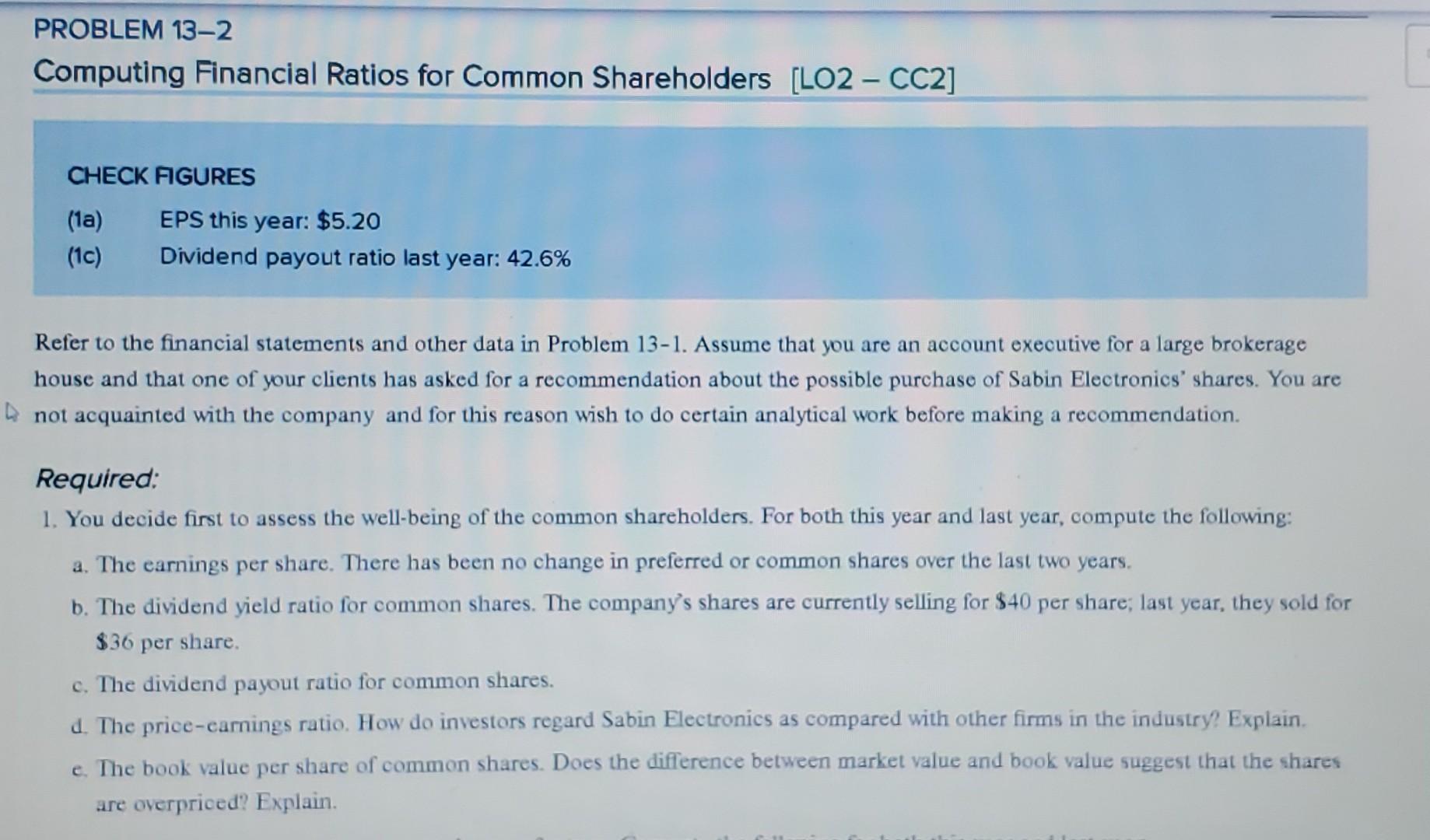

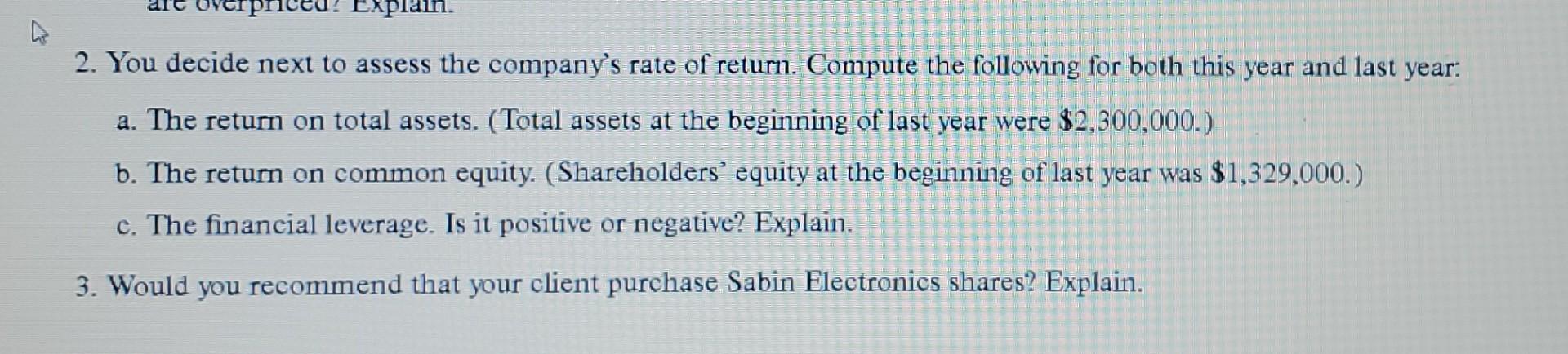

Refer to the financial statements and other data in Problem 13-1. Assume that you are an account executive for a large brokerage house and that one of your clients has asked for a recommendation about the possible purchase of Sabin Electronics' shares. You are not acquainted with the company and for this reason wish to do certain analytical work before making a recommendation. Required: 1. You decide first to assess the well-being of the common shareholders. For both this year and last year, compute the following: a. The earnings per share. There has been no change in preferred or common shares over the last two years. b. The dividend yield ratio for common shares. The company's shares are currently selling for $40 per share; last year, they sold for $36 per share. c. The dividend payout ratio for common shares. d. The price-earnings ratio. How do investors regard Sabin Electronics as compared with other firms in the industry? Explain. e. The book value per share of common shares. Does the difference between market value and book value suggest that the shares are overpriced? Explain. 2. You decide next to assess the company's rate of return. Compute the following for both this year and last year: a. The return on total assets. (Total assets at the beginning of last year were $2,300,000.) b. The return on common equity. (Shareholders' equity at the beginning of last year was $1,329,000.) c. The financial leverage. Is it positive or negative? Explain. 3. Would you recommend that your client purchase Sabin Electronics shares? Explain. Refer to the financial statements and other data in Problem 13-1. Assume that you are an account executive for a large brokerage house and that one of your clients has asked for a recommendation about the possible purchase of Sabin Electronics' shares. You are not acquainted with the company and for this reason wish to do certain analytical work before making a recommendation. Required: 1. You decide first to assess the well-being of the common shareholders. For both this year and last year, compute the following: a. The earnings per share. There has been no change in preferred or common shares over the last two years. b. The dividend yield ratio for common shares. The company's shares are currently selling for $40 per share; last year, they sold for $36 per share. c. The dividend payout ratio for common shares. d. The price-earnings ratio. How do investors regard Sabin Electronics as compared with other firms in the industry? Explain. e. The book value per share of common shares. Does the difference between market value and book value suggest that the shares are overpriced? Explain. 2. You decide next to assess the company's rate of return. Compute the following for both this year and last year: a. The return on total assets. (Total assets at the beginning of last year were $2,300,000.) b. The return on common equity. (Shareholders' equity at the beginning of last year was $1,329,000.) c. The financial leverage. Is it positive or negative? Explain. 3. Would you recommend that your client purchase Sabin Electronics shares? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started