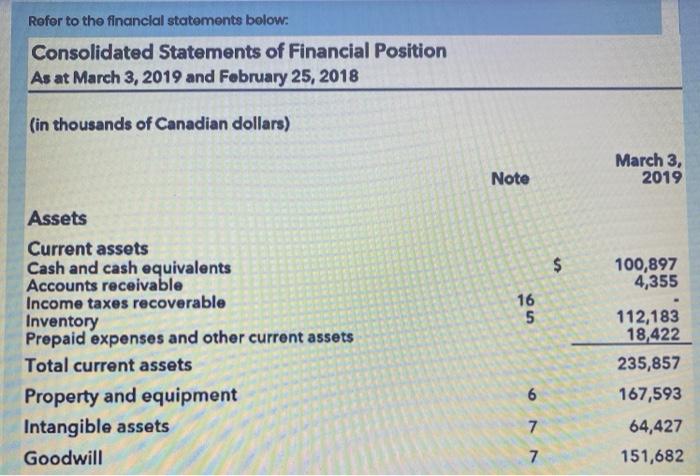

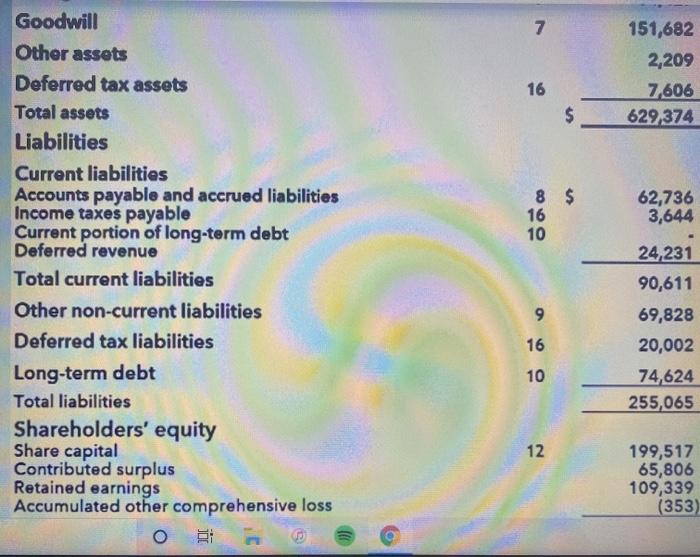

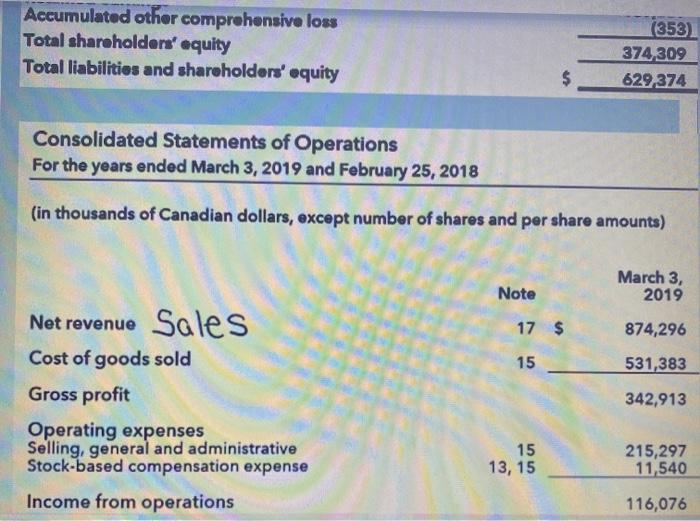

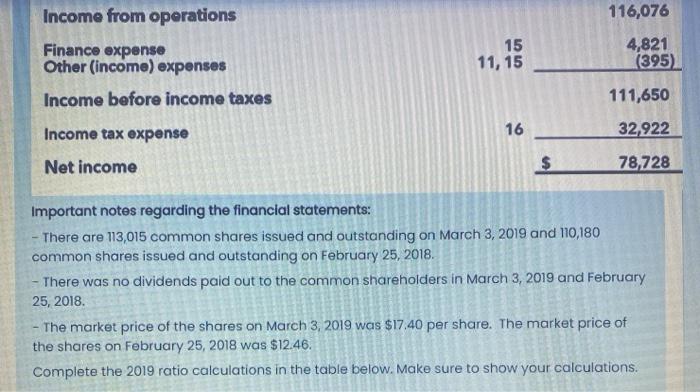

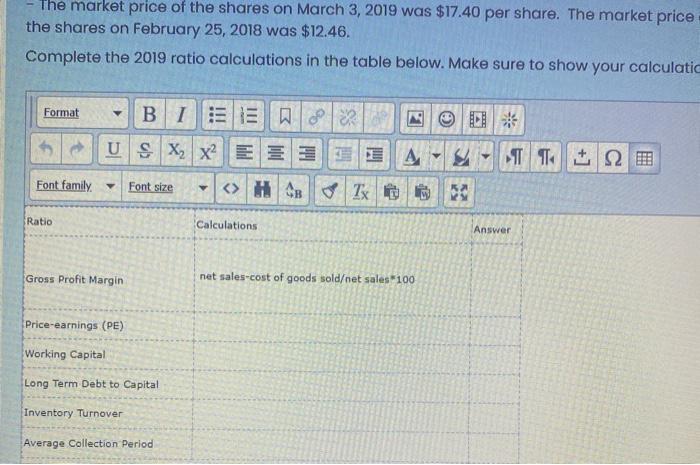

Refer to the financial statements bolow: Consolidated Statements of Financial Position As at March 3, 2019 and February 25, 2018 (in thousands of Canadian dollars) March 3, 2019 Note $ 100,897 4,355 16 5 Assets Current assets Cash and cash equivalents Accounts receivable Income taxes recoverable Inventory Prepaid expenses and other current assets Total current assets Property and equipment Intangible assets Goodwill 6 112,183 18,422 235,857 167,593 64,427 151,682 7 7 7 151,682 2,209 7,606 629,374 16 $ 8 $ 16 10 62,736 3,644 Goodwill Other assets Deferred tax assets Total assets Liabilities Current liabilities Accounts payable and accrued liabilities Income taxes payable Current portion of long-term debt Deferred revenue Total current liabilities Other non-current liabilities Deferred tax liabilities Long-term debt Total liabilities Shareholders' equity Share capital Contributed surplus Retained earnings Accumulated other comprehensive loss 24,231 90,611 9 16 69,828 20,002 74,624 255,065 10 12 199,517 65,806 109,339 (353) Accumulated other comprehensive loss Total shareholders' equity Total liabilities and shareholders' equity (353) 374 309 629 374 $ Consolidated Statements of Operations For the years ended March 3, 2019 and February 25, 2018 (in thousands of Canadian dollars, except number of shares and per share amounts) Note March 3, 2019 17 $ 874,296 15 531,383 Net revenue Sales Cost of goods sold Gross profit Operating expenses Selling, general and administrative Stock-based compensation expense Income from operations 342,913 15 13, 15 215,297 11,540 116,076 The market price of the shares on March 3, 2019 was $17.40 per share. The market price the shares on February 25, 2018 was $12.46. Complete the 2019 ratio calculations in the table below. Make sure to show your calculatic Format B IEE U S X, X2 3 1 A Font family Font size o Tx Ratio Calculations Answer Gross Profit Margin net sales-cost of goods soldet sales*100 Price-earnings (PE) Working Capital Long Term Debt to Capital Inventory Turnover Average Collection Period Important notes regarding the financial statements: There are 113,015 common shares issued and outstanding on March 3, 2019 and 110,180 common shares issued and outstanding on February 25, 2018. There was no dividends paid out to the common shareholders in March 3, 2019 and February 25, 2018 The market price of the shares on March 3, 2019 was $17.40 per share. The market price of the shares on February 25, 2018 was $12.46. Complete the 2019 ratio calculations in the table below. Make sure to show your calculations